MCV Explanation

/in Analytics, MarketColor /by JSServices![]()

MC VALUE (MCV)

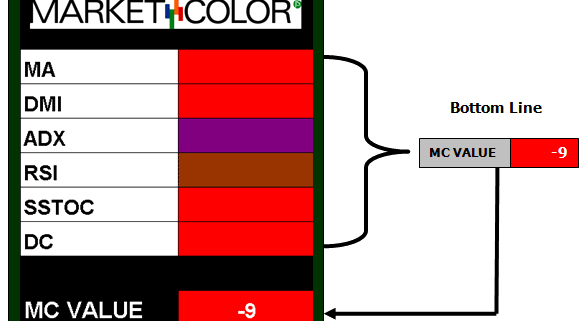

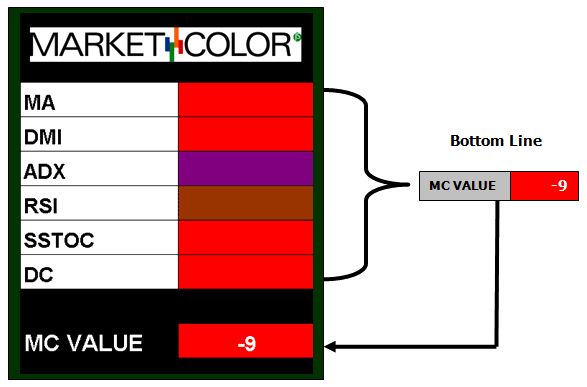

The MCV is a summation of the different MarketColor technical indicator systems and represents a market’s technical bottom line position.

MCV defines a market’s general market state type as a single value technical “rank”. Markets with more systems in a positive position will have a greater positive MCV, and markets with more systems in a negative position with have a greater negative value. Markets counter balanced or neutral will have a value close to zero (0).

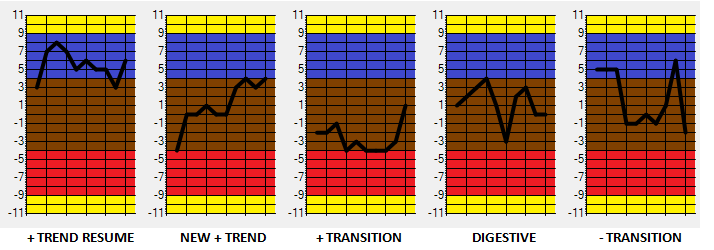

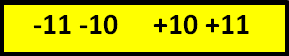

MCV TABLE

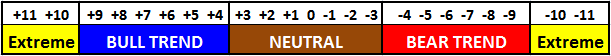

In the table above, each segment defines a general state where the –3 to +3 segment is the NEUTRAL ZONE, -9 to –4 and +4 to +9 are the TREND ZONES and 10 to 11 on either side are the EXTREMES.

It is important to remember that this is not a “signal” of what might occur but rather a definition of what “is” the market’s current technical state. Just because a market has a positive MCV does not mean one should just buy the market. It just means that buy signals will have a better chance of succeeding over sell signals because the market’s underlying technical state is positive.

The MCV defines the session “playing field” so strategy criteria can be optimized and aligned with the Market STATE.

Example:

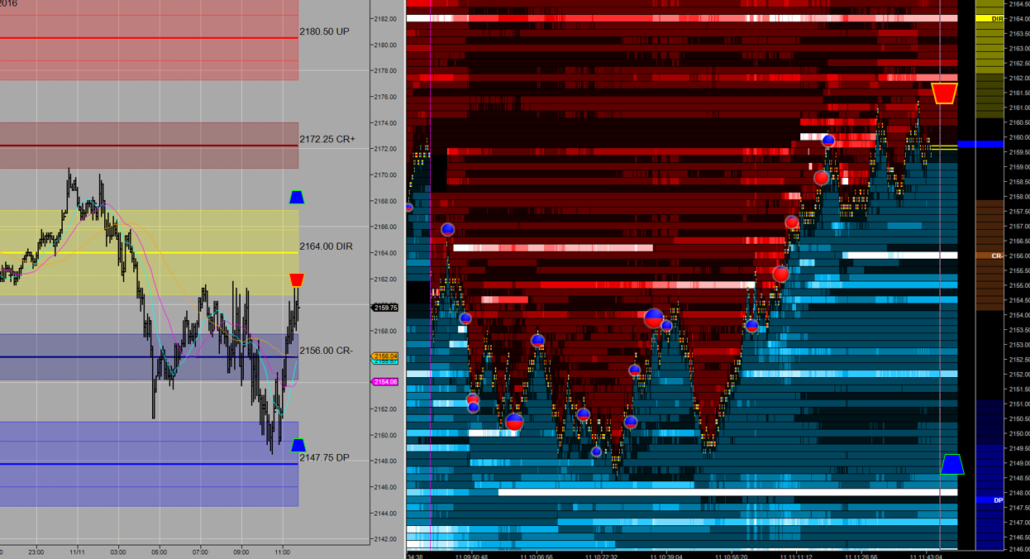

![]()

DIRECTIONAL BIAS = SELL STRATEGY SELECTION = NON TREND

- A market with an MCV = -3 is in the soft side of the NEUTRAL zone. The expectation is that the market is vulnerable to a negative shift into a BEAR TREND state or has the potential to bounce back to the middle of the NEUTRAL zone. SELL strategies in this technical state are expected to have more potential over BUY strategies. However, the market’s NEUTRAL posture may limit any opportunity, valuing deviation NON-TREND type tactics over TREND type.

The MCV summarizes the MarketColor profile results into a single value within a bounded scale, providing an “at a glance” indication of a market’s technical position. The effect is an objective numerical definition of a market’s general state type that can be used for Strategy Selection, Size Management, and as a technical Relative Strength comparative.

MCV – NEUTRAL

NEUTRAL ZONE

NEUTRAL ZONE

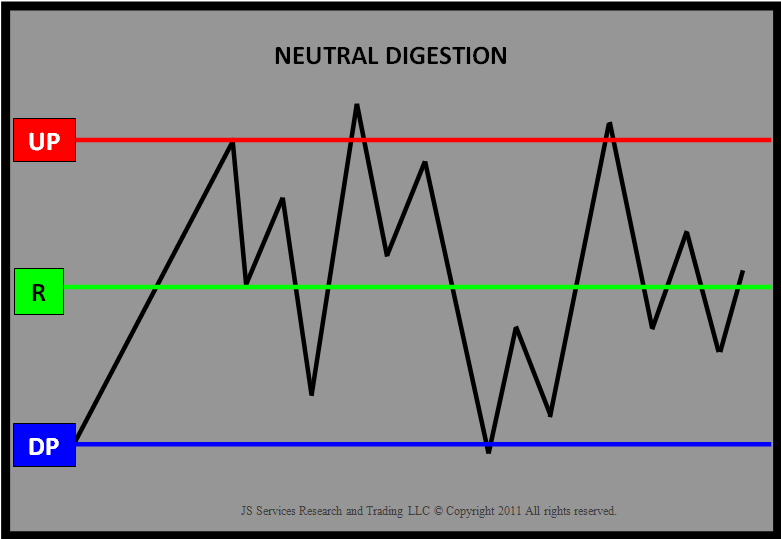

The -3 to +3 area defines the NEUTRAL ZONE. Markets in this position are in 3 typical states; Digestion, Correction or Transition.

DIGESTION – A sideways environment with choppy trading conditions. In this condition directional moves are not expected to be sustained. Opportunity exists on both sides of the market, albeit profit potential is limited and should be realized “sooner than later”. Fade and Reversal strategies are recommended. Markets that do end a session with a strong directional bias will have trouble sustaining that bias in the coming session, without the support of a like change in the next session’s MC Value.

CORRECTION – The market has been displaying a directional bias and has had >2 sessions with an MC Value in the Trend zone. A Neutral MC Value following these conditions signals a potential “corrective” trade. The longer the “established” trend and the “sharper” the MC Value “shift”, the more likely the market is in a corrective mode. Best opportunity exists in entering the market in the direction of the previous trend. Fade, Reversal and Breakout strategies in the direction of the previous trend are recommended.

TRANSITIONAL – The market has seen a steady deterioration in directional bias, slowly moving from the Trend Zone to the Neutral zone. These are difficult trading conditions. False signals in both directions are common. Opportunity exists on both sides of the market however aggressive risk management should be implemented. Reversal and Breakout strategies are recommended. Successful Breakout or Trend strategies under these conditions are a “one-shot” opportunities, using aggressive trail stops and having expectations of a one-way “railroad” trading environment.

MCV – TREND

BEAR TREND ZONE BULL TREND ZONE

The BULL TREND and BEAR TREND define the Positive and Negative Trend Zones respectively. Markets in this position are in 3 typical Trend states; Beginning, Established and Late (End).

BEGINNING TREND – The market has had >= 2 sessions with the MCV in the trend zone. The environment is expected to be “stop and go”, with opportunity on both sides of the market with the best opportunity @ the R Level in the direction of the Trend bias. Fade and Reversal strategies are expected to be more successful over Breakout strategies as the Trend has yet to establish itself and may be “choppy”.

ESTABLISHED TREND – The market has had >3 sessions of MCV in the trend zone, at least one value => 6. Values of 7 or 8 show a strong trend bias. Breakout and Fade strategies in the directional of the MC Value and R Level bias are recommended as well as Reversal strategies in both directions. Expectations are for a “smoother” trading environment.

LATE TREND STAGE – The market has had >= 9 sessions in the Trend Zone with at least 3 sessions >= to 8 and one of those sessions a >=9. Trend strategies remain in effect, however large price movement in the direction of the trend bias should not be expected to be maintained. Any Breakout strategy should look to take profit on “exhaustive” surges as the market is expected to “give back” the bulk of the intra-day move in this stage. Reversal strategies should focus on counter trend opportunities as these signals are expected to be a foreshadowing of an impending “correction” or “digestive” trade.

MCV – EXTREME

NEGATIVE EXTREME ZONE POSITIVE EXTREME ZONE

These zones define the Positive and Negative Extremes. Markets in this position are extended and are expected to Reverse or trade in a sideways digest. Counter trend Reversal, Oscillator OB/OS type Fade, divergence and Breakout strategies are recommended. Breakout strategies in the direction of the trend are not advised however if implemented should use tight risk management. The market is at an extreme and an exhaustive or reversal signal is expected.

Weekly Radio Segment with Topstep Trader

/in Company News /by JSServicesJan 6 2016

JSServices in conjunction with TopstepTrader launch a weekly web radio broadcast each Thursday at 11:30am cst with host Eddie Horn to discuss market insights and the practical application of state analytics.

MarketColor Profile Analysis

/in Analytics, MarketColor /by JSServices![]()

MARKETCOLOR PROFILE

Technical indicator analysis by design is lagging. It is always looking backward and “waiting” for the last price to determine a signal. This is an important point, as all technical indicator analysis should be looked at as a foundation for an opportunity rather than a signal for one. Opportunities must be anticipated.

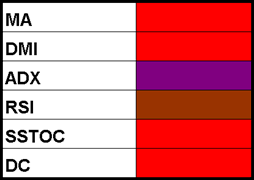

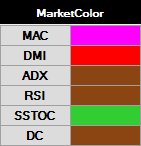

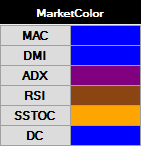

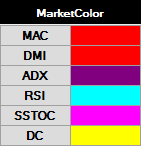

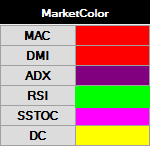

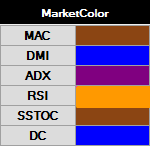

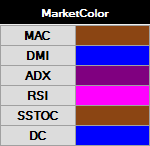

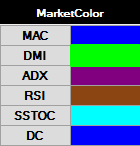

Sample Profile

The Market Color Profile is made up of six classic technical indicators. The numerical and logical results of these indicators are color coded to simplify their interpretation. The technical indicators included in the profile include the following:

- TREND – Moving Average “MA“, Directional Momentum Index “DMI“

- TREND ABILITY – Average Directional Momentum Index “ADX“

- OSCILLATION EXTREME – Relative Strength Index “RSI“

- TURNING POINT – Slow Stochastic “SSTOC“

- EXTREME DEVIATION – Bollinger Band / Keltner Channel / Dynamic Channel “DC“

MarketColor Sample Profile

Color Codes

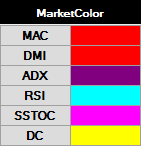

The numerical and logical results of the technical indicators (shown above) are represented by color codes. The table below displays how to interpret the results using the colors shown.

MarketColor Profile Result Color Codes

Analysis Steps

Step 1. Does the market have a trend bias? What is the color position of the DMI and Moving Average?

- A GREEN, BLUE, ORANGE or RED color signifies a trend bias. If the color of either the MA or DMI indicator is BROWN, the other indicator’s trend color should be discounted. If both are BROWN, the market is in a NEUTRAL posture.

- In a NEUTRAL trend bias, the analysis should focus more on the Oscillator indicators. The Moving Average indicator can be in a YELLOW or extreme position which would signal caution to any DMI signal.

Step 2. If the market has a trend, how strong is it? Do both trending indicators confer?

- If both trending indicators have any combination of GREEN | BLUE or ORANGE | RED, the market will have a strong trend bias. AQUA or PINK are transitional colors and should NOT be considered trending.

- After a trend has been determined, the next indicator to look at is the market trending ability or ADX.

Step 3. Does the market have follow through potential?

- An ADX with a BROWN color signals that the market is not showing any trending tendencies and would discount the trend color bias. In this instance, greater weight should be placed on the Oscillator indicators.

- A PURPLE color signals a trending market that will add weight to any trend signal and discount the Oscillator indicators. A trending market with trending tendencies should then view the Turning Point and Dynamic Channel extremes.

Step 4. Is the trend at a turning point?

- The SSTOCH (Slow Stochastic) Turning Point counter trend signals warn that the current trend is ready to take a pause and possibly reverse. A trend reversal signal would have a counter trend action color (GREEN or ORANGE) associated with it and should always be respected. A YELLOW color is a signal that the market is at an extreme, and the trend is exhausting with the possibility of a pause or reversal of the current trend bias.

- Turning point indicators with like trend bias colors will add weight and reinforce the current trend.

Step 5. Is the market at an extreme?

- The Dynamic Channel color profile shows if a market is moving to or is at an extreme. All other colors should be noted for their support for or against the current trend.

Step 6. Is the market in a Neutral posture?

- If the market does not have a trend bias or does not have any trending tendencies, then the Oscillator indicator (RSI) will determine the market’s tone.

Step 7. Is the market overbought or oversold?

- If the Oscillators is at an extreme, it will produce a color signal. The RSI Oscillator indicator can produce a momentum signal with a GREEN (BUY) or ORANGE (SELL) signal associated with it. This signal is usually early in a market’s transitional posture.

Step 8. What is the general tone or MC Value?

- The market’s technical “color” profile is summarized into a single numeric value – the MC Value. The value is based off the color position of the different MarketColor indicator technical systems. Markets with more systems in a positive position will have a greater positive MC Value, and markets with more systems in a negative position will have a more negative value. Markets counter-balanced or NEUTRAL in color will have a value of zero (0).

Analysis Summary

After going over the MarketColor profile a market’s underlying technical tone will be revealed. This result should be used as a component when making trading decisions with or without other supporting technical or fundamental work.

Practical Examples

EXTREME DEVIATION – Dynamic Channel (Bollinger Band)

MarketColor uses the Dynamic Channel and Bollinger Band to show the stage of the trend a market is in. When the cells are YELLOW the market is at an extreme, and a pause should be expected. Typically, the market has made a sharp price move, either with or against the current trend.

A price move with the trend signals a sign of exhaustion. The market is a little ahead of it-self and will have difficulty sustaining price moves in the direction of the trend. Early morning follow through in the trend direction are particularly vulnerable and provide good opportunity.

Low Risk Trade Opportunity

- The market has rallied hard for the past 7 days. On the 8th day, the DC (Dynamic Channel) cells light up YELLOW, signaling that the market is at an extreme. The market opens higher. For a scalp, look for opportunities to FADE this strength either at major PriceMap resistance targets or even a better use a REVERSAL entry technique on a failure back through a violated PriceMap resistance level. This type of opportunity is even greater when the extreme signal (YELLOW) is against the underlying trend analysis. This type of signal is corrective and the market is “squeezing” the trend positions.

- The market has been in a 2-week BEAR TREND move and then has a sharp 1-3 day corrective rally, which turns the DC to YELLOW (Extreme). A higher opening, followed by fresh buying, would provide a FADE buy opportunity off major PriceMap resistance levels or even better a SELL REVERSAL opportunity on a violation back down through a violated PriceMap support level. This opportunity is farther reaching, as the signal is in the direction of the underlying trend and provides a low risk entry for potentially the start of the market’s next decline.

TURNING POINT – SSTOCH – Slow Stochastic BUY (GREEN) / SELL (ORANGE) signals

MarketColor uses this indicator to show trend turning points. When the cells are GREEN (Buy) or ORANGE (Sell), a turning point signal has been generated and Price Map moves in the direction of this signal should be respected.

These signals have the highest probability of success and should be expected to last for at least 1 to 3 days.

Low Risk Trade Opportunity

- The market has been strong for the past 10 days. On the 11th day, an ORANGE sell signal is generated on the SSTOC. Traders should look for FADE and REVERSAL opportunities to sell the market against the UP (Upside Pivot) or R (Reversal Number) or on a failure BREAKDOWN from the DP (Downside Pivot), as the chance of a corrective set-back is higher.

- A held trade above the UP will negate this signal for the session.

MOMENTUM – RSI – Relative Strength BUY (AQUA or GREEN) / SELL (PINK or ORANGE) signals

MarketColor uses the RSI indicator to show short-term shifts in momentum.

These signals are most successful in the initial signal session, but GREEN and ORANGE signals can influence the market for up to 3 days. The probability of success will increase when the ADX is in a BROWN (Neutral) position.

Low Risk Trade Opportunity

- The market has been trading directionless for the past 5 days. On the 6th day, a GREEN buy signal is generated on the RSI. Traders should look for buy FADE opportunities off the DP (Downside Pivot), the DIR or on a BREAKOUT above the UP (Upside Pivot), as the probability of a rally is higher. FADE and BREAKOUT entry strategies can be used off the R LEVEL as well.

- A held trade below the DP will negate this signal for the session.

TREND SIGNALS – MA (Moving Average) and DMI (Directional Momentum) BUY/SELL signals

MarketColor uses these indicators to show a market’s trend. Action colors [GREEN = BUY, ORANGE = SELL]in either the MAC (Moving Average Close) or DMI (Directional Momentum Indicator) systems indicate that a new trend signal is being generated.

New signals in one indicator that have a like-color bias in the other indicator should be viewed as a stronger signal. In addition, a PURPLE trending ADX (Average Directional Index) will add value to any buy or sell signal.

Low Risk Trade Opportunity

- The market has been working higher for the past 5 days. On the 6th day, a GREEN buy signal is generated on the DMI. Traders should look for opportunities to buy the market off the DP (Downside Pivot) or R LEVEL as well as a BREAKOUT entry strategies above the UP (Upside Pivot), as the chances of a rally are improved.

- In the above example, the MAC system is already in a Bull Trend (BLUE) and the ADX is PURPLE. This new buy signal in the DMI is both in the direction of the current trend (BLUE MA) and has follow-through potential (PURPLE ADX). Signals like these, if sustained, have the potential to carry the market for 2-5 weeks.

- A BROWN neutral ADX or MAC would take away from the strength of the DMI signal and any lasting effects. Buying opportunities under these circumstances should be considered short-lived, as a choppy trading environment is expected.

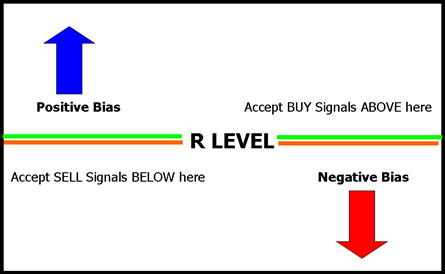

PriceMap R LEVEL

/in Analytics, PriceMap /by JSServices![]()

R LEVEL

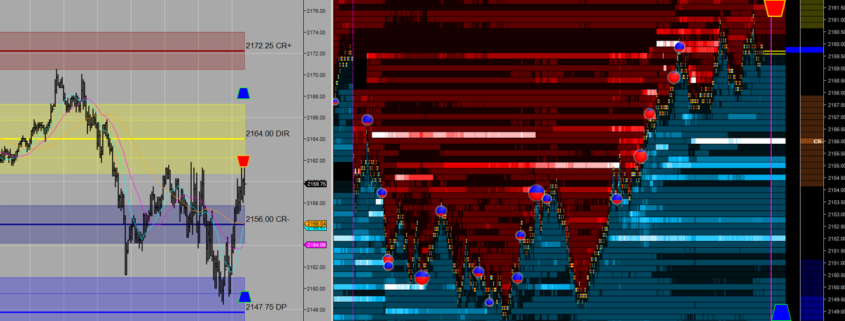

The PriceMap defines the price structure of the market state by identifying the sentiment bias for the trade period. It is the specific price point where shifts in state occur and where increased levels of liquidity can be anticipated to offer the most consistency.

The R LEVEL represents the equilibrium level within the PriceMap structure. It is the “Over-Under” number for the day and identifies the session’s trend bias.

Trading above the R LEVEL signals a positive buy break bias and trading below the R LEVEL signals a negative sell rally bias. It is this inflection point where sentiment shifts from positive to negative and vice versa.

The R LEVEL is the most significant price level on the PriceMap as it defines the session bias and is the best starting point when using the service. Traders should be aware of price activity in relation to the R LEVEL and note if the current action is with or against the R LEVEL bias.

Signals with the trend should be expected to be smoother, with follow through potential, and signals against the R LEVEL bias to be more laborious.

Because the R LEVEL is so significant price action around this level can be rotational as equilibrium balances its self out.

R LEVEL Overview

The R LEVEL can be used as a criteria filter for signal acceptance as well as a size and position management tool. If a signal is accepted that is counter to the R LEVEL bias, lower size is recommended along with a more aggressive position management with the target objective for the trade being the R LEVEL itself.

Note: the R LEVEL represents the optimal risk / reward entry level for any directional opportunity.

In situations where the current Price is significantly above or below the R LEVEL, any trades initiated in the direction of the R bias are ultimately at risk to and through the R LEVEL. A position is not “wrong” until the R-LEVEL is taken out. Trading action early in the session in the direction of the R LEVEL bias but significantly away from the R LEVEL is vulnerable to a “corrective” move later in the session. The market has a lot of room to “play” as counter session trend moves will not mean much as long as the R LEVEL is not violated.

Practical Application

The FTSE MIB over the past few sessions has provided corrective, directional and rotational examples of the R LEVEL behavior.

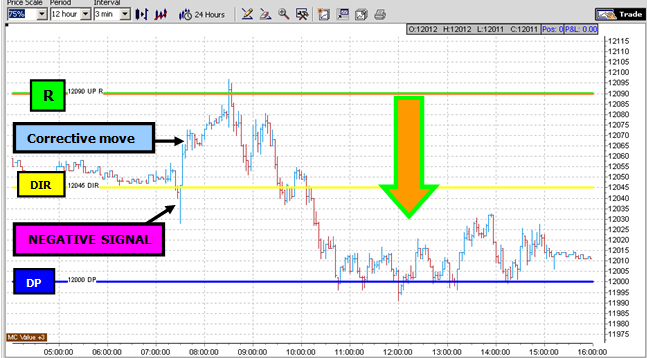

CORRECTIVE

JULY 28 2015 – FTSE MIB

On the OPEN the MIB broke structure producing a positive “corrective” rally targeting the R LEVEL. This type of corrective action is typically and a difficult trade. The market produces a trade against the R LEVEL bias which takes all session to play out. These types of opportunities typically happen after a negative signal the session prior with the R LEVEL significantly above the market . The “tell” being a break in structure at the DIR (Directional).

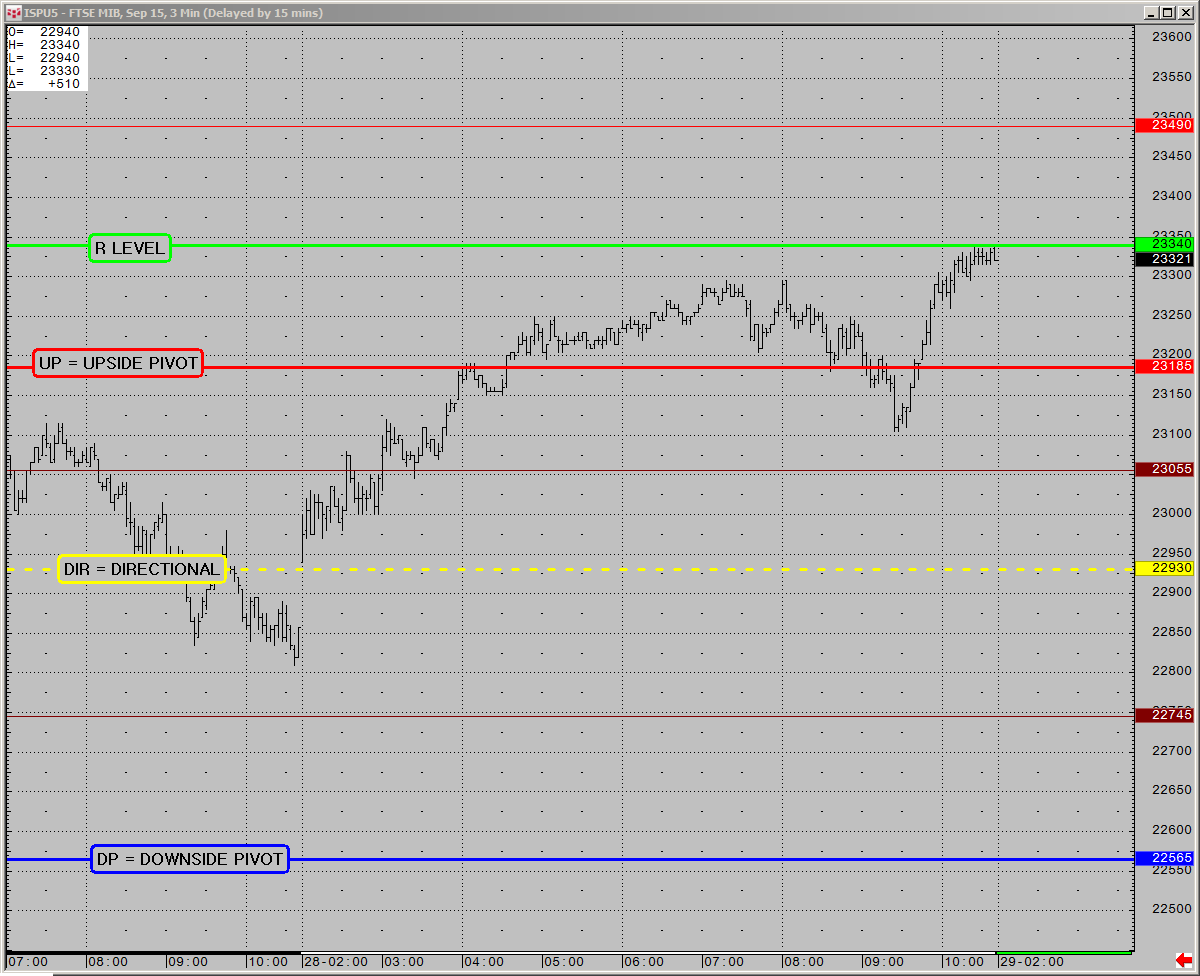

DIRECTIONAL

JULY 29 2015 – FTSE MIB

On the 29th the MIB was in a NEUTRAL DIGESTION market state identifying NON TREND condition. In NON TREND market state conditions we have a sideways expectation for price action. On the OPEN the MIB gaps higher against the R LEVEL bias and immediately turns in the direction of the R LEVEL bias. This example is interesting as the price action could not reach the R LEVEL and exhausted in front of the top of the CRITICAL RANGE at the UP (UPSIDE PIVOT). The market does not always give us what we want but it does tell us what it wants to do.

The price action around the 23380 * (CR+ = Critical Range + Minor Level) signaled a break in the OPEN positive momentum and the alignment with the R LEVEL bias. This signal, although a lower size opportunity, forecasts a “play” for the bottom of the CRITICAL RANGE at the 23055 DP (DOWNSIDE PIVOT). NON TREND market states have a sideways expectation to “digest” and the CRITICAL RANGE identifies the digestive extremes. After a “test” of resistance at 23505 UP and a break in structure at 23380 * in agreement with the R LEVEL bias, a lower forecast should be anticipated. The opposite would be true had the R LEVEL been below the market with a positive break in structure.

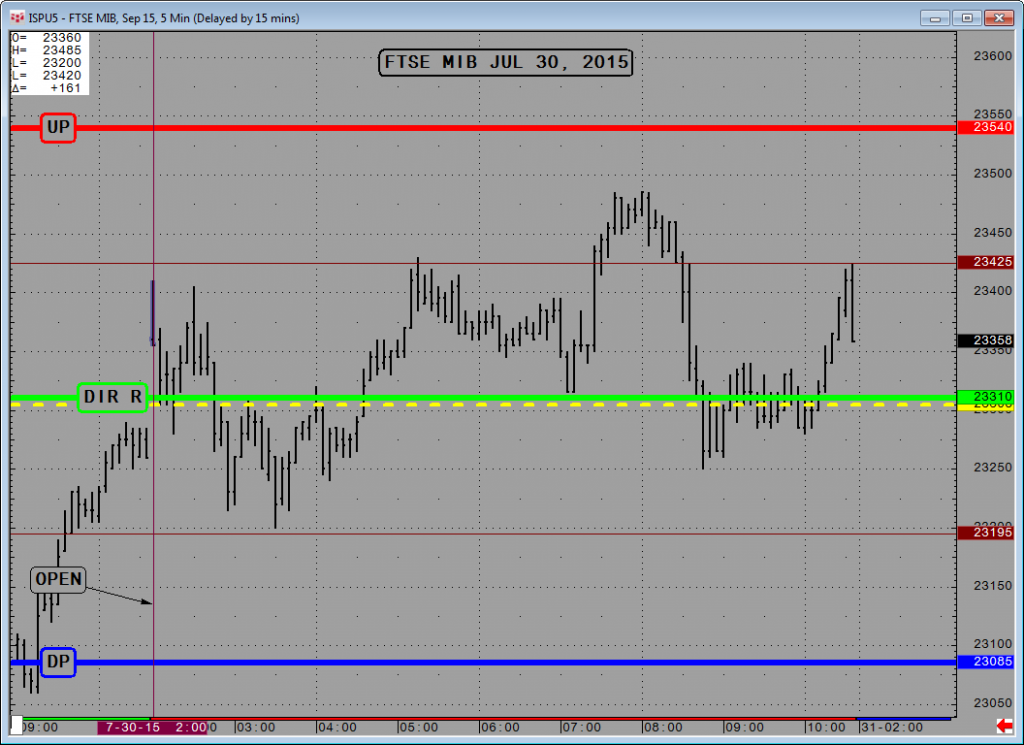

ROTATIONAL

JULY 30 2015 – FTSE MIB

On the 30th the index remained in a NEUTRAL DIGESTION market state but the equilibrium R LEVEL was balanced in the middle of the CRITICAL RANGE.

The R LEVEL equal to the DIR (Directional) is in a classic pivot point position, as the sentiment bias is basically “on the fence”. The market is indecisive or is preparing to make a move. Any Market State with the R=DIR should respect the pivotal nature of sentiment. Typically when the R LEVEL is in this position it will either just breakout and “go” producing a linear move or a difficult rotational trade will consume the market for the trade period. The price action in this session is an example of the later.

Note: When the R LEVEL = the DIRECTIONAL there is a higher probability that a rotational trade will occur, especially if there is a break in structure early in the session. This happened in the above example, after the OPEN above the DIR R LEVEL and then followed by a failure below. This “fact” and the bottoming out at the 23195 (CR- minor level) is a tell for a rise up to the 23425 (CR+ minor level). In a typical “coil” the rotational price action will be contained within the 2 minor levels (CR +/-) on either side of the DIR. In the above example the summer sideways trading condition provided a head fake to the upside but stayed true to form of the no follow through expectation of the NON TREND market state.

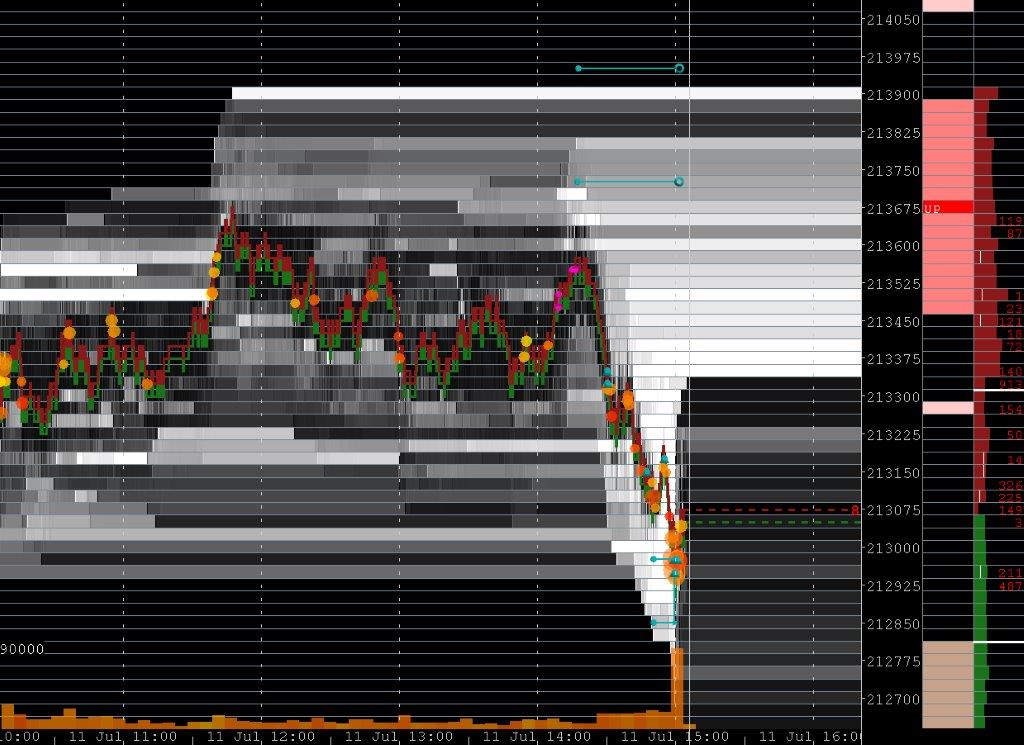

Bookmap Integration

/in Company News /by JSServicesNovember 11 2015

Bookmap launches JSServices Analytics integration as a “JSNotes” column including the full PriceMap Framework and MarketMetrics.

Market State Transition

/in Analytics, PlayBook /by JSServices![]()

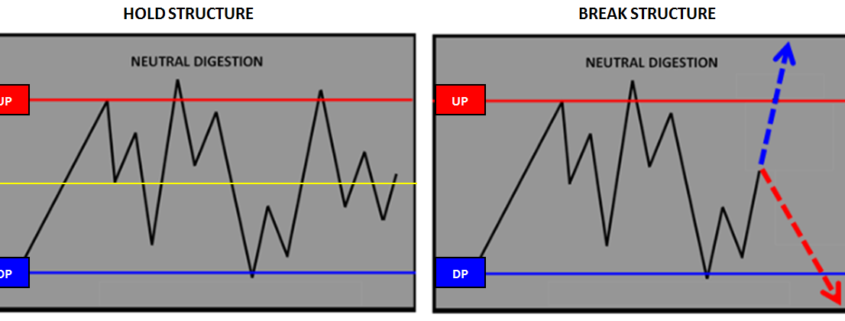

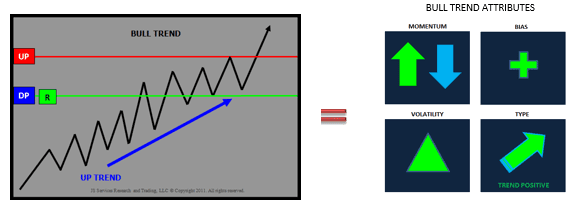

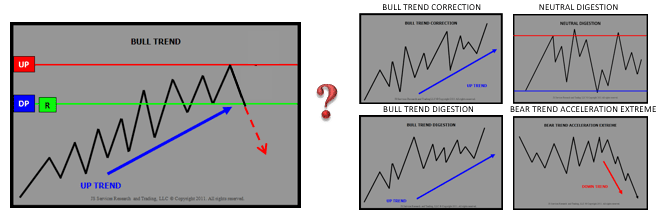

MARKET STATE TRANSITION

A market STATE condition as a definition does not change and is the same from day to day or from market to market regardless of asset class. A BULL TREND STATE will always be classified as a trending market that has positive higher move high higher move low structure. That is the definition of what a BULL TREND “is”. If the market is not maintaining positive structure then the definition is no longer true and signals that the market is transitioning into a different STATE. In a general sense markets that are performing to their STATE expectation are easier to anticipate verses markets that are not performing to expectation and are transitioning into a new market STATE.

We do not know when a market will transition to a new market STATE but we do know where it will make a decision to do so or not. It is at the market STRUCTURE points that define the price alignment the STATE that the market will make a decision for the current STATE to persist by holding structure or break structure and transition to a new MARKET STATE.

Hold Structure

Break Structure

If price action holds STRUCTURE, it is a sign that the attributes of the market STATE will dominate price action. A break in STRUCTURE is a signal that the market is in transition to a new STATE. Markets that hold STRUCTURE are easier to predict as the context of the trading condition is known. Markets in transition that break STRUCTURE are more difficult to predict as the characteristics of the condition are fluid and not defined.

Market Strategy Insight

/in PlayBook, PriceMap, Trader Insight /by JSServicesFACT FOUNDATION

When you look at a chart at the end of the day the price action seems self-evident even though at the moment it was anything but. The reason is that the trade vision at the moment is clouded with bias and opinion hiding what the market is “telling” you what is wants to do.

When we view the market with a fact focus, though a MARKET STATE lens, the “tells” are revealed in real time by the price action within the MARKET STRUCTURE, identifying the STRATEGY THEMES that are dominating the session so opportunities can be anticipated and trading tactics aligned.

Market State Awareness

/in MarketColor, Trader Insight /by JSServicesThe EDGE in discretionary trading comes in your ability to make intuitive decisions. It is the fluid execution of a trade plan with no hesitation or 2nd thought. The ability to trade “in the zone” comes from awareness of the current market state condition and getting “in sync” with its attributes and nuances. Awareness increases with a granular definition of the technical facts that make up the current market state. Understanding and knowing these facts improve awareness and provides “real time” CLARITY. It is in these moments of CLARITY that the decision process shifts from “reacting” to events to anticipating them. As a trader you are no longer “trying” and thinking about what to do but rather you know what to do and are doing it.

JSServices provides market clarity and gives you the edge by providing a structured approach to trading.

You Are Your Edge

/in Trader Insight /by JSServicesThe trading landscape is dominated by massive funds at one end who trade once a day against the VWAP and quantitative traders at the other who define their strategies in milliseconds. Technical traders struggle, getting chopped up by the algos and run over by the funds.

Identifying the structure of this landscape is what JSServices analytics do, providing technical traders with the knowledge base they need to get the EDGE, which is their ability to make intuitive decisions.

A true professional is an artist. The art of trading is expressed in intuitive decision making. Intuitive function comes from self-trust. Self-trust is created from a knowledge base of “truths”, facts that provide the awareness to the reality of what “is”. When real-time events are processed within this context, without being filtered with a subjective bias or emotion, it is the difference between great trading and marginal trading at best.

To attain this level of performance one must compile a comprehensive knowledge base of facts, yet remain unbiased. Remaining objective in this process is a challenge itself not to mention the time and skill set needed to process the data. A solution is a partnership with an objective experienced fact source.

The solution is JSServices.

Latest News

Support Contact

Email: info@jsservices.com

Risk Disclosure

Financial trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.