The purpose of this document is to provide awareness on the steps needed to apply JSServices Analytics to Standardize a TradePlan and make it sustainable.

Knowing personality traits associated with successful traders and things you “should” do to succeed in trading does not bring us any closer to achieving success unless we are practicing what we know to be true and are doing it consistently.

The problem is that we know but we don’t do. For successful traders, this trait to “do” is innate and there is no issue. For most however it is the challenge that keeps trading success elusive.

The reason is trust. Trading strategies must be based on a foundation of truth to succeed. Good market awareness allows you to “see” the truth more clearly so you have more confidence “doing” and executing the proper tactics.

How do you improve your market awareness and start to take the steps to develop a path to success: Self-Identification.

Core Strength Assessment – Who Are You?

Traits

Before you can define who you are, you have to understand your personality. Ask yourself a question, such as “What do I like to do?” or “who am I?” When you can answer that question, then you can use the information to discover what your personality is and how it affects your decision process in trading. Personality does not just influence how we move and respond in our environment; it also causes us to act in certain ways which is reflected in your trading methods. By understanding your personality you are better able to modify behaviors that are detrimental to your trading and create a trade plan that supports the behaviors your have. There are many different personality types, and it is sometimes difficult to classify a person into a single type as there are many different personality traits you can possess. Personality traits are simply:

- Actions

- Attitudes

- Behaviors you possess

Personality Type

Your personality type can be determined by many factors. You can approach it the scientific way, by testing yourself and having a psychologist analyze you or by taking a personality test which is rather simple. By answering a few questions about your likes and dislikes and where you would like to go in life, a professional can give you a report detailing the type of personality you have.

In psychology, there are five factors that determine different personality types. The big five factors are:

- Openness is appreciation for a variety of experience.

- Conscientiousness is planning ahead rather than being spontaneous.

- Extraversion involves work environment.

- Agreeableness is, as it says, being agreeable.

- Neuroticism refers to worrying or being vulnerable.

Your personality test assesses how much of each of these five factors you possess and provides you with insight into who you are and the actions you need to take to developing a TadePlan that puts you on a path to success.

Personality Profile

A personality profile is a knowledge management tool used to provide an evaluation of a trader’s personal attributes, values and life skills, in an effort to maximize his or her performance. Questions in a personality profile test are designed to seek out information about a trader’s temperament, decision-making methods, trading style, general attitude and commitment towards work, along with quality of life considerations. The information can be used to match the right trading approach to natural skill set. Behaviors can be modified; however the core of who you are is difficult to change. Why force yourself to be something that you are not but rather develop a plan built to support your attributes and leverage your core strengths.

Profile Results

The best profile results come from taking an honest assessment. One reason a lot of traders struggle is that they believe by following a TradePlan that works for someone else it will work for them. This is not the case (unless of course your account is a direct “mirror” of that trader’s program). The reason is that the strategies they are applying are designed around their personality not yours. You are unique and your path to success will be your own. To achieve the best results in your profile commit to your feelings and have a bias in your answers. When faced with a question you are not sure of, press yourself for a bias and avoid non committed neutral answers. Uncommitted “neutral” answers do not help or provide insight into who you are. There are no “right or wrong” answers. The more honest you are, the quicker you can get on that path to sustainable profitability. Honest, biased answers provide you with the personality facts you need to build a TradePlan that works for you.

- Personality Assessment link [The following link provides a complimentary OCEAN 5 Factor assessment questionnaire. It is recommended that you read this the document in its entirety before you take the assessment.]

Acumen Alignment – What Works for You?

TradePlan Profile

A TradePlan is the rules that cover the entire trading program and is how you define your edge which will tip the balance of probabilities toward your success. This set of rules is your trading business plan and are the standards that allow you to measure your results and quantify your improvements. No plan will guarantee success. However, a good plan when adhered to, will provide consistency and enable you to stay in the game a lot longer than if you do not have a plan. By aligning your TradePlan rules with your personality traits and core strengths it makes it easier and more enjoyable to follow that plan.

A TradePlan is not a trading strategy but a good plan will always contain a strategy. The goal of this section is to highlight parts of your personality that will affect your decision making which should be taken into account in the development of a TradePlan. The objective is to end up with a plan that is tailor made to suit your personality, ability and resources.

The TradePlan should be developed around these key factors:

Motivation

Why do You Want to be a Trader? “To make money”, is a generic answer that is applicable to all traders. It is not personal to you and, therefore, it is not helpful to your plan. It may be that you have a need for excitement which can easily lead to catastrophe if allowed to go unchecked. Perhaps you have heard stories about traders making exorbitant amounts of money in a single day? Without doubt, some do; but they are only a small fraction of traders who make any money at all in the markets. Overwhelming disappointment is often the reward for uncontrolled greed. Dreams about trading via a laptop, sipping champagne in the islands, are entertaining, but they are hardly grounded in reality. Such fantasies may help to motivate you to study the markets, but the emotions that accompany them will not help you when it comes to trading the markets. Just as the trader with a thirst for excitement is doomed to fail, the fate of a trader motivated by greed or reacting to fear is almost certain to end in disaster. These thoughts and emotions are not the problem and they occur naturally; it is how you allow them to impact your trading that is the problem.

Do not pretend to be someone you are not. Be honest with yourself to uncover the real motivations, fears and desires that fuel your ambition. Some of these will be helpful while trading, others will not. How you allow them to impact your trading is what, to a large extent, what a TradePlan will measure. To ensure that the impact of your motivation is a profitable one, you must start by examining your real reasons for trading and, hopefully, learn more about yourself in the process.

Question your true motivations. Are you certain that trading is the right business for you? If you believe that the markets exist for the sole purpose of showering you in vast quantities of easy money – then think again! Beware: trading is NOT the easy option and the effort needed to run a trading business must be respected.

Risk

What is Your Attitude towards Risk? This may seem an odd question, but it is a good starting point to ensure that your feelings about risk are compatible with your trading style. Opinions on risk vary. Some traders think of the stock market as a hot potato – the longer you hold a position, the greater the chance of getting burned. To these traders, market risk is measured by the amount of time you are in the market. It could be seconds, minutes, hours, days or weeks. The longer you are in the market the greater the chance something will go wrong. Therefore, the trading style that keeps you in the longest can also be the most risky. There are many traders who will totally disagree with this and feel much happier and sleep better at night by holding medium to long-term positions. For them, trading momentum plays in volatile Indices intraday carries far too much risk. Understanding your risk tolerance is a key factor in developing a sustainable TradePlan.

Reward

What are Your Income Targets? There are numerous reasons for becoming a trader; making money is the one reason that unites us all. It is important to know your financial targets and to break them down into daily/weekly time frames. It is much easier to focus on short term goals than feeling the pressure each day to make your objective. Needless to say, if your strategies only generate 5% a month, it is counterproductive to have a target of 1% per day. Your targets are not idle fantasies; they must be based upon your back and forward testing results.

Setting goals is an essential part succeeding at anything worthwhile. Goals therefore; are a big part of your trading plan as they provide you with a meaningful objective to work towards and a way to track your progress. A well done plan will help give you all the motivation needed to get the job done because it is personal to you. When developing a plan think in terms of your development as a trader, as opposed to thinking of purely financial goals. By developing yourself as trader first you are able to identify a method that works for you and create structure to capitalize on the opportunities presented. Decide how you will achieve your goals. Reward yourself once you do. The rewards should be specific and meaningful to you.

Application- How To Do It?

Analytics Alignment

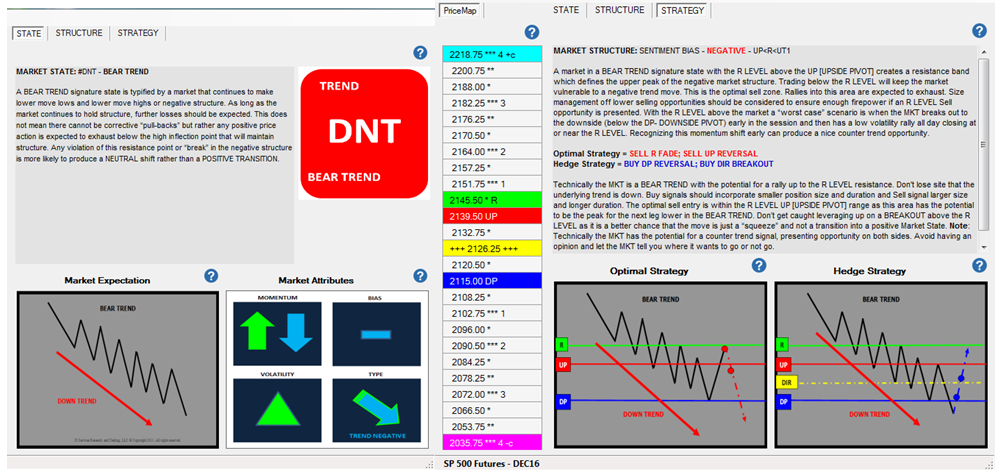

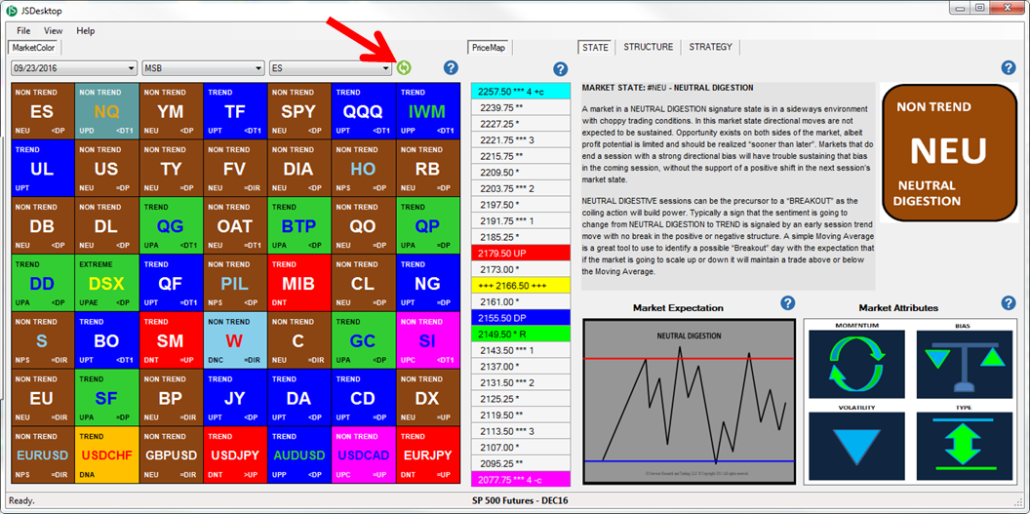

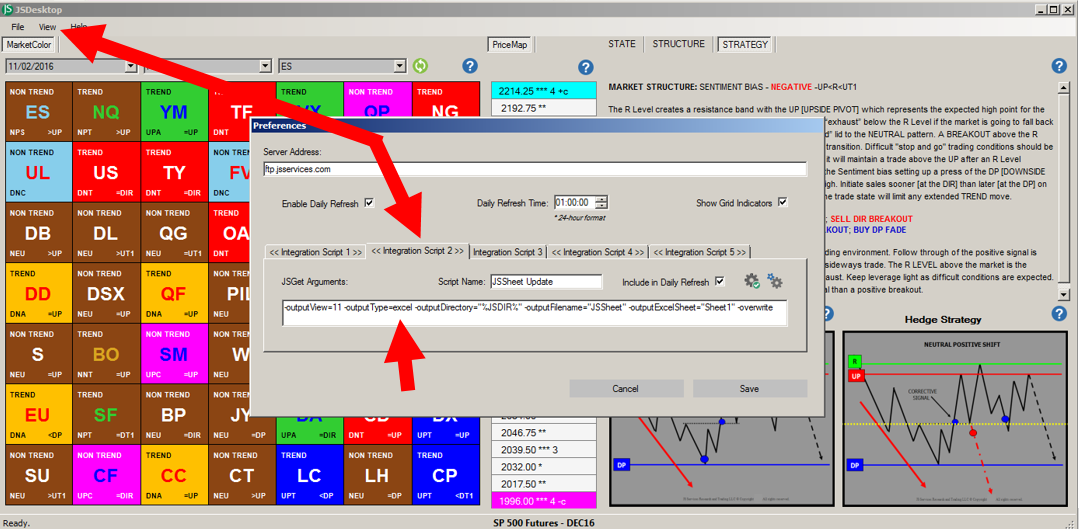

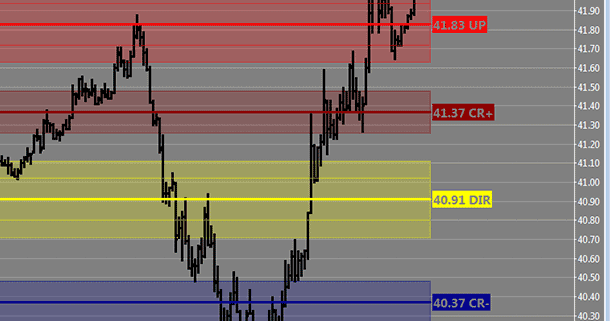

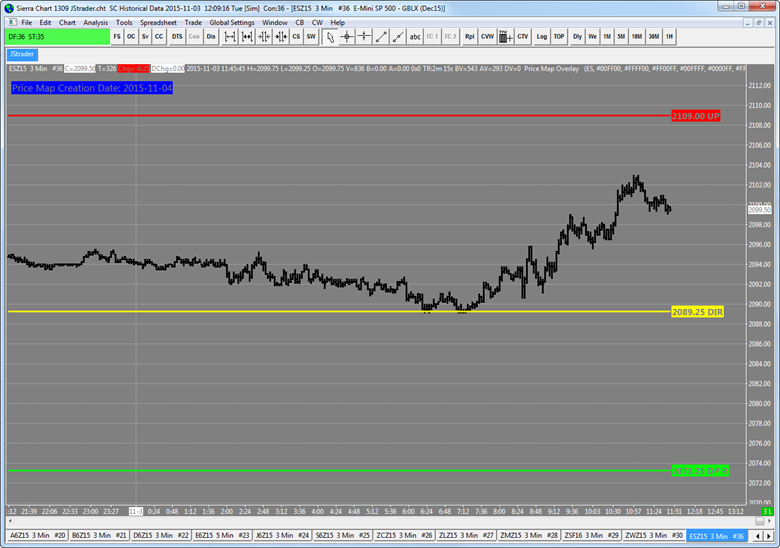

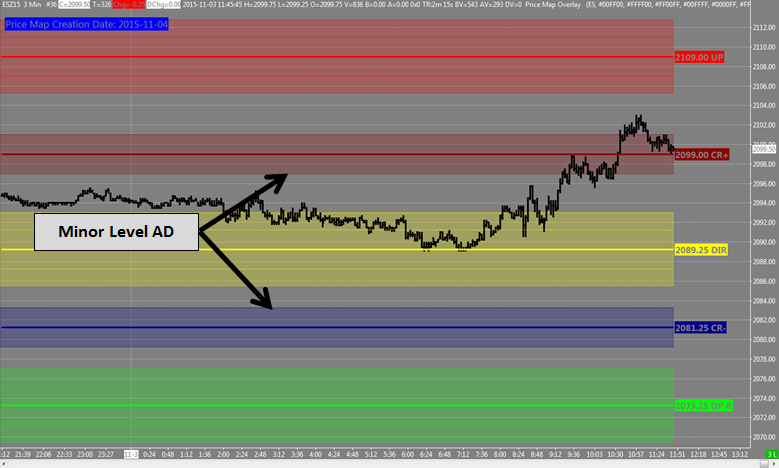

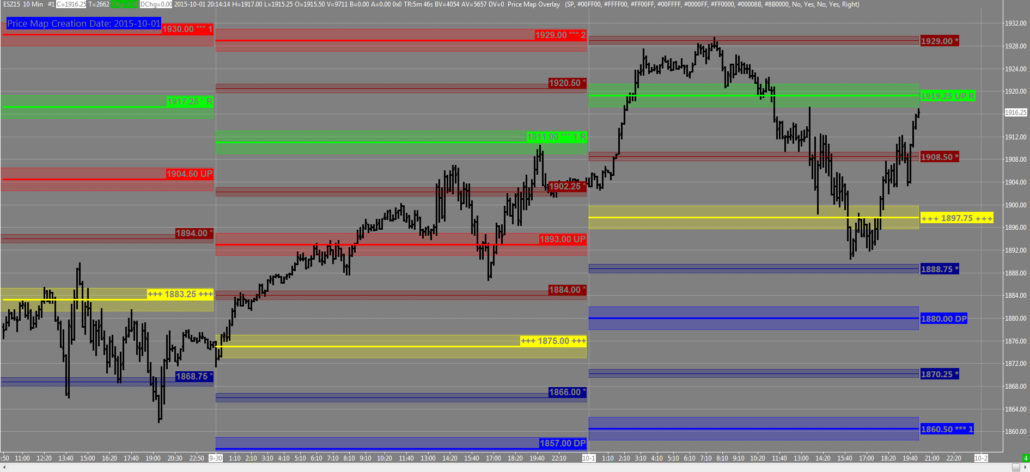

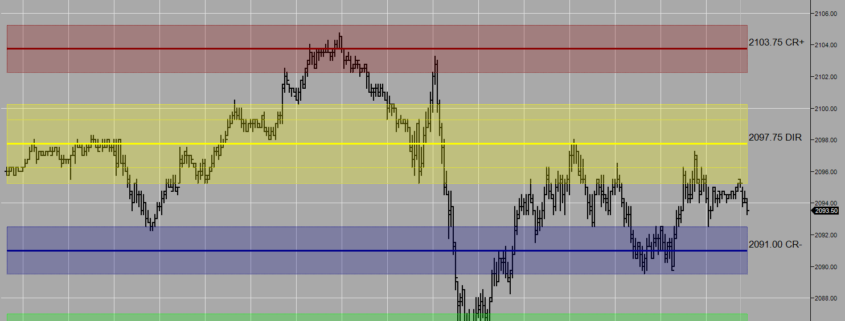

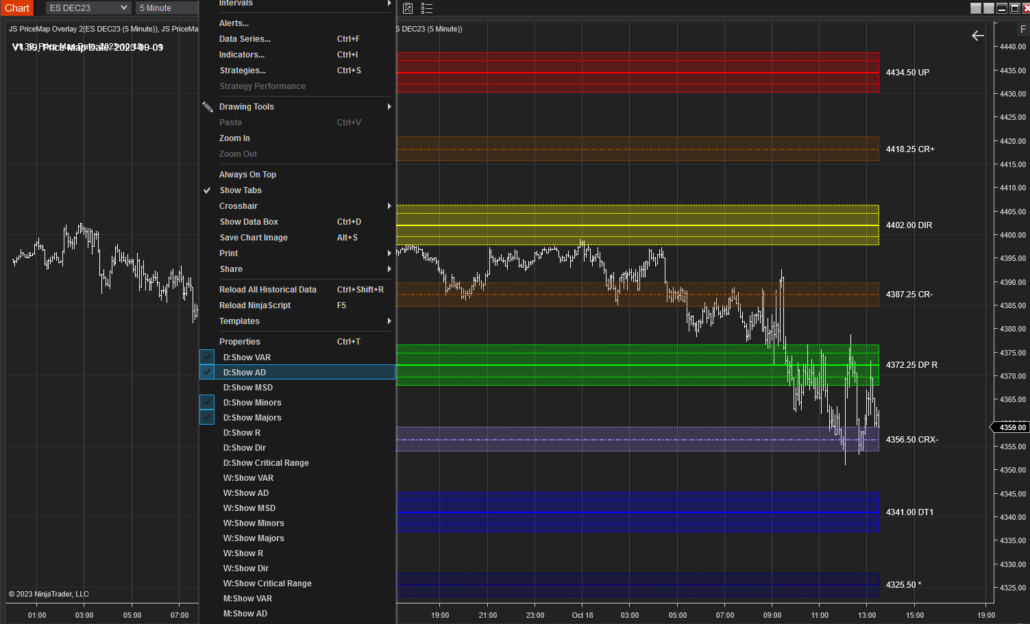

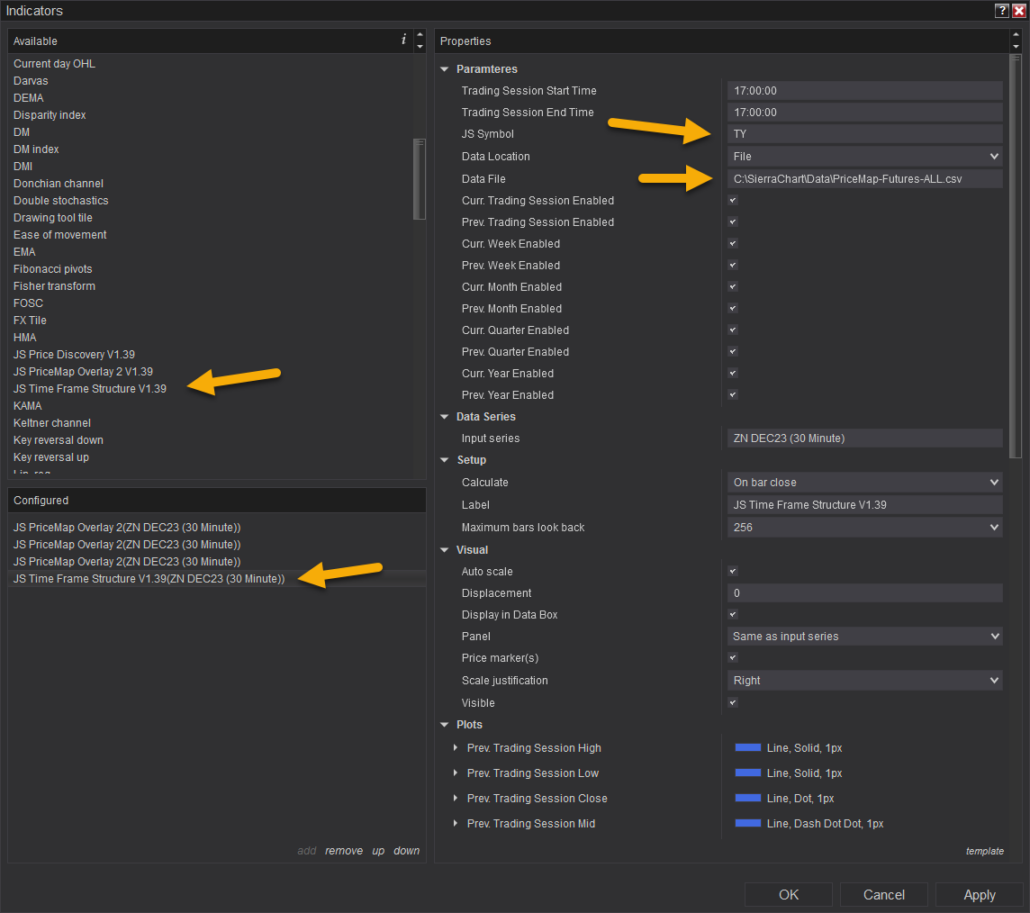

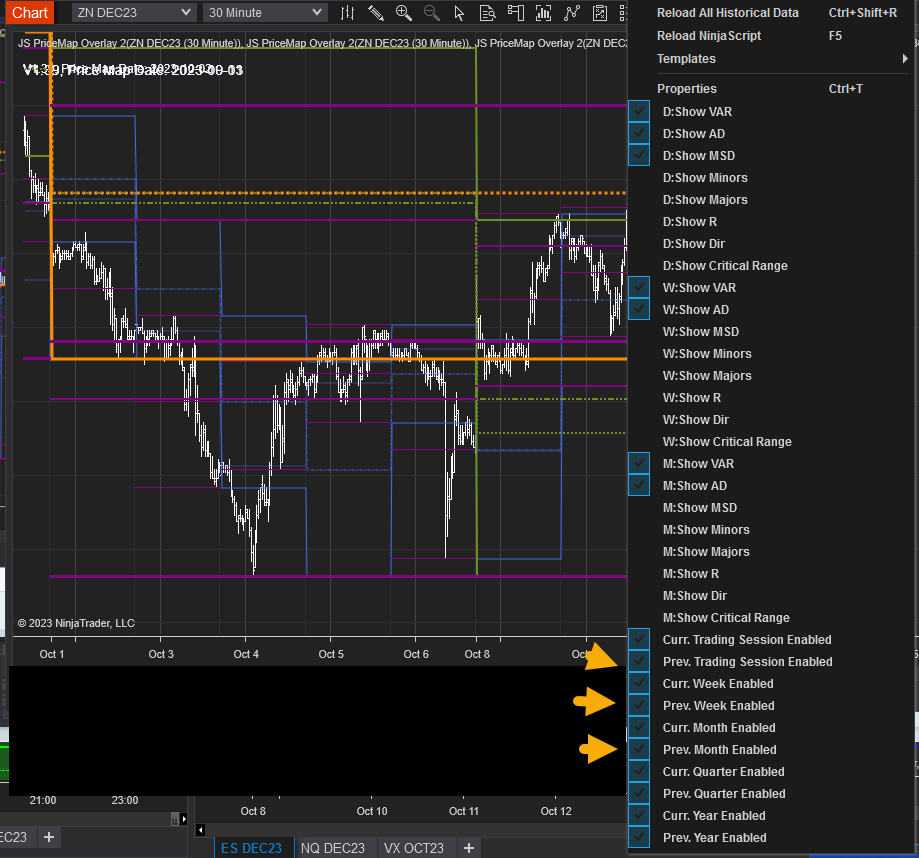

Self-Identification attained through a Personality Assessment and the development of a TradePlan, provide better awareness of what works for you. What you are comfortable with and willing to commit to too achieve fulfillment as a trader. It should be understood that every trader’s path is unique and building a strategy foundation from your core strengths and risk tolerances will provide for the best chance to create a sustainable trade plan. Improved awareness in how you respond to market conditions, gives you insight into developing strategies to capture opportunity. By knowing yourself and your own responses to specific behavior, you understand the market better and are able to identify shifts in market state faster and implement the correct strategy. Creating a sustainable TradePlan starts with aligning this awareness to market state conditions, structure and strategy themes that compliment your acumen. What market state environments are most comfortable to trade and whose characteristics align with core strengths? Are pivotal structure points favorable or is foundational structure better for risk tolerances? What strategy themes support profit expectations? JSServices Analytics identify the market state, structure and strategy themes that core strengths can be aligned with to create a sustainable TradePlan.

TradeStrategy Development

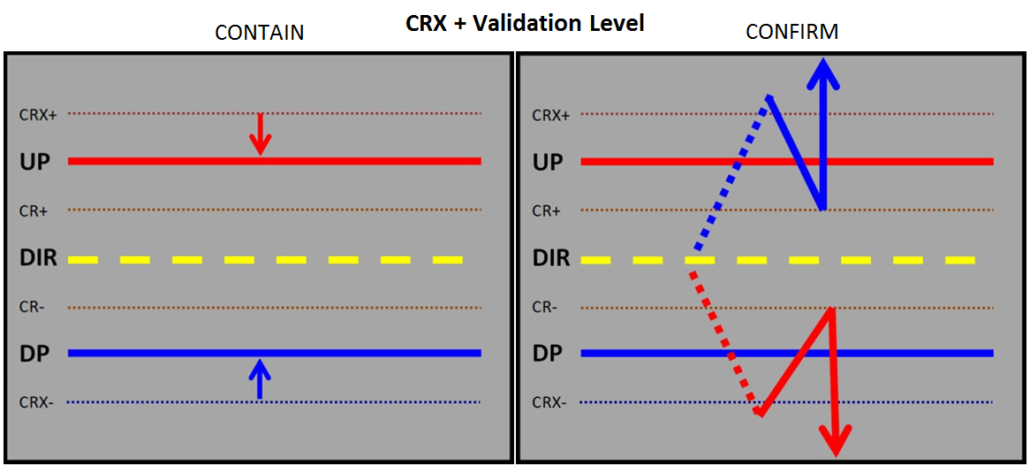

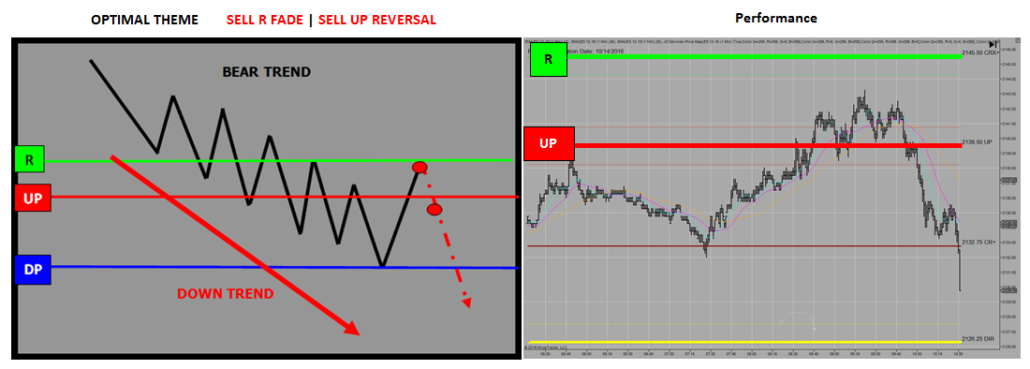

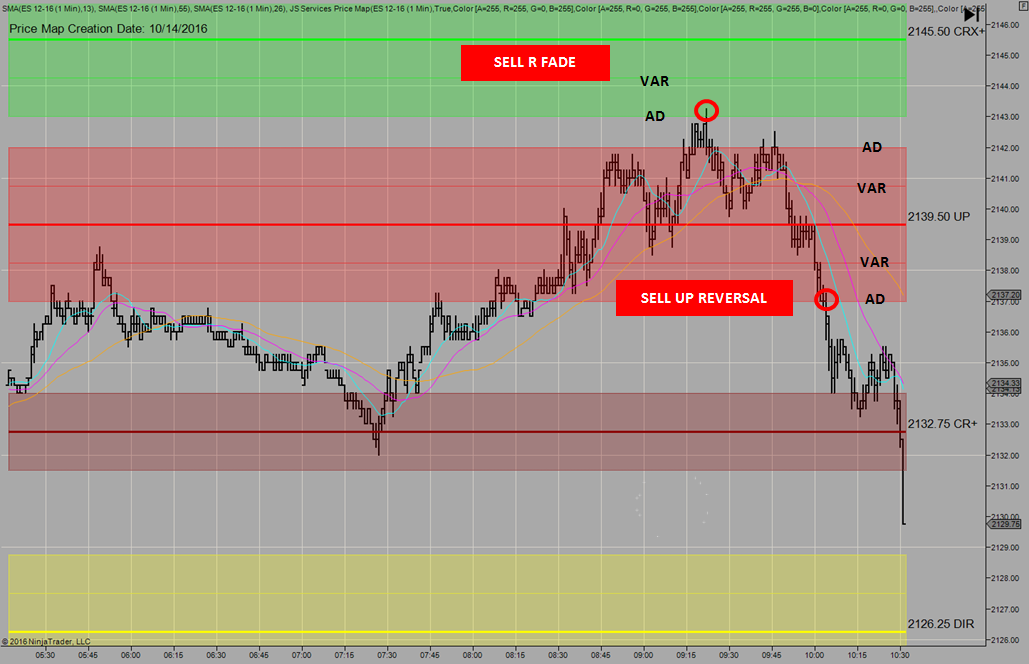

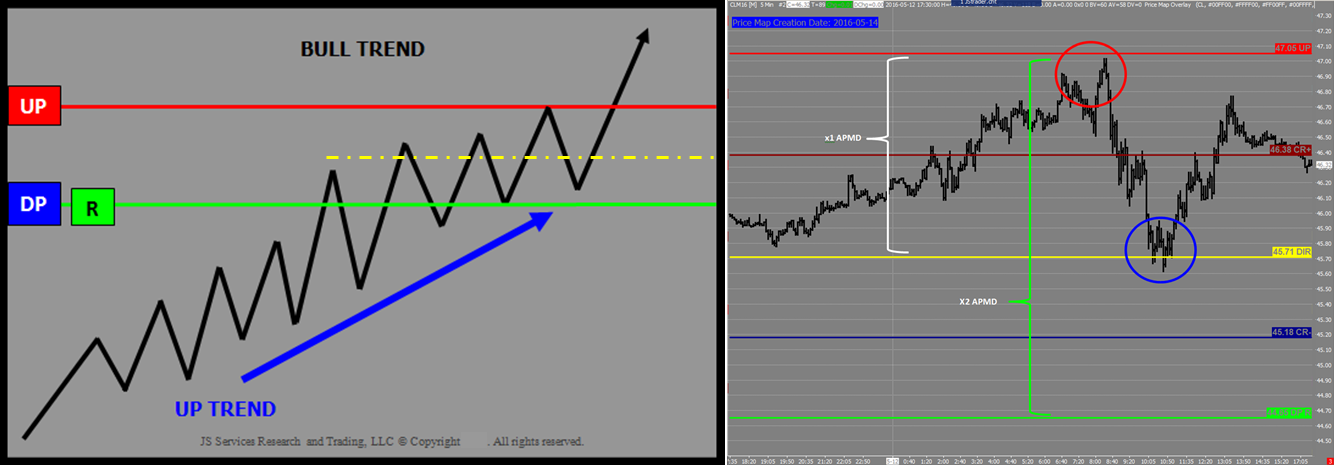

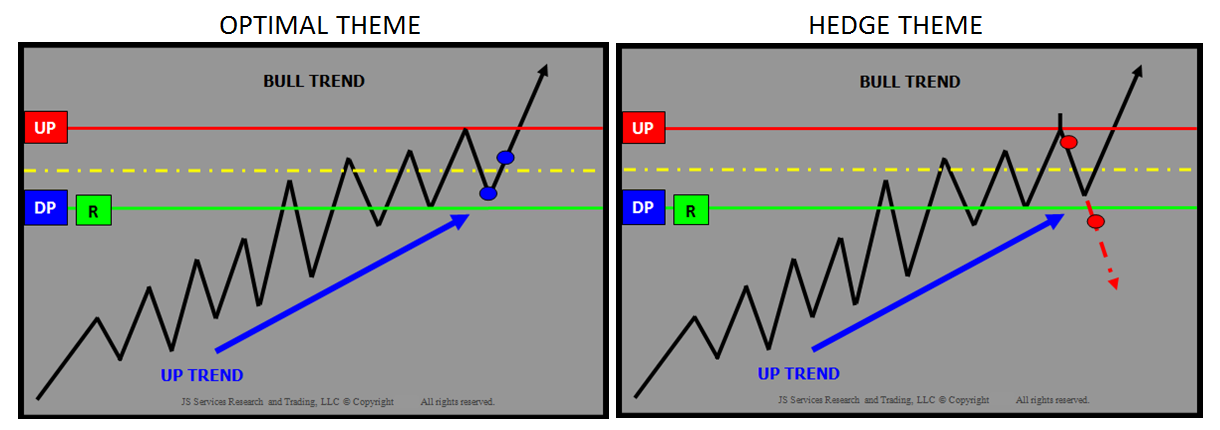

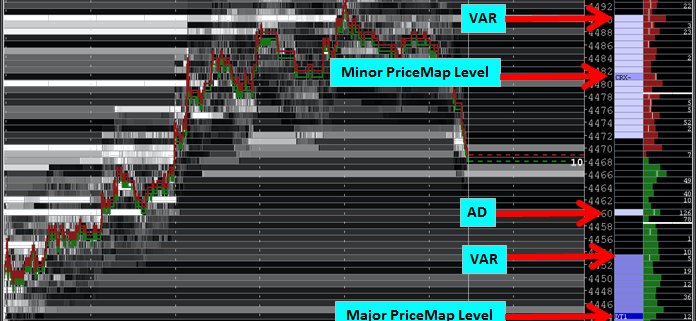

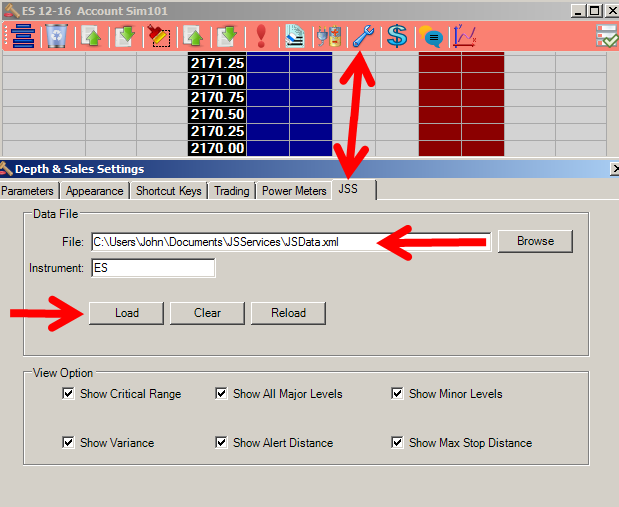

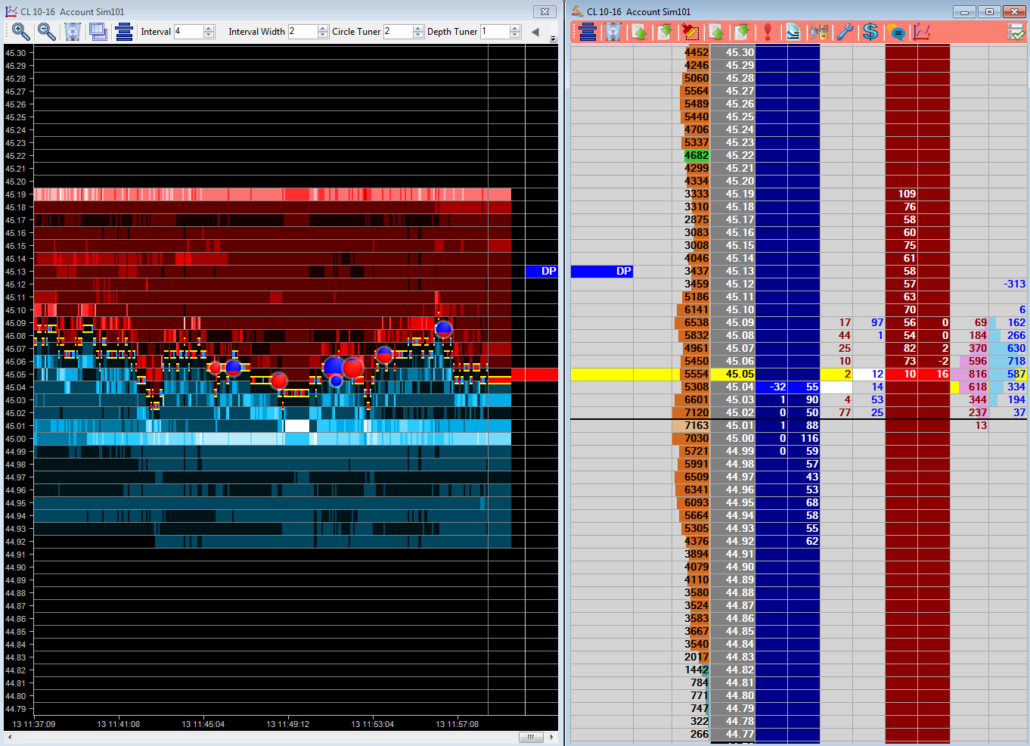

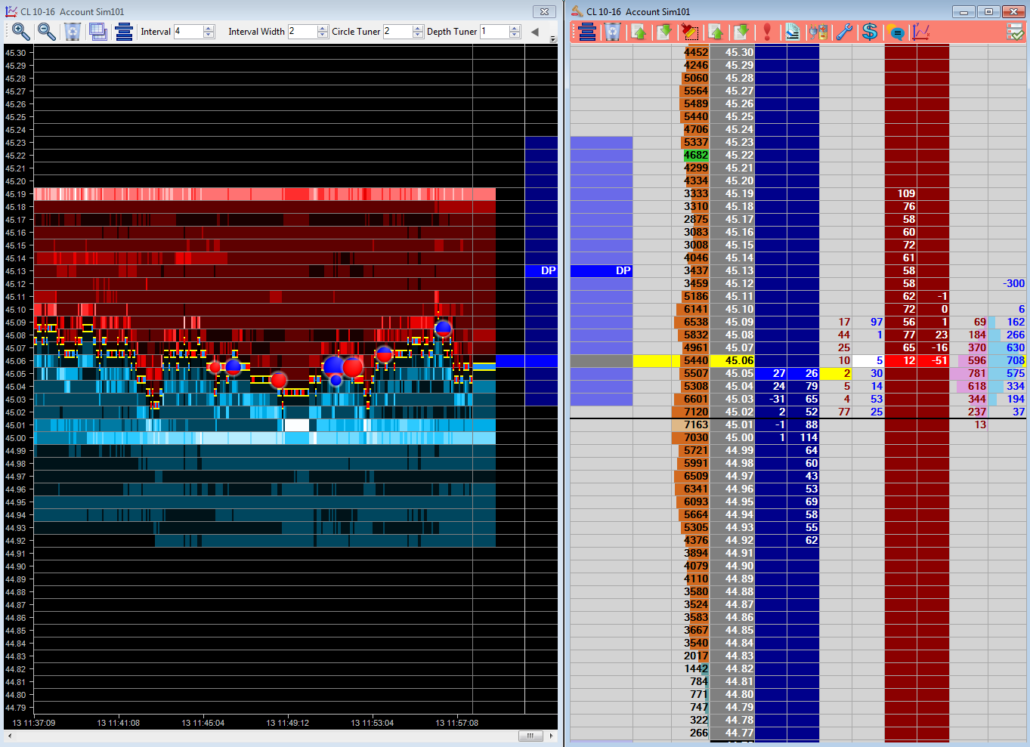

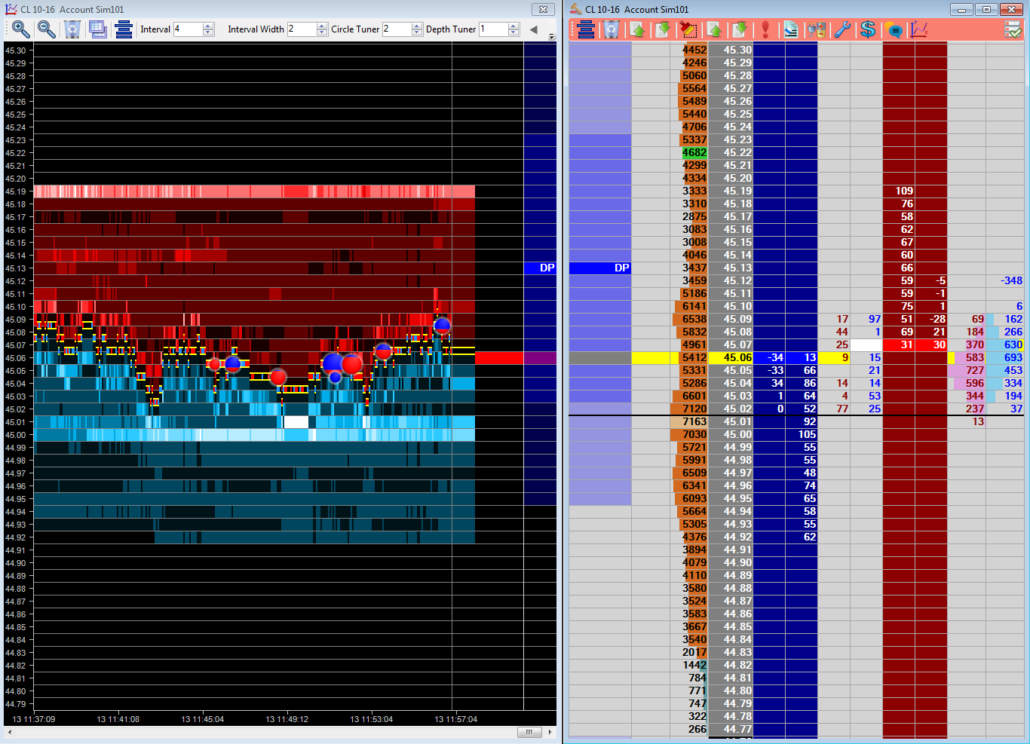

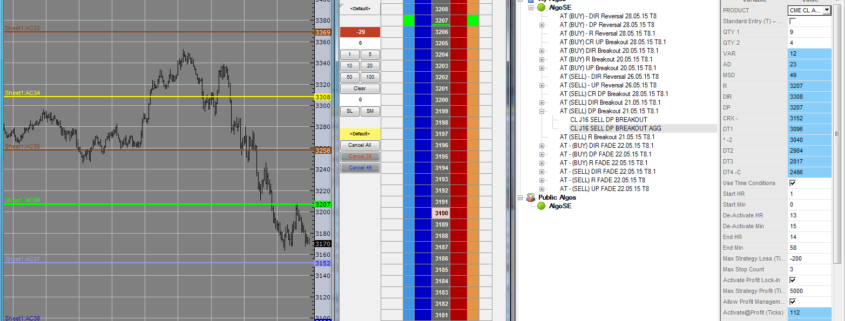

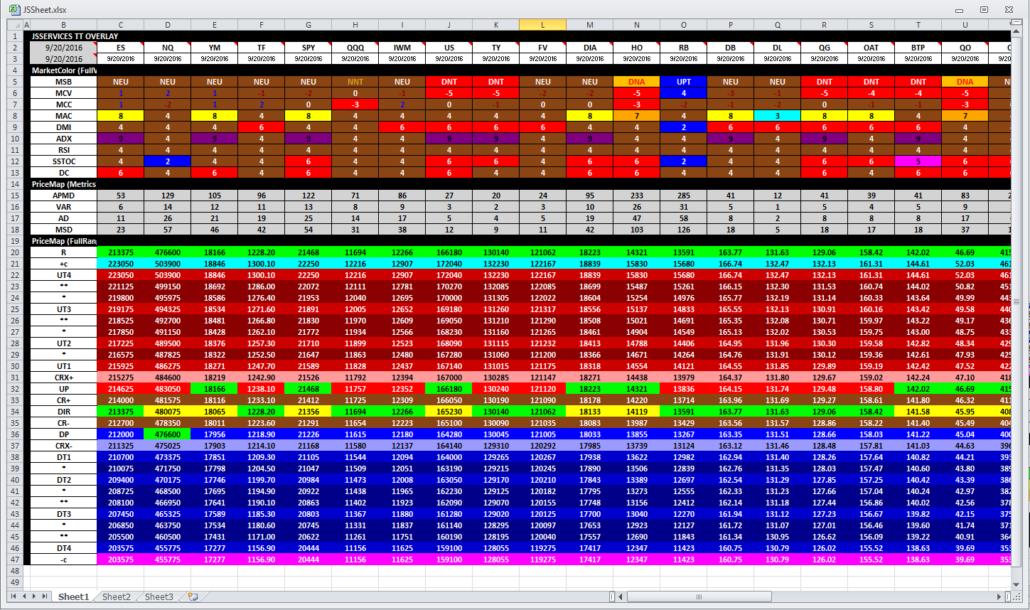

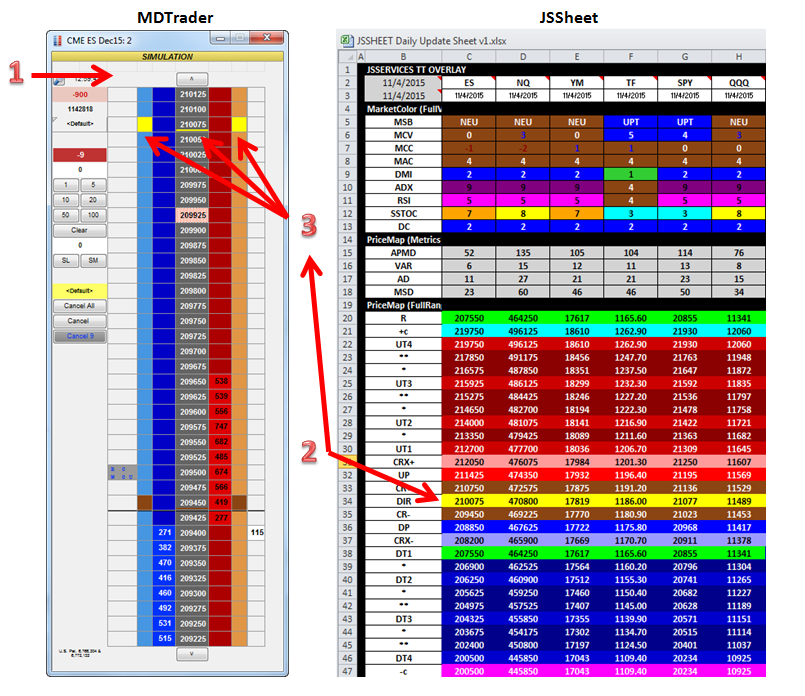

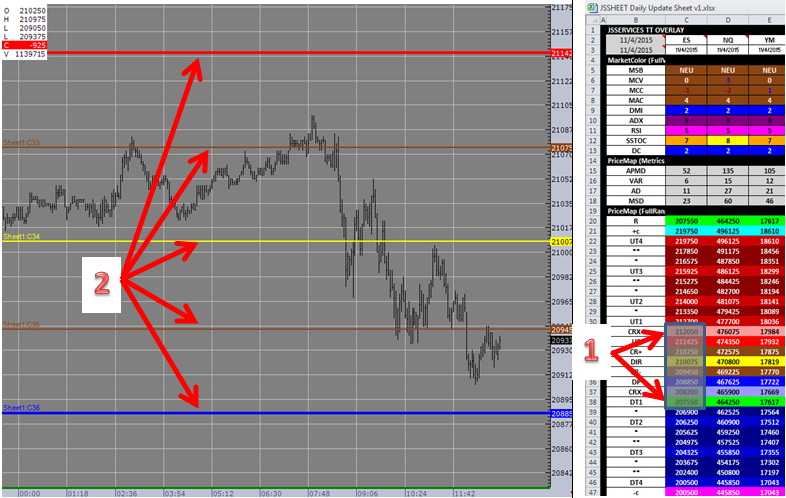

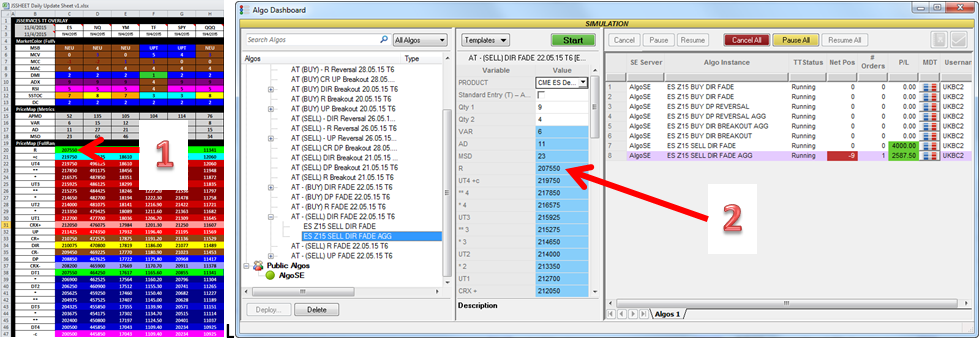

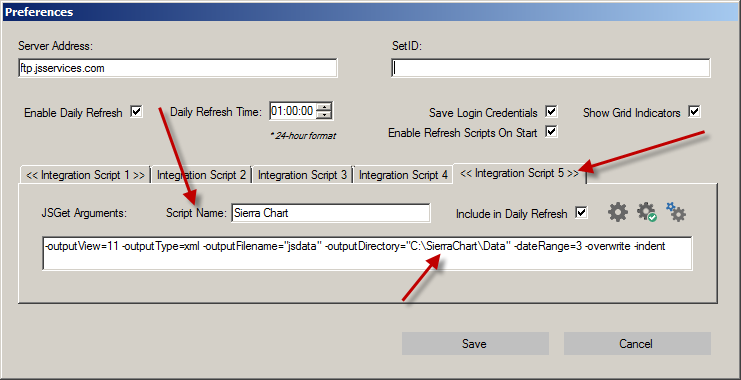

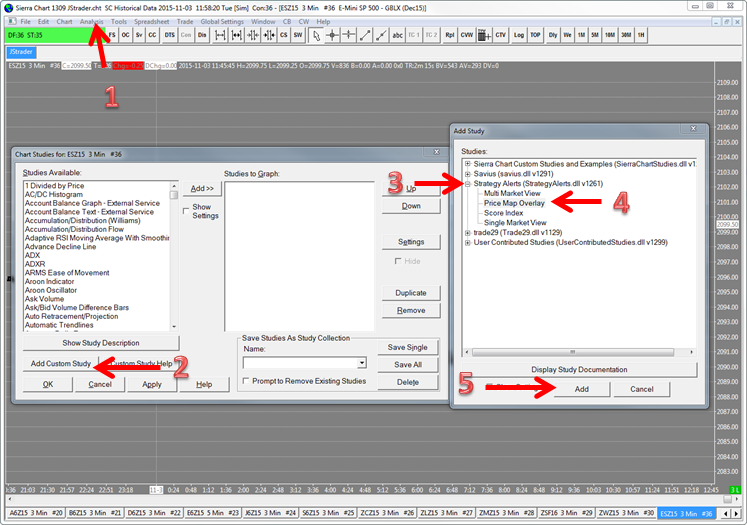

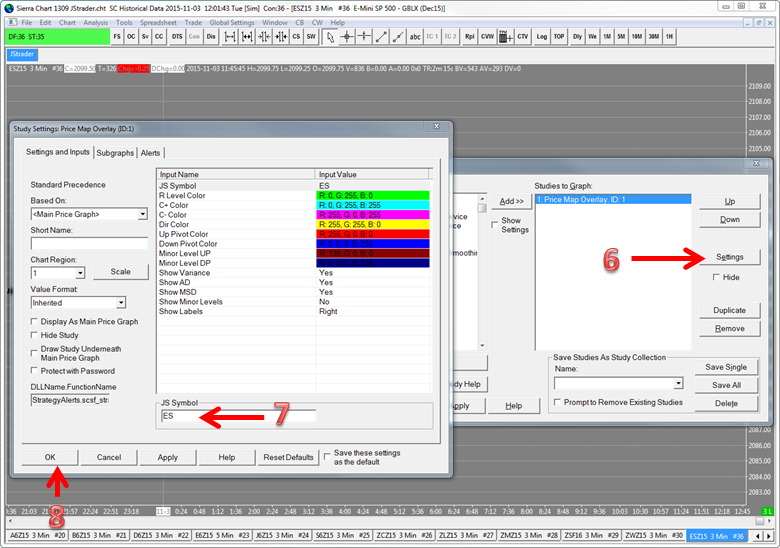

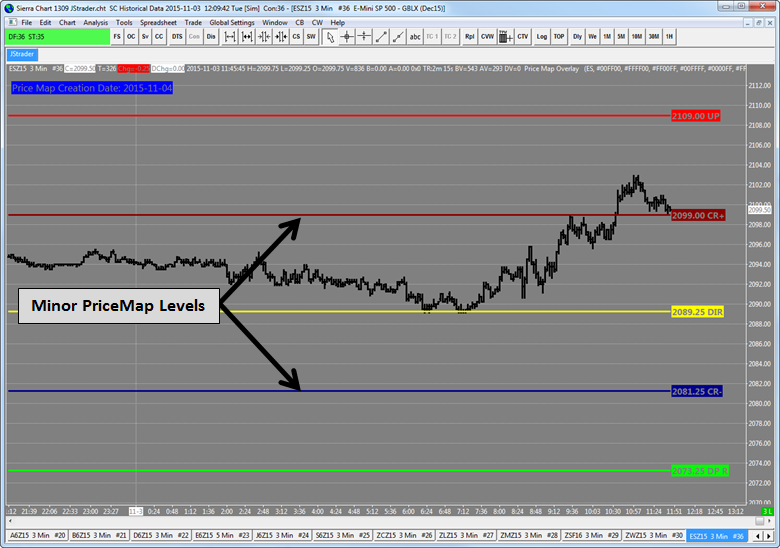

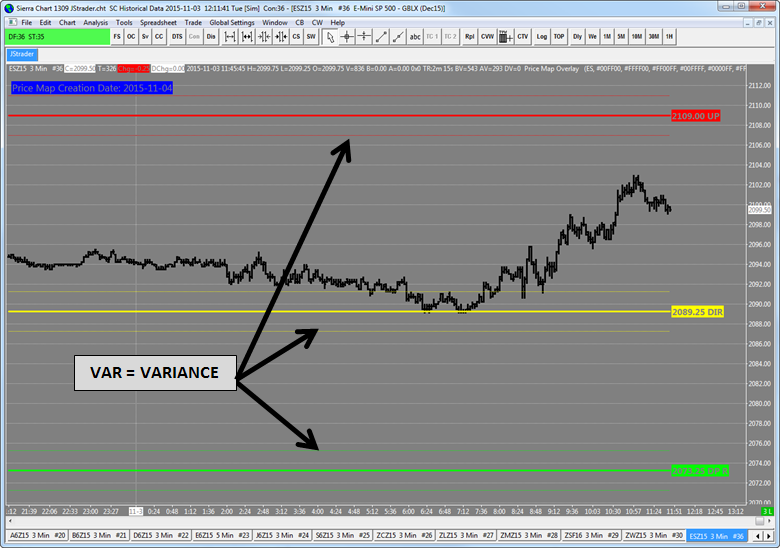

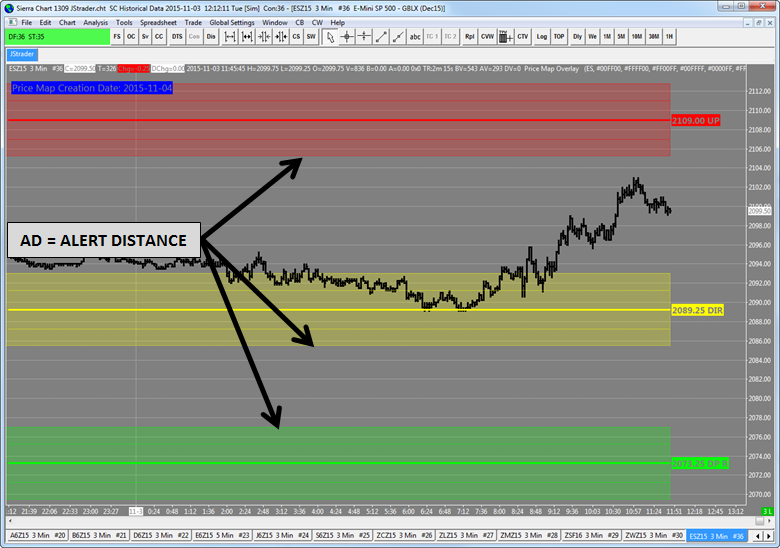

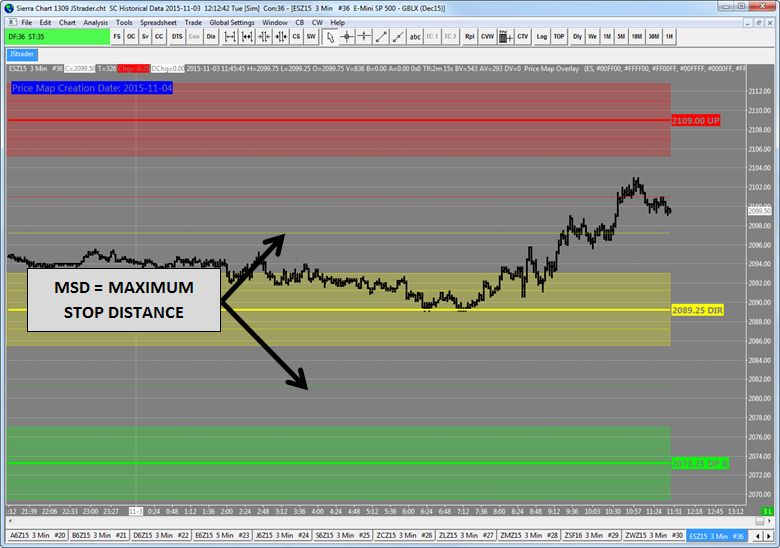

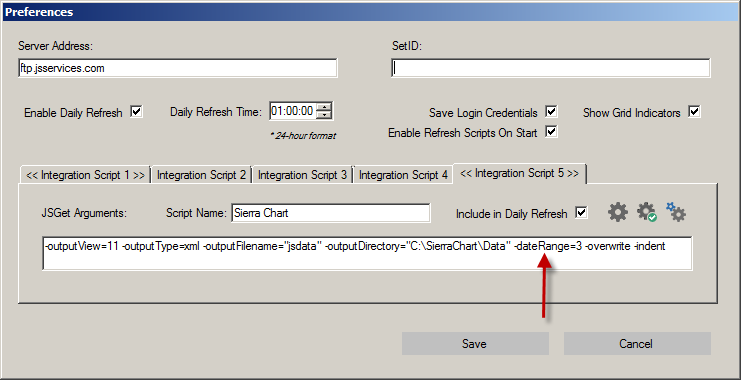

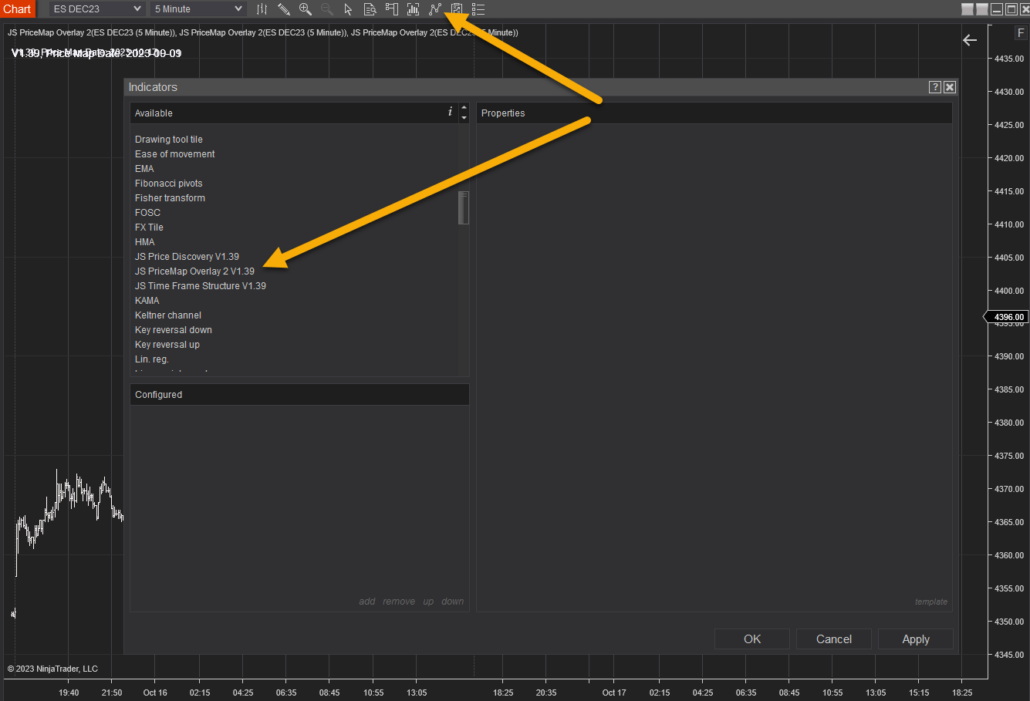

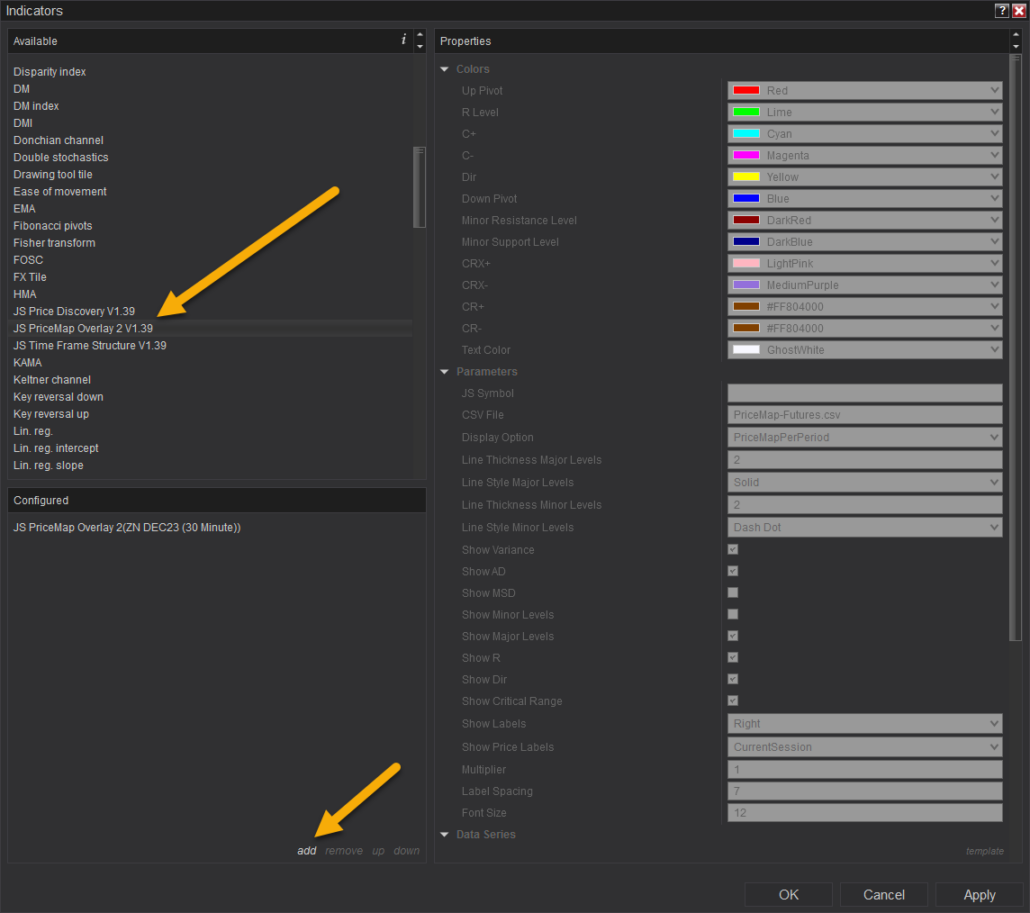

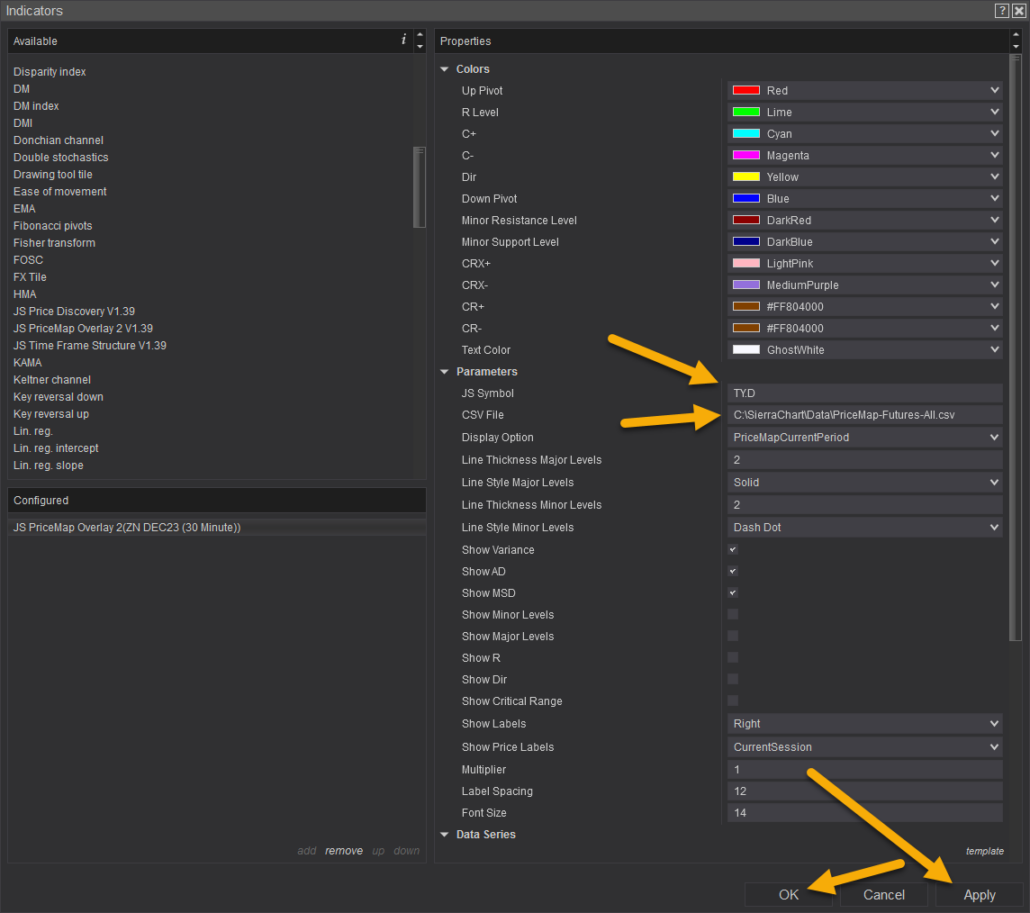

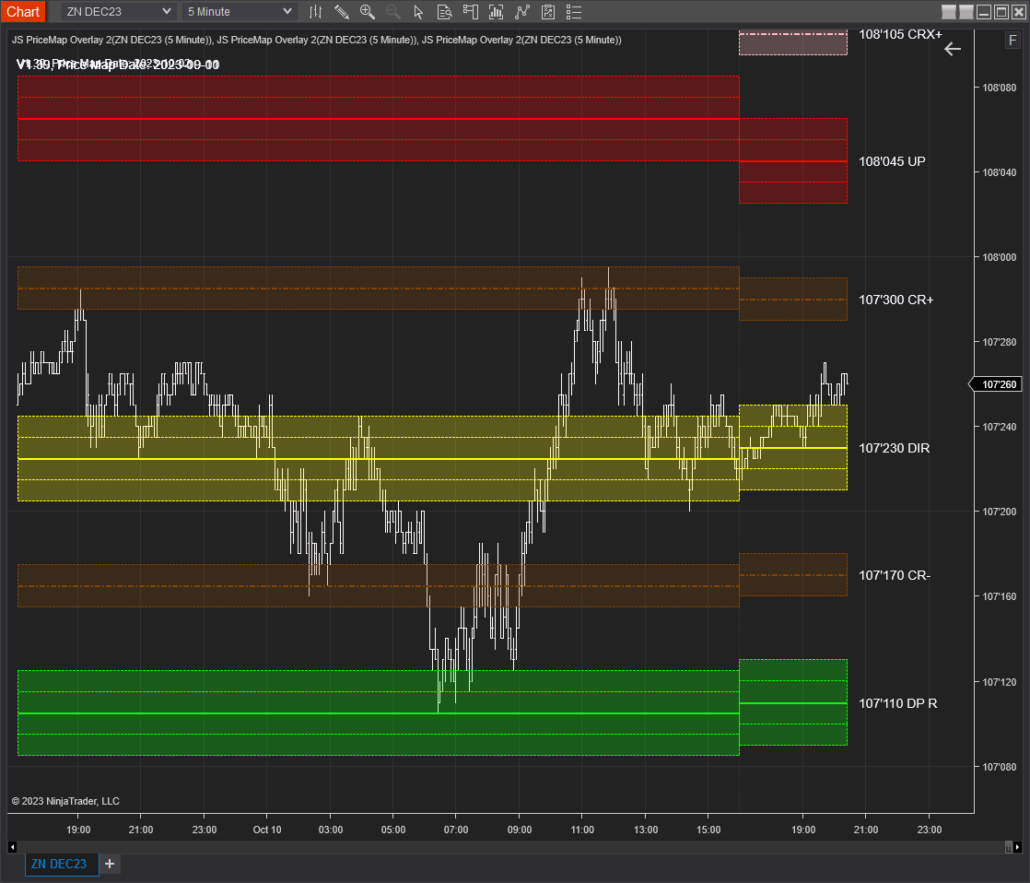

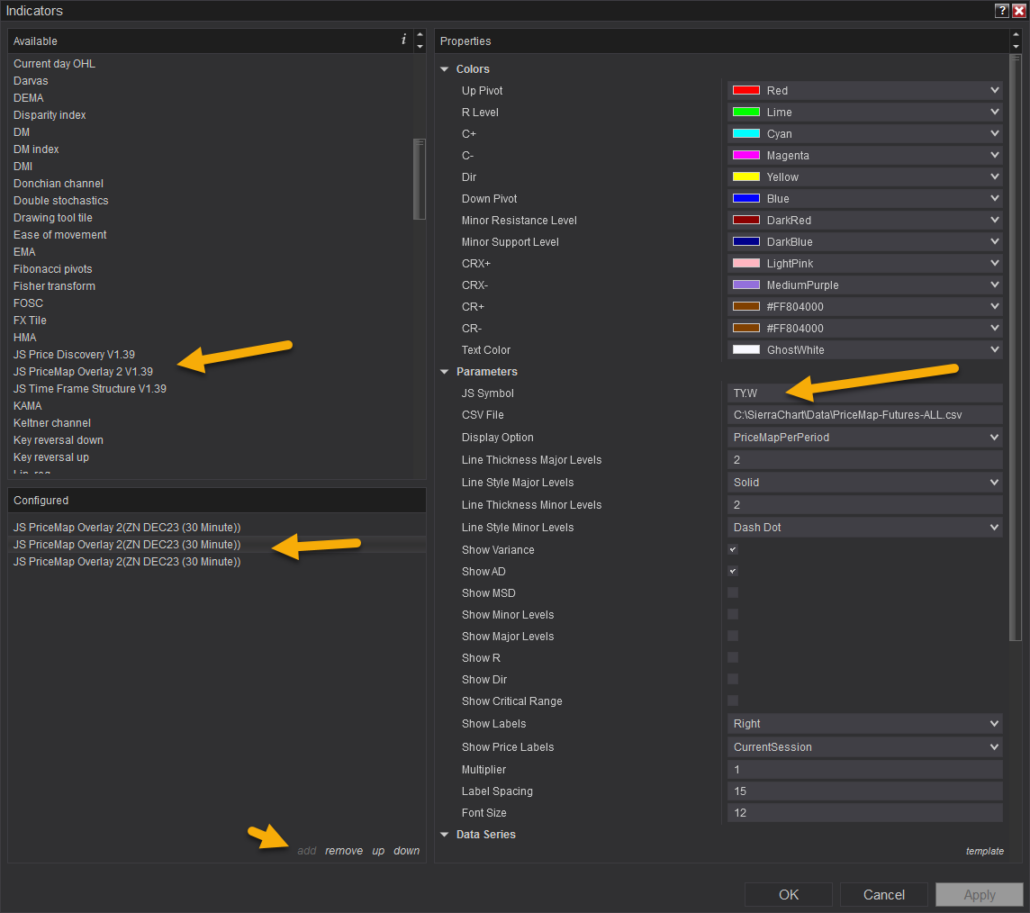

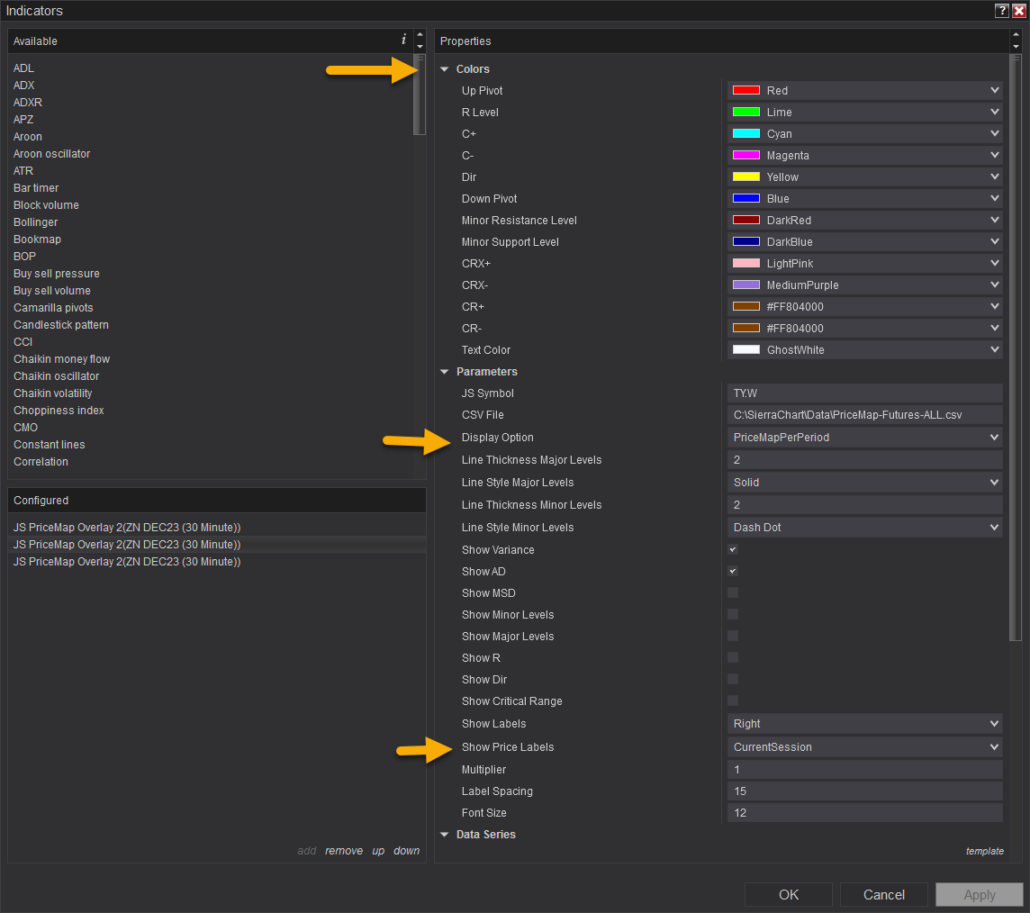

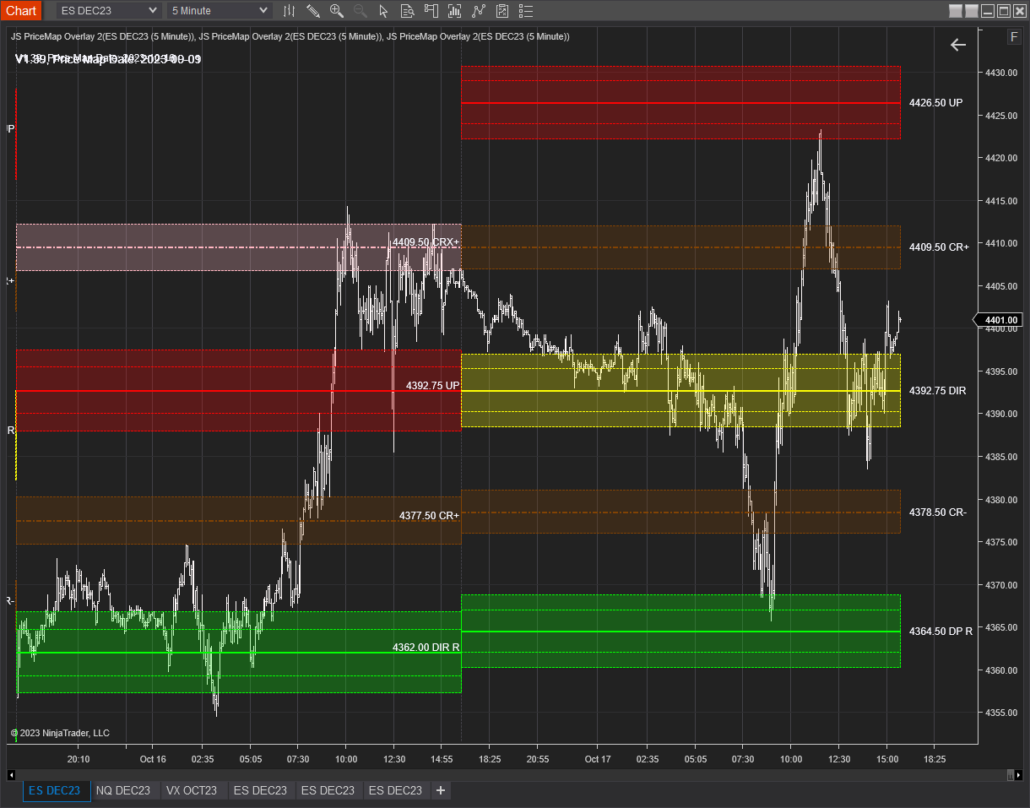

The awareness the analytics alignment provides is a knowledge management tool to develop a TradeStrategy by creating a decision template based on truths. Do you like to trade with momentum or against it. If you like to trade counter trend do you want to take advantage of the initial turn or prefer to wait for a confirmed reversal. Are you a directional trader or would you rather base your strategy on volatility movement. Does your profile show you have a need to always be “involved” or do you want more selective strategy that only trades a couple of times a day. Do you prefer a mechanical automated approach or more “seat of the pants” discretionary trading? The answers to questions like these form the foundation of a standardized TradePlan which must be normalized into a TradeStrategy. This is done using JSServices applications which integrate into your daily work-flow and provide context for a consistent execution of a TradePlan. Every market state has its own characteristics and structure that defines it. Certain strategy themes that are inherent to these conditions will have better alignment than others to a trader’s unique standardized TradePlan. By normalizing favorable market state conditions that compliment a TradePlan with specific entry and exit points which define the market structure alignment, the optimal TradeStrategy can be achieved.

Optimization

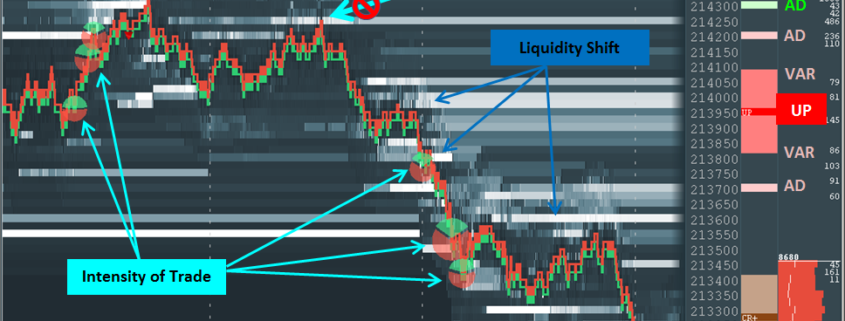

Every trader has certain trading tactics they have acquired over the years that provide the basis of the method they use to trade the market. Although the applied practice and theory may resonate and bring a high level of trust, the success ratio without a standardized TradePlan and normalized TradeStrategy will undoubtedly lack consistency and not be sustainable. Applying TradeTactics within the construct of a normalized TradeStrategy improves their effectiveness and can be optimized when executed within defined MarketMetrics and by incorporating dynamic order book events. For example, if you have a deviation tactic that uses multiple oscillators in different time periods to identify an extreme overbought/oversold reading, the TradeTactic needs to be normalized in the TradeStrategy development process during “trending” market states. A deviation strategy will work well in a neutral sideways trading environment in either direction but will most certainly fail when applied to fading a trend move. To optimize the TradeTactic it should be executed within defined MarketMetric thresholds that surround TradeStrategy entry and exit points. Performance can further be enhanced by incorporating dynamic micro structure events in the orderbook.

Peak Performance

The key to attaining peak performance is related to the ability to stay consistent and plan-driven. Traders fail not because of their emotions, but because their emotions deflect them from their purpose. In developing their rules and systems, the successful traders had found a way to immunize themselves from the emotional effects of market volatility by having a TradePlan standardized to core strengths and aligned to market state conditions. Indeed, in many respects, the successful traders appeared to be every bit as fearful as the unsuccessful ones. It’s just that the fears of the successful traders were not those of drawdown or missing a market move. Rather, they feared deviation from their plans. Dedication to purpose was the cornerstone of their success. Knowing who you are and what works for you makes it easier to stick to your plan and achieve sustainable results.

Consistency is improved by having a structured framework to execute a TradeStrategy. By normalizing entry and exit points to specific market structure levels trade execution becomes more constant and uniform. It becomes easier to identify when something is working or when it is not, as there is a standard to compare like events. Traders build self-trust and are able to trade more intuitively. Trade management decisions become a harmonious flow with steady execution of position, risk and size adjustments.

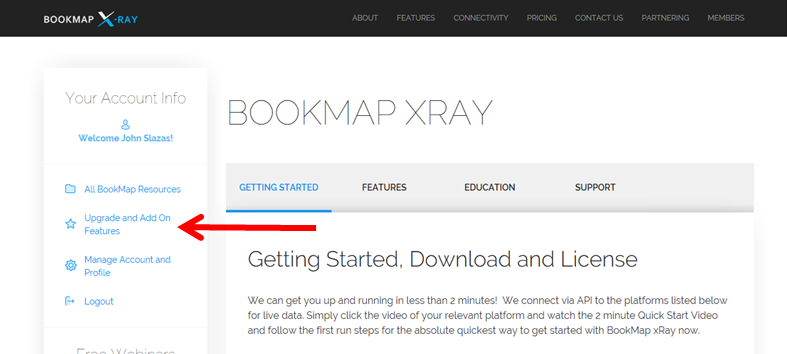

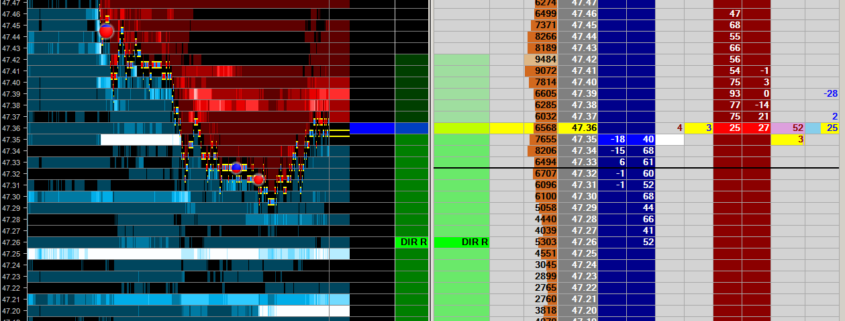

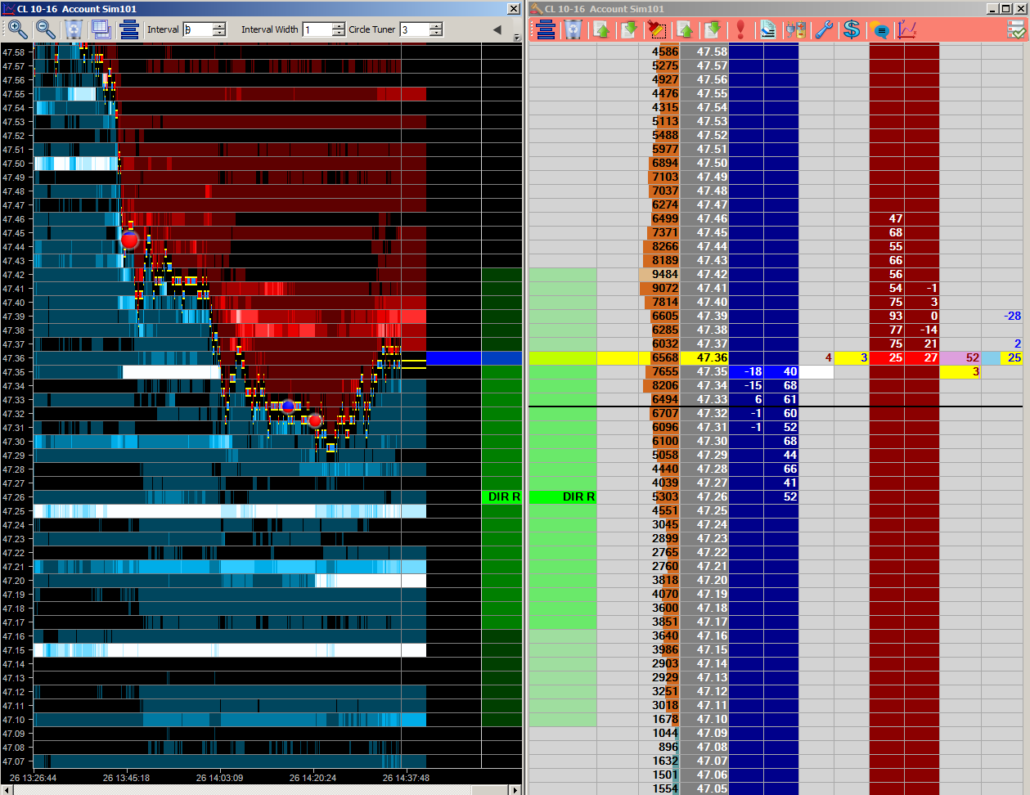

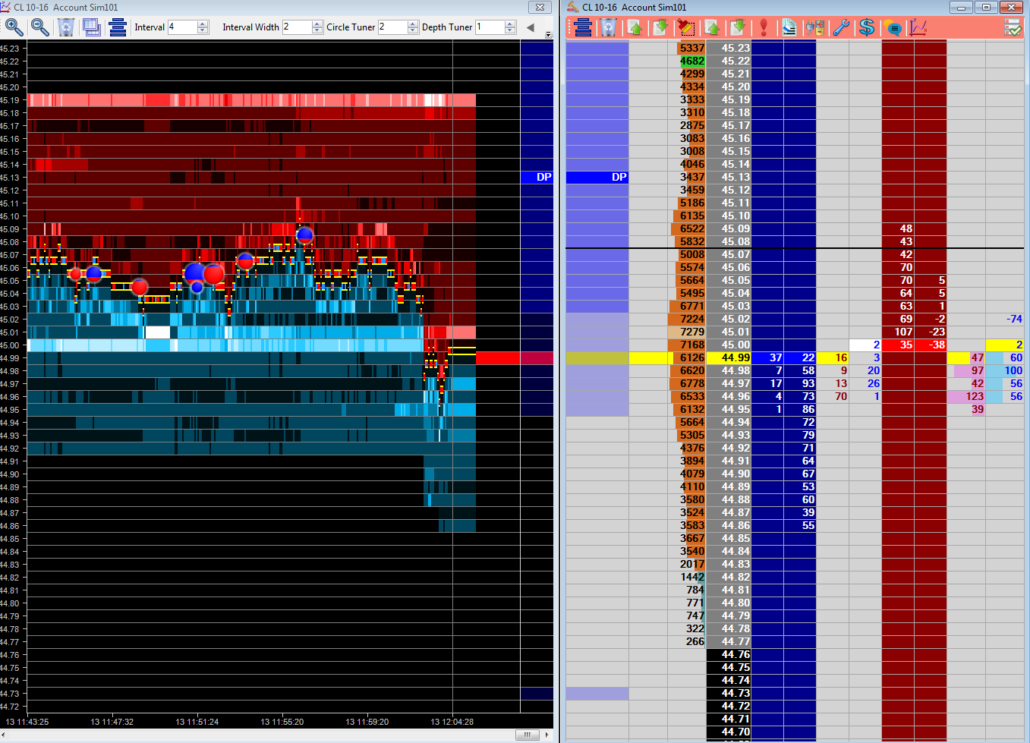

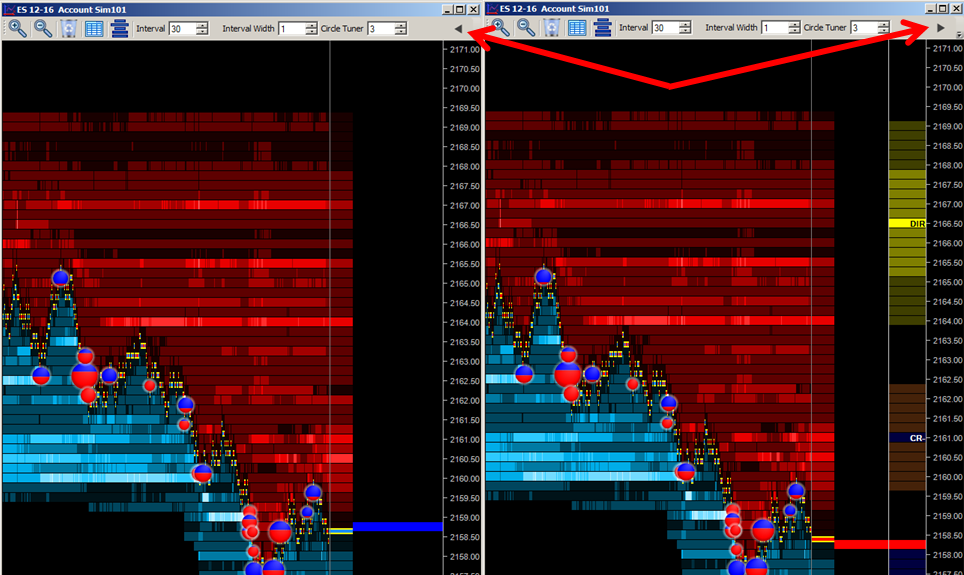

Peak performance is achieved by putting the process into action. All thinking is stripped away to action or no-action. TradeTactics are optimized at defined areas where TradeStrategy signals can be accepted. A trade or no-trade price threshold that supports a do or do not intuitive process. New technological advances offer additional ways to improve the effectiveness of a TradeStrategy by incorporating dynamic order book events. Through JSServices integration partners the unique ability to visualize specific order flow events offer an optimization tool to improve the effectiveness of TradeTactics and help traders achieve peak performance.

Get Started

STEP 1. Take the Personality Profile and have an Assessment created.

STEP 2. Send the your scores to info@jsservices.com and schedule a consultation to discuss the path that is best for you.