Application Integration Bookmap

/in JSIntegration /by JSServices![]()

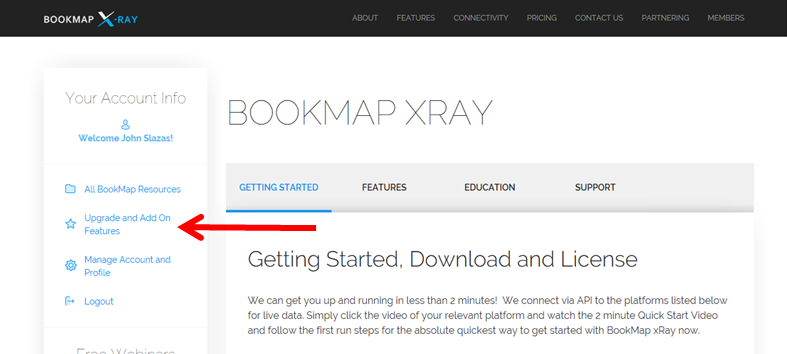

The JSServices PriceMap integration with Bookmap is contained within the Bookmap application itself as an “John Slazas Notes” or “JSNotes” Add-On.

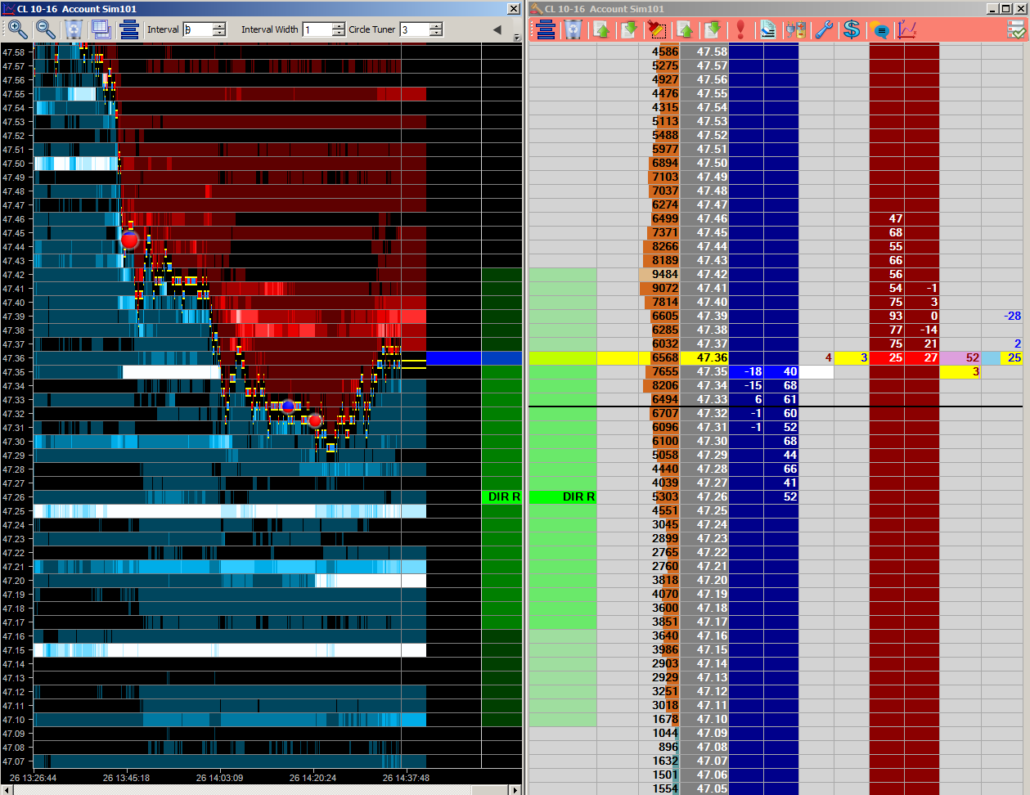

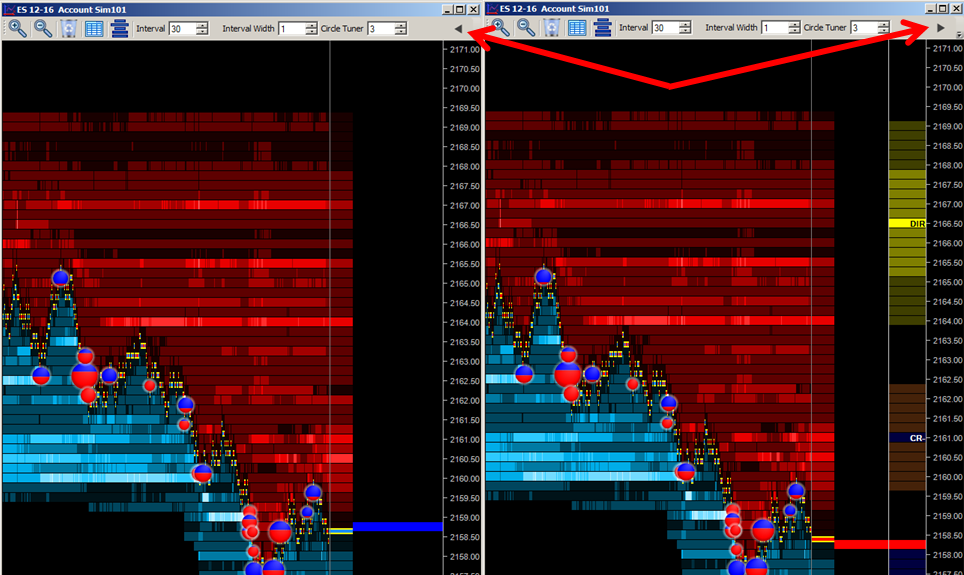

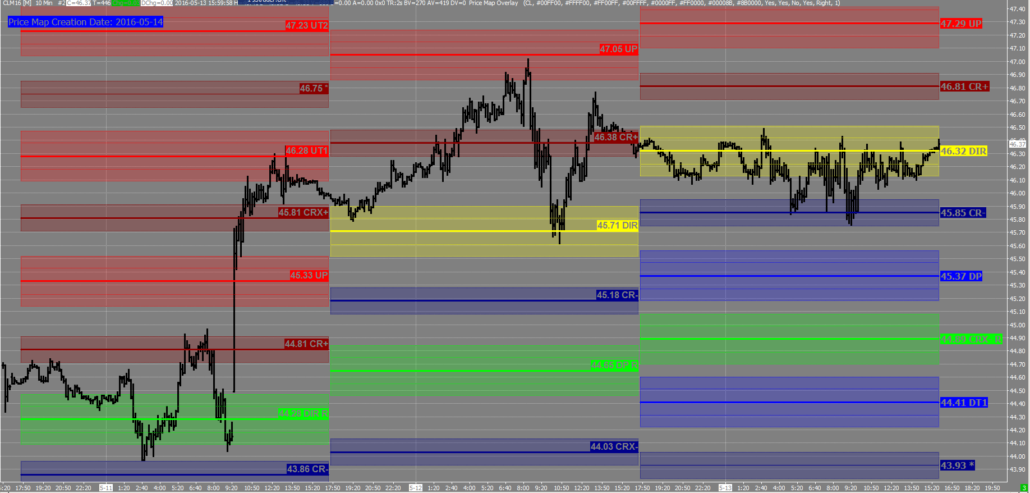

DEMO Bookmap with JSNotes Integration and JSDesktop

The JSNotes integration works in conjunction with the JSDesktop so you will need to download both applications.

- Please click here for a JSNotes DEMO

- Please click here for a JSDesktop DEMO

For more information please contact us at info@jsservices.com

Bookmap Clients

Bookmap clients are able to subscribe to the John Slazas Notes through the Member area Add On section.

JSNotes Set-Up

Once enabled the John Slazas Notes column can be inserted by right clicking on any column.

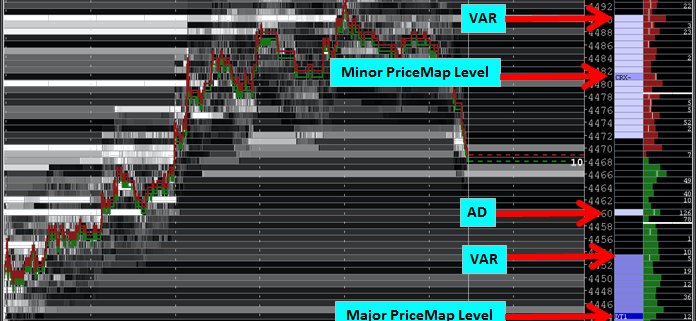

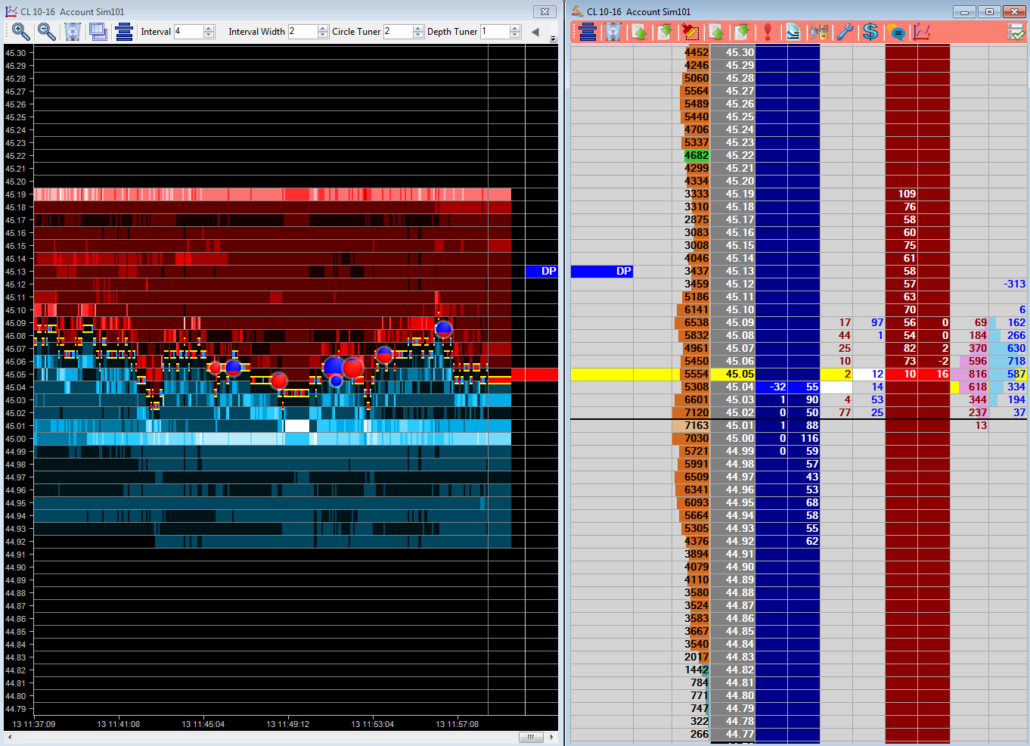

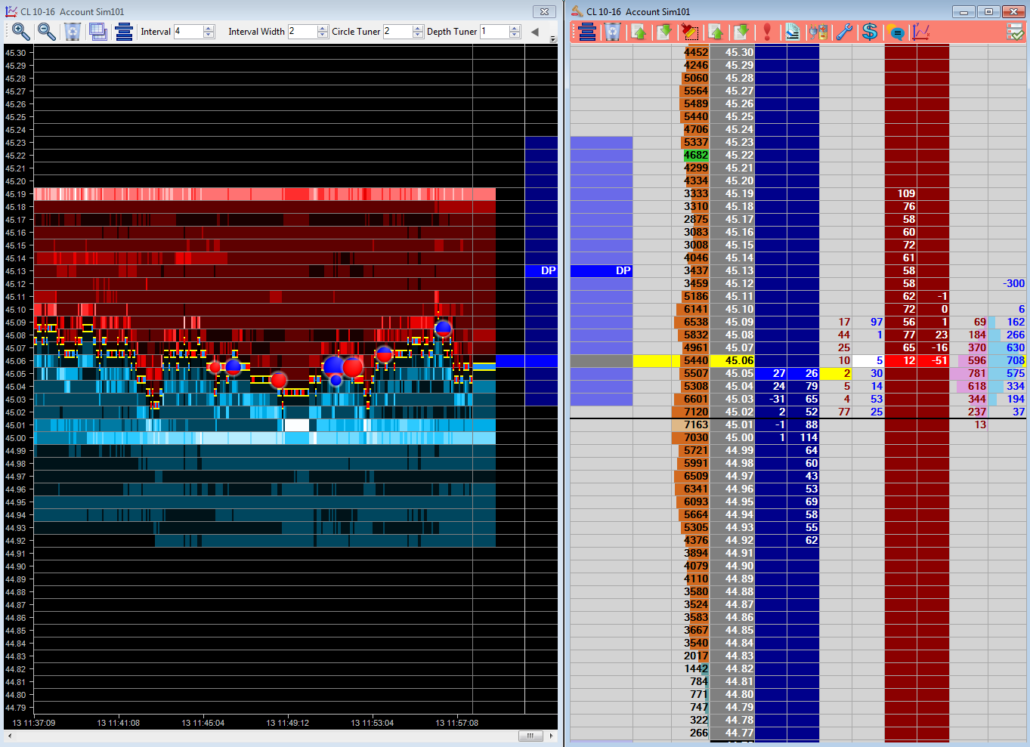

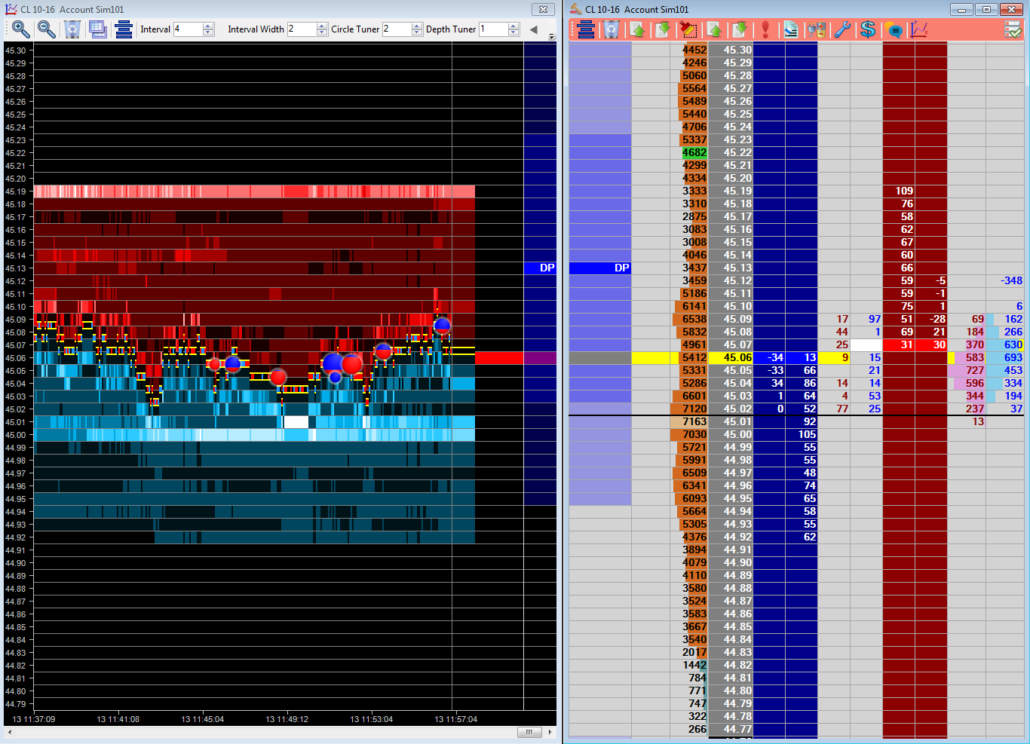

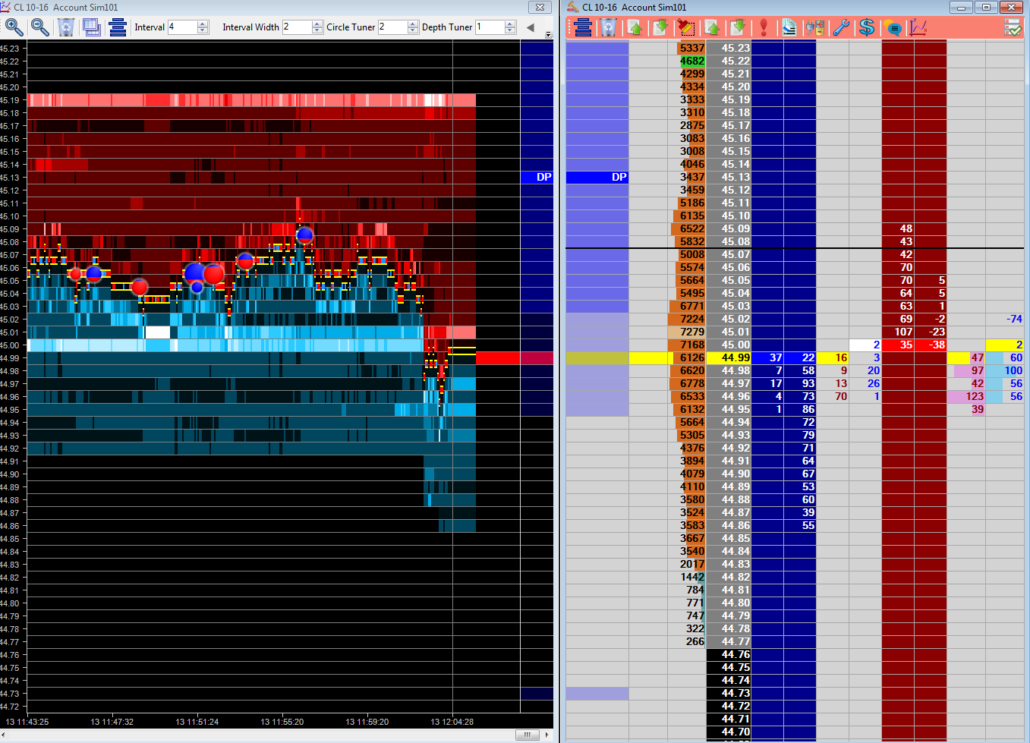

The full PriceMap Framework is presented in the JS Notes column along with the Market Metrics associated with each level.

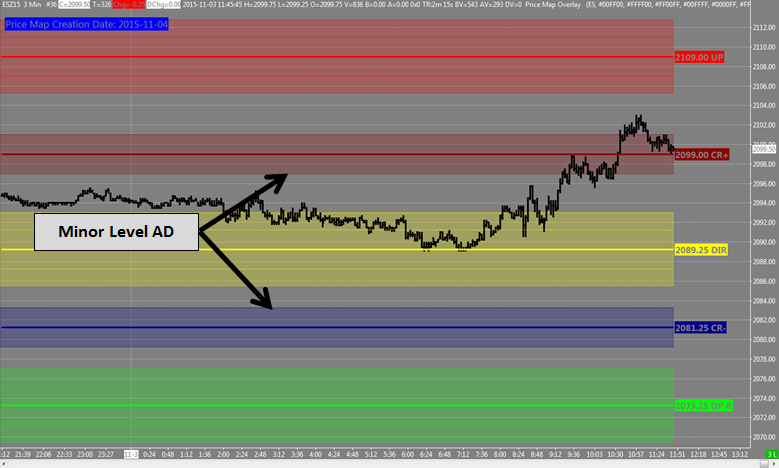

Directional and Major PriceMap levels will have both a VAR and AD metric identified as shown below. Minor PriceMap levels will only have there VAR displayed.

Click here for more an Overview of the JSNotes.

Application Integration Jigsaw Trading

/in JSIntegration /by JSServices![]()

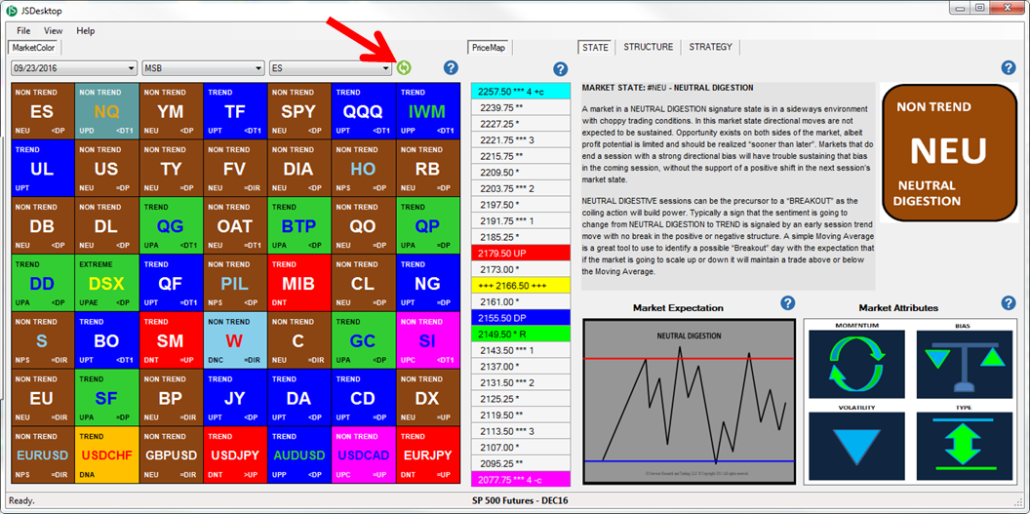

The Jigsaw Trading integration works with the JSDesktop so that the PriceMap Framework and Market Metrics are visible on both the Depth & Sales and Auction Vista.

STEP 1

Be sure you are running Jigsaw Trading version 5.4 or higher.

STEP 2

Open the JS Desktop application, which will automatically create a file with the PriceMap levels for that day. The REFRESH button can be used to request an update.

STEP 3

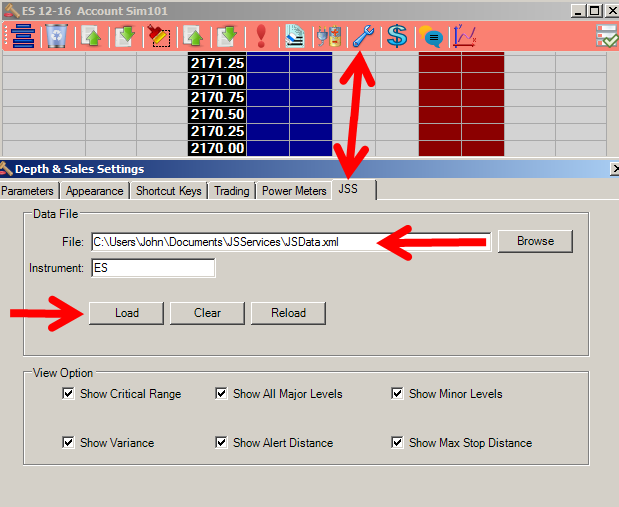

- OPEN the Jigsaw TOOLS Depth & Sales Settings window and select the JSS tab.

- The DATA FILE path should be set to your C:\Users\???\Documents\JSServices\ directory with the \JSData.xml file extension that you want to LOAD

- Select LOAD to import JSData into Jigsaw

STEP 4

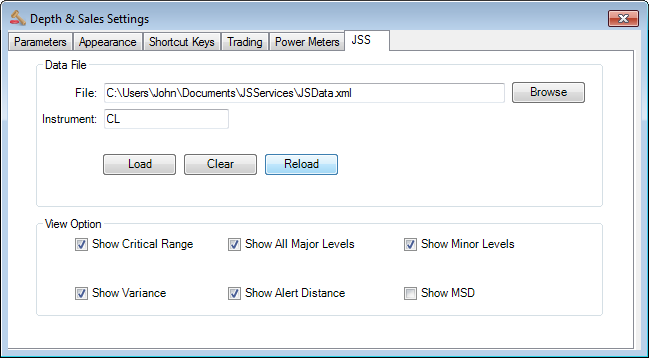

The JSS Tab defines the different options for JS Services Jigsaw Integration.

• Data File – The location of the data file produced by the JSDesktop Tool. By Default this is the (My) C:\Users\???\Documents\JSServices\JSData.xml Documents\JSServices\JSData.xml

• Instrument – The Jigsaw Depth & Sales Settings Instrument id defaults to the first 2 characters of the platform instrument id. The Instrument id must match the JS Symbol from the JSDesktop Market Grid. If it does not, then change the Instrument to the JS Symbol. For example IF ZN is entered in the Instrument box for the 10yr T-NOTE futures THEN change it to the JS Symbol TY to view the Price Map levels for the 10yr T-Note.

• Load – Click the LOAD button to update the levels each day. The data is loaded from the JSDesktop which will automatically update if left open. Note the Desktop date to confirm it is current. If not then refresh the JS Desktop so it has the correct Date and then click LOAD in the JSS integration setting to update JIGSAW.

View Options– Allow you to customize the JSServices PriceMap levels to be displayed.

o Show CriticalRange – Check if you want to display CriticalRange

o Show All Major Levels – Check if you want to display all Major PriceMap Levels

o Show All Minor Levels – Check if you want to display all Minor PriceMap Levels

o Show VAR – Check if you want to display the Variance around the level

o Show AD – Check if you want to display the Alert Distance around the level

o Show MSD – Check if you want to display the Maximum Stop Distance level

Examples:

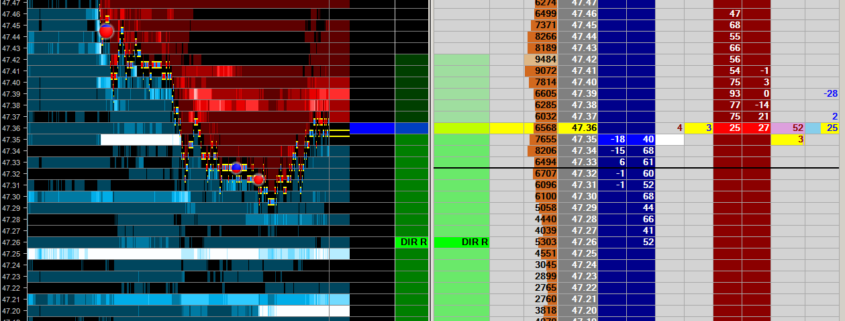

Show CriticalRange, all Major Levels and Minor levels

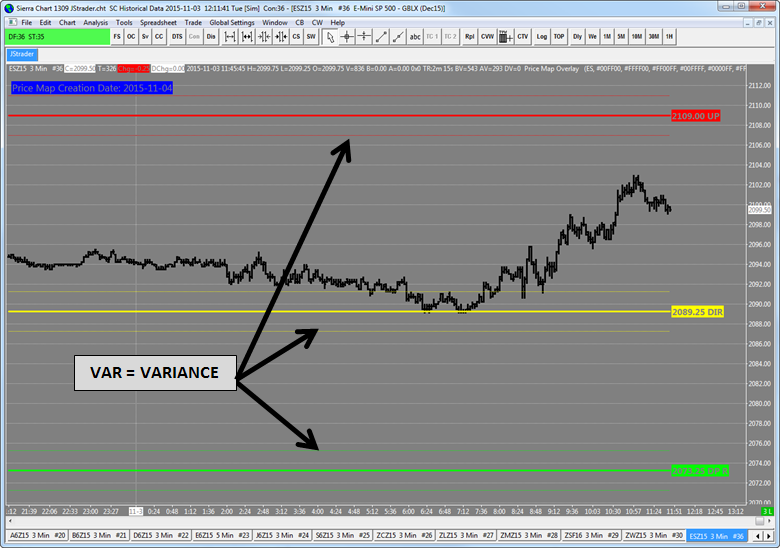

Show VAR

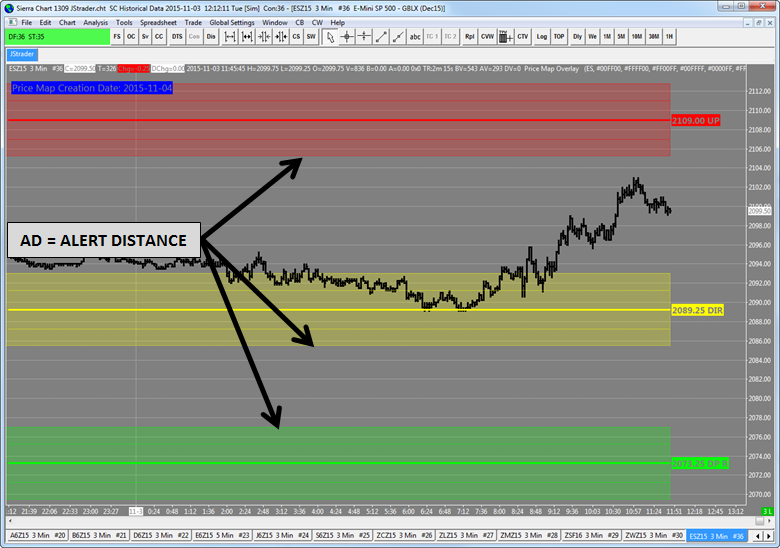

Show AD

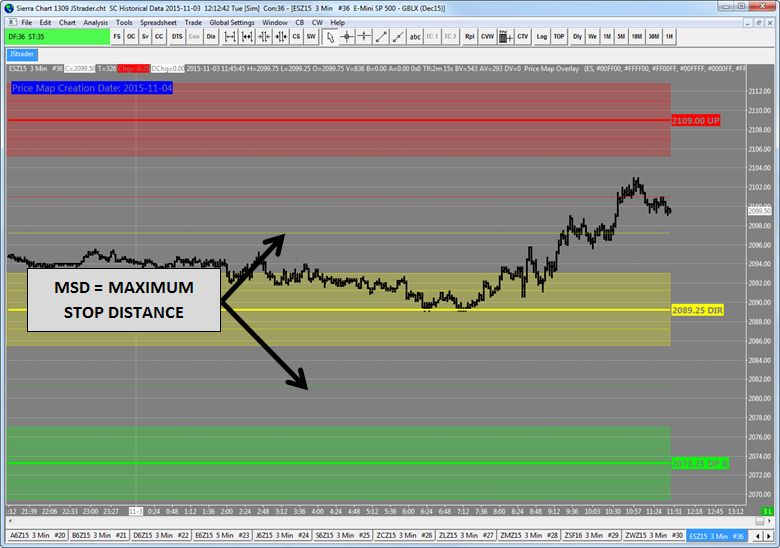

Show MSD

Note: Use the open arrow key to show and hide the PriceMap levels on the Auction Vista.

Web Videos

Daily Recap CL Example with Jigsaw Integration set-up

Strategy Recap: ES Example with Jigsaw Part 1

Strategy Recap: ES Example Part 2

Strategy Recap: ES Example Part 3

Webinar

Optimizing Trade Tactics Jigsaw Webinar http://www.jigsawtrading.com/auction-vista/optimize-trading-tactics-to-make-them-more-effective/?mc_cid=e69e9cca58&mc_eid=30deff3432

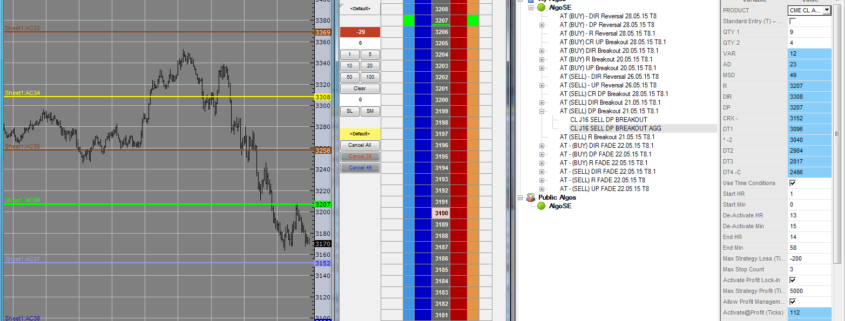

Application Integration Trading Technologies

/in JSIntegration /by JSServices![]()

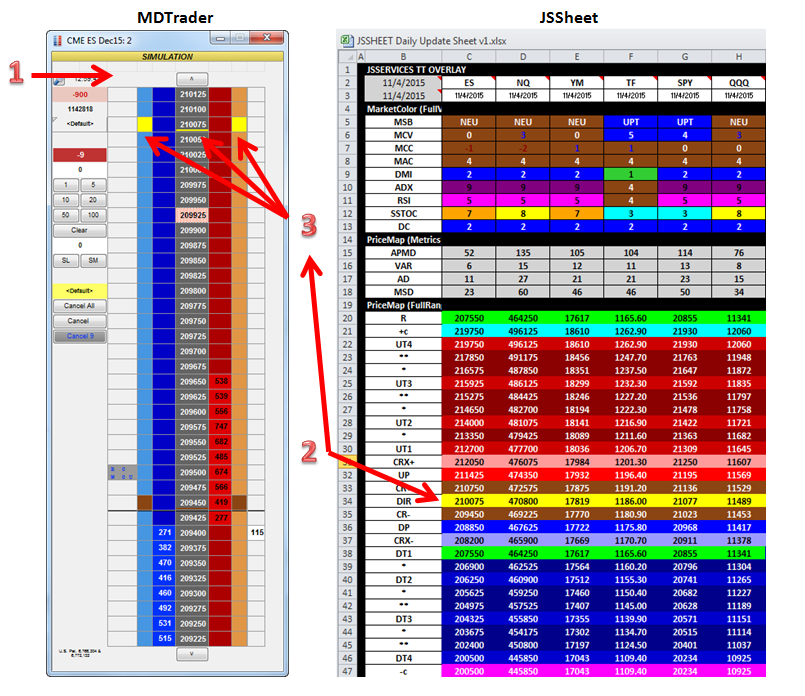

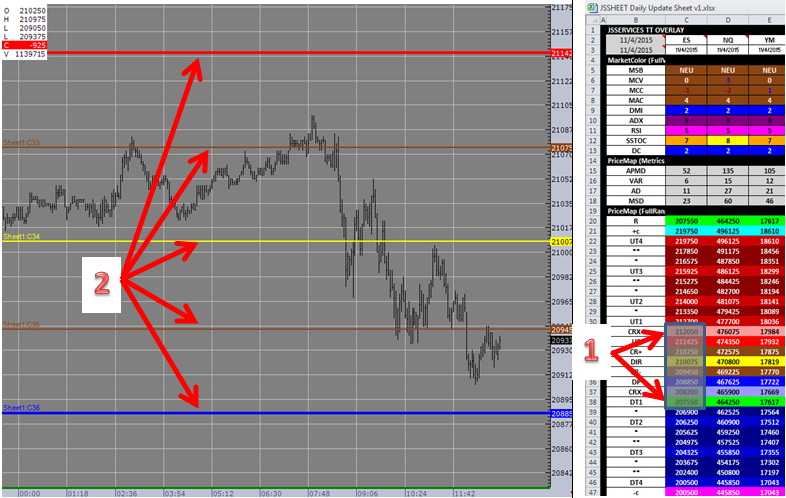

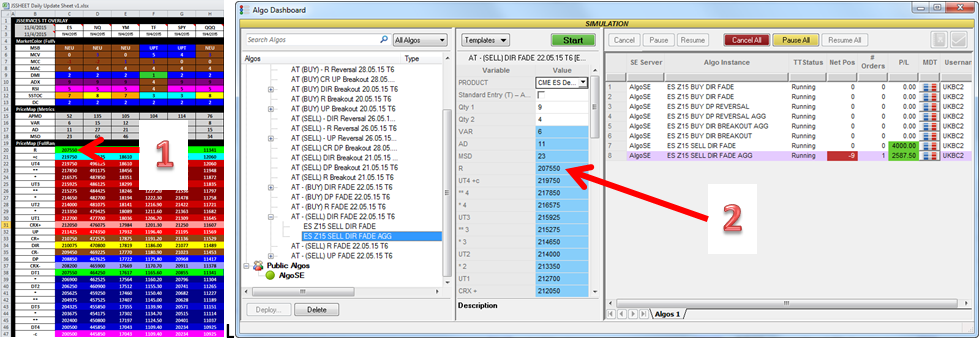

This document will go over how to integrate JSPriceMap Analytics with Trading Technologies MDTrader, XStudy Charts and ADL.

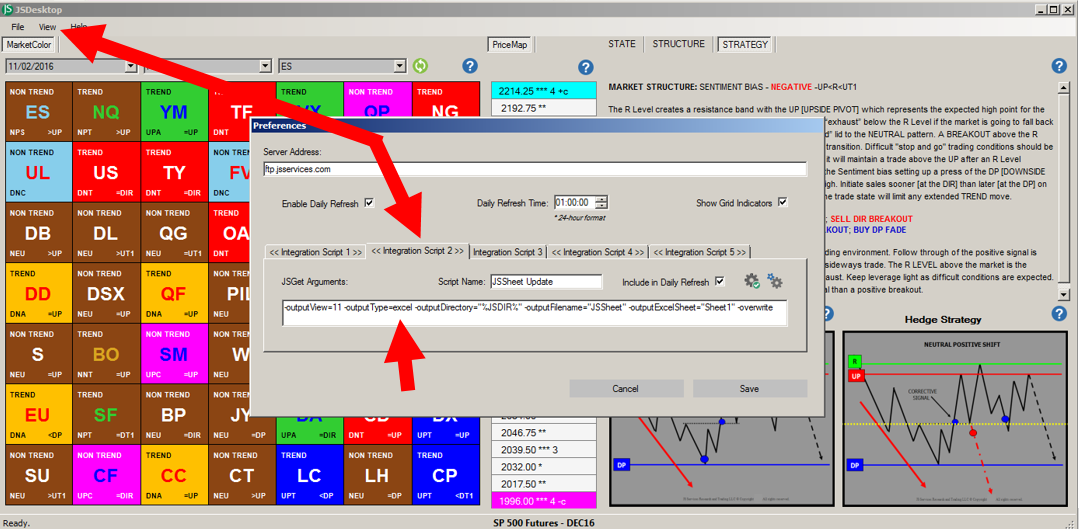

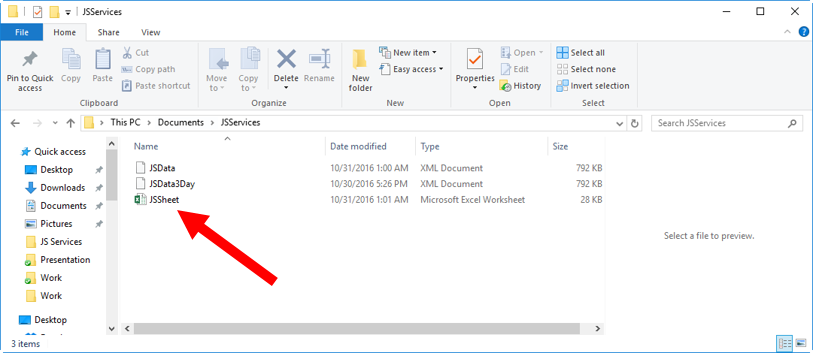

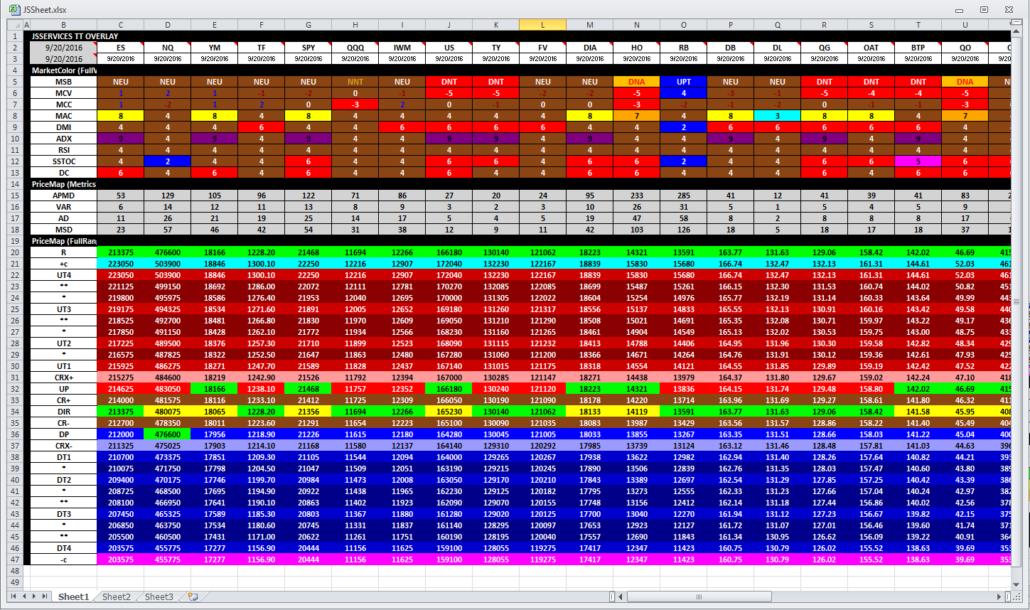

The JSDesktop Data Utility function creates an Excel (JSSheet.xls) in its Default Integration Script which is used to dynamically link into MDTrader, XStudy and ADL.

The JSSheet.xls file is saved in the C:/Users/………../Documents/JSServices/ directory.

STEP1 – OPEN the JSSheet that was created using the Default Integration Script 2 first before opening TT. The Excel sheet must remain open and stay open until after TT is closed to ensure the integrity of the dynamic linking. If you close the JSSheet prior to closing TT you may lose ALL you saved links.

JSSheet TT VIEW 11 Example

MDTrader

STEPS to ADD JSServices PriceMap analytics to MDTrader.

- Right click to open properties window and check ADD INDICATOR COLUMN. Set as default.

- Right click on the JSSheet Symbol and PriceMap level and select copy

- Right click on the MDTrader middle price column and paste. Do the same for both the left and right indicator columns. You don’t need to scroll to paste at the exact price for the links to work but you do need to link all 3 columns for each PriceMap level you want linked to the MDTrader window. You can scroll up and down the ladder after you have created the links to confirm that they are working.

- Save your settings

XStudy Chart

STEPS to ADD JSServices PriceMap analytics to an XStudy chart.

- Right click on the JSSymbol PriceMap level column highlighting up to 10 price levels at a time and COPY.

- Right click on the Chart and click PASTE. The PriceMap level should show up on the chart in the correct color code.

- If the PriceMap levels come up in BLACK then you must remove the black border of the excel cells. Be sure there are no borders

- If PriceMap levels do not show up be sure you have cut and paste the correct JSSymbol and price to the same XStudy chart symbol.

- To customize the thickness of the PriceMap level highlight level on the chart and right click to edit font size.

- Save your settings

ADL

STEPS to ADD JSServices PriceMap analytics to an ADL template.

- Right click on the JSSymbol PriceMap level and COPY.

- Right click on the ADL User defined variable and click PASTE.

Application Integration Sierra Charts

/in JSIntegration /by JSServices

Sierra Charts Webvideo Tutorial Click here

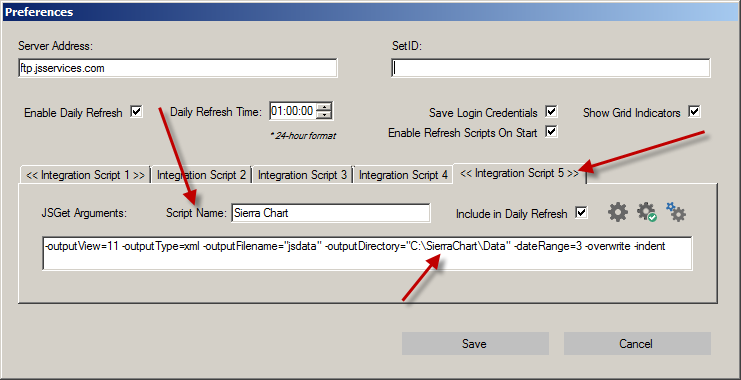

There are 2 STEPS to ADD JSServices PriceMap analytics to a Sierra Charts. Step 1 is the JSData integration which creates the js_data.xml file that Sierra Charts needs to “read” the analytics and the Step 2 is the Set-Up procedures to load the PriceMap script into Sierra Charts with the proper display settings.

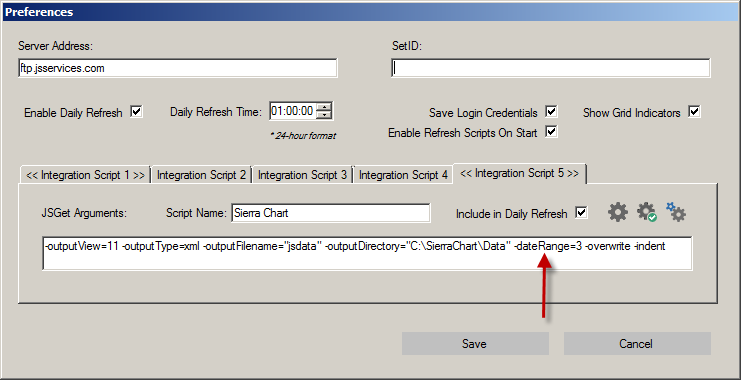

Step 1 : JSData Integration

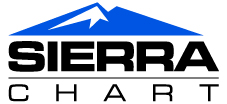

A Sierra Chart Integration Script must be created in the JSDesktop Preference section. The script must have a -outputFilename= “js_data.xml“. Sierra Chart uses the js_data.xml file to display the data. Below is a sample script which should be entered in the INTEGRATION SCRIPT tab 4 or 5.

Example

jsget -outputView=11 -outputType=xml -outputFilename=”js_data” -outputDirectory=” C:\SierraChart\Data” -dateRange=3 -overwrite –indent

After the script is entered click on the gear with the green check to confirm that everything has been entered correctly. If not an ERROR message will alert you to the issue. If the script has been entered correctly then a message of “No Issues found” will be shown. To test that the script is working, click on the small gears to run the script. The large gear to the left will reset the script to the default settings.

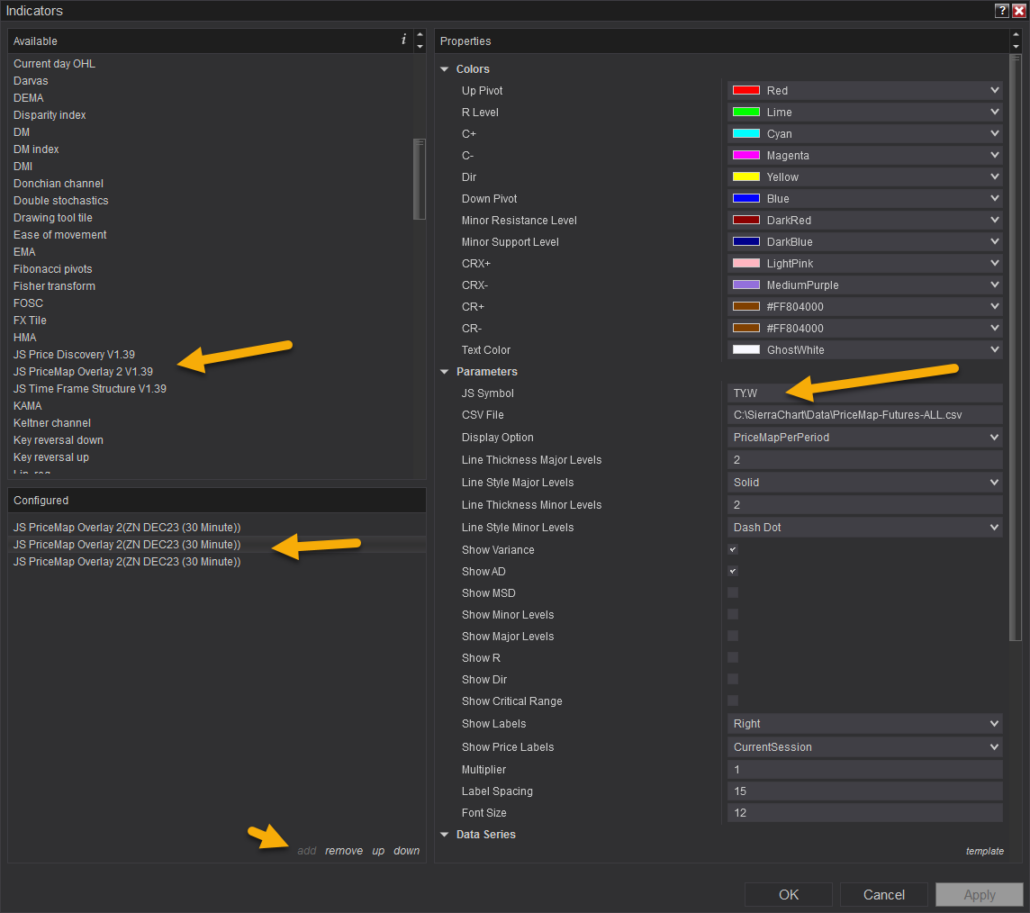

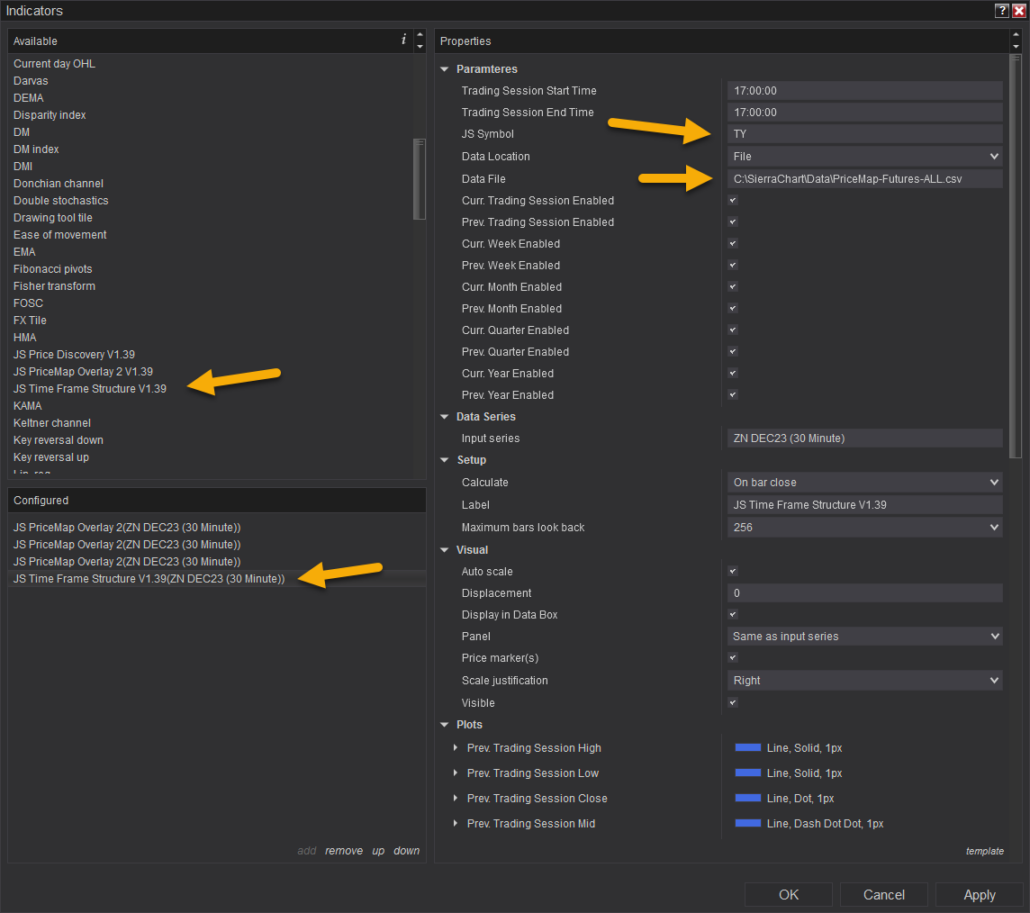

STEP 2 : Sierra Charts Set-Up

Note: Prior to the Set-Up process you must send mailto:info@jsservices.com your Sierra Charts User ID. Please let us know if you are on Transact. The JSServices Sierra Chart integration does not need to be downloaded separately it is all done with permissions using your User ID within Sierra Charts. Be sure to have the latest version of Sierra Charts loaded.

Set- Up procedures

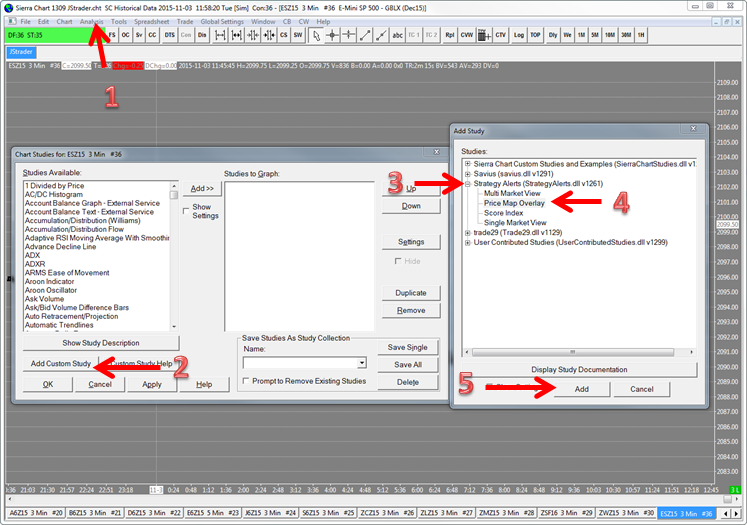

- Open ANALYSIS –> STUDIES editor or type F6

- Select ADD CUSTOM STUDY to open the Add Study Window

- Locate STRATEGY ALERTS and select PRICE MAP OVERLAY

- Select PRICE MAP OVERLAY

- Click ADD

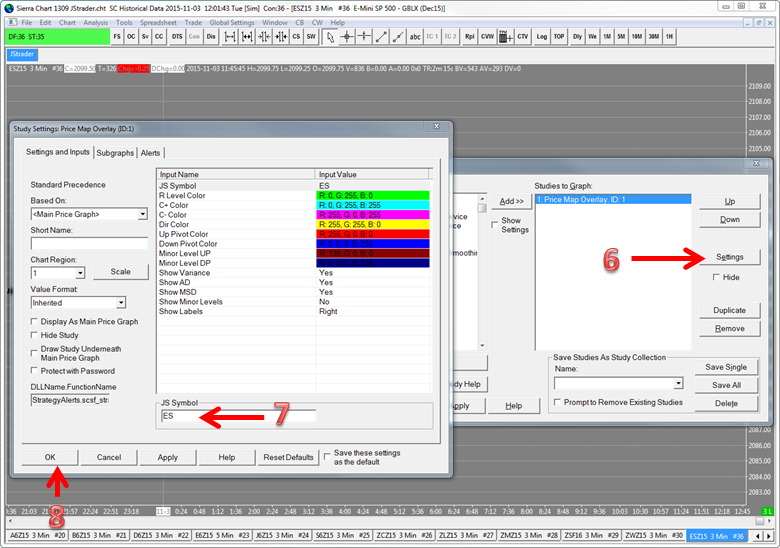

6. Click SETTINGS to open the STUDY SETTINGS PRICE MAP OVERLAY window

7. Edit the JS Symbol. The symbol should match the symbol on the JSDesktop MarketColor Grid.

8. Click OK

- Note: You can right click on the chart tab and select DUPLICATE CHART. This will create a chart with the identical settings. To create additional market hit F5 to open the CHART SETTINGS menu and edit the SYMBOL of your choice. Save and then HIT F6 to open the STUDIES window and edit the JS SYMBOL SETTINGS. After you have created all the charts you want by repeating this process save them in a CHARTBOOK.

DAILY REFRESH

When you open the CHARTBOOK each day the PriceMap levels may not be visable until you change a chart parameter like the chart TIME from 3min to 5min for example. An alternative is to OPEN the CHARTBOOK and then CLOSE the CHARTBOOK. Then when you OPEN it again all the levels should be displayed.

CUSTOMIZATION

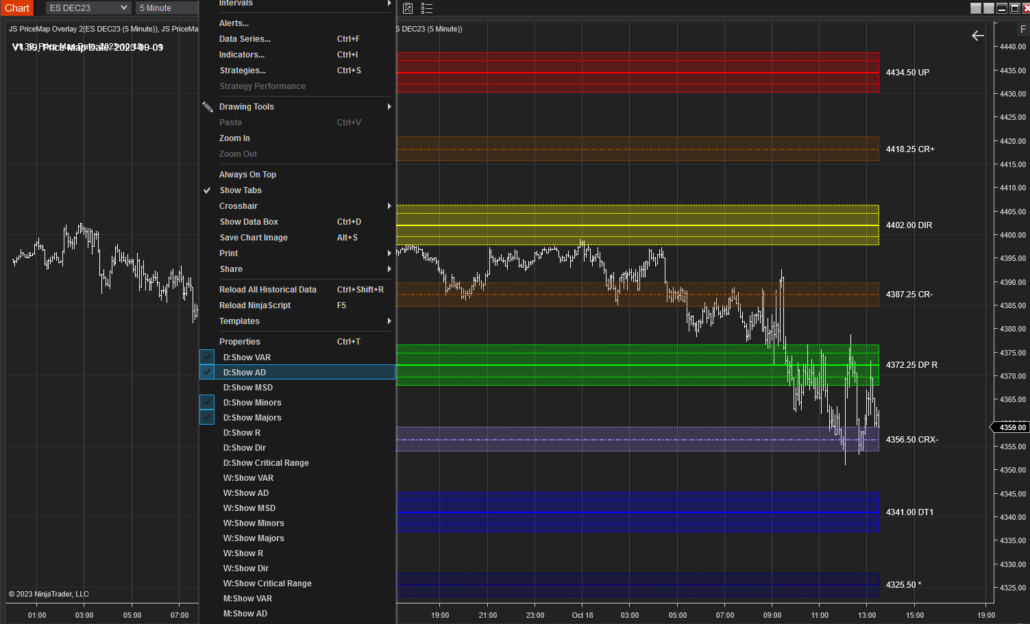

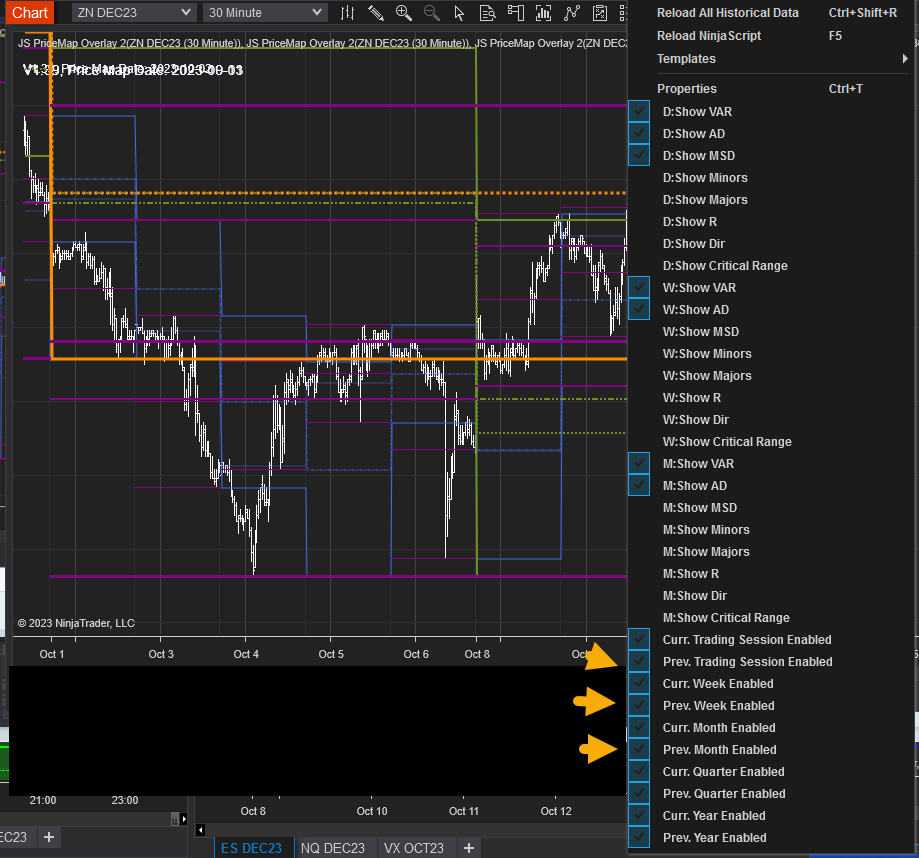

The PriceMap levels and Market Metrics can be customized by right clicking the chart.

- Show Minor

- Show VAR

- Show AD

- Show MSD

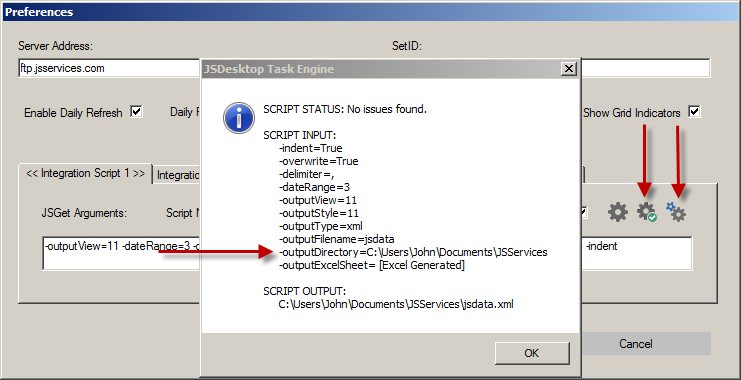

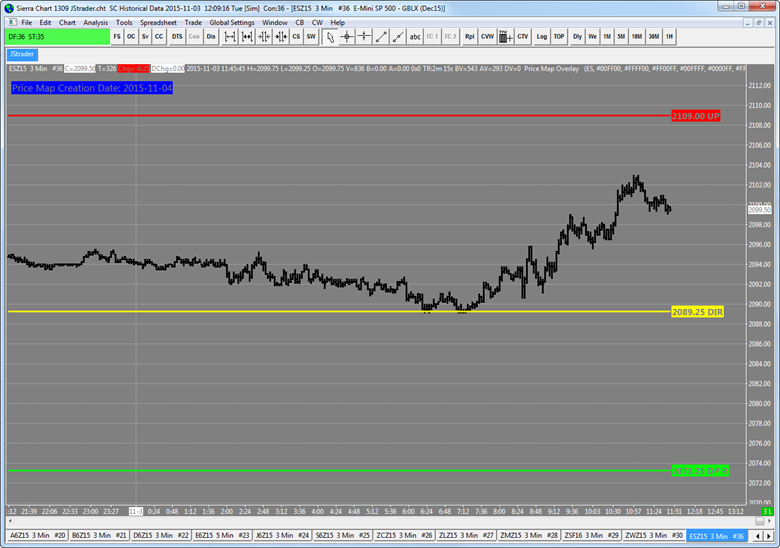

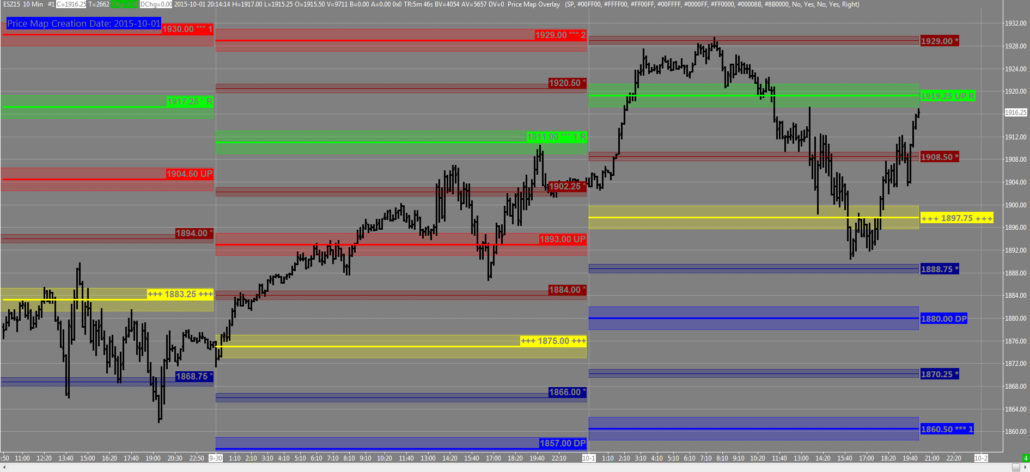

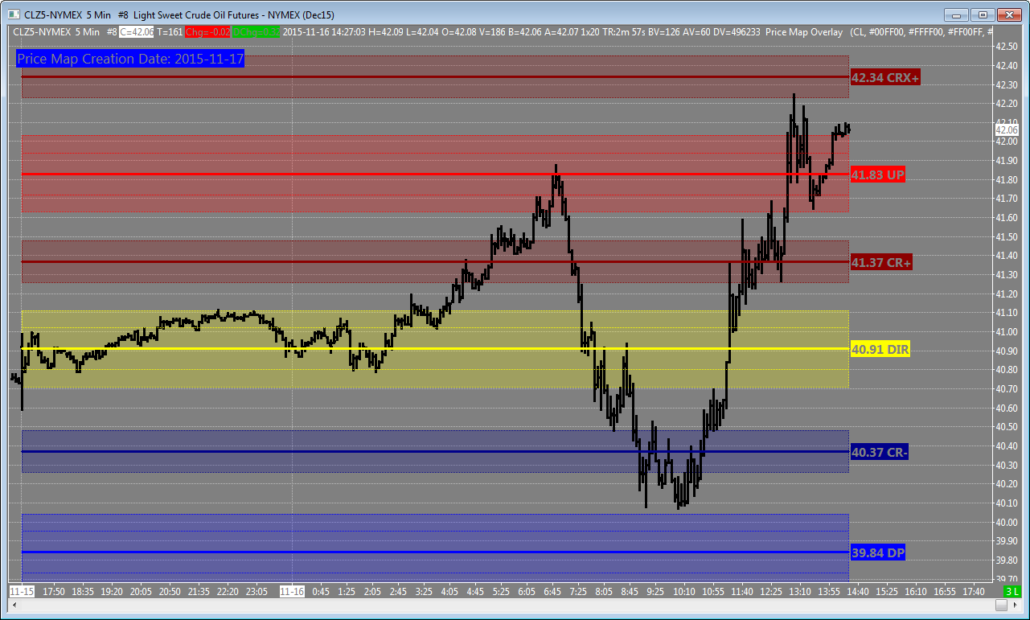

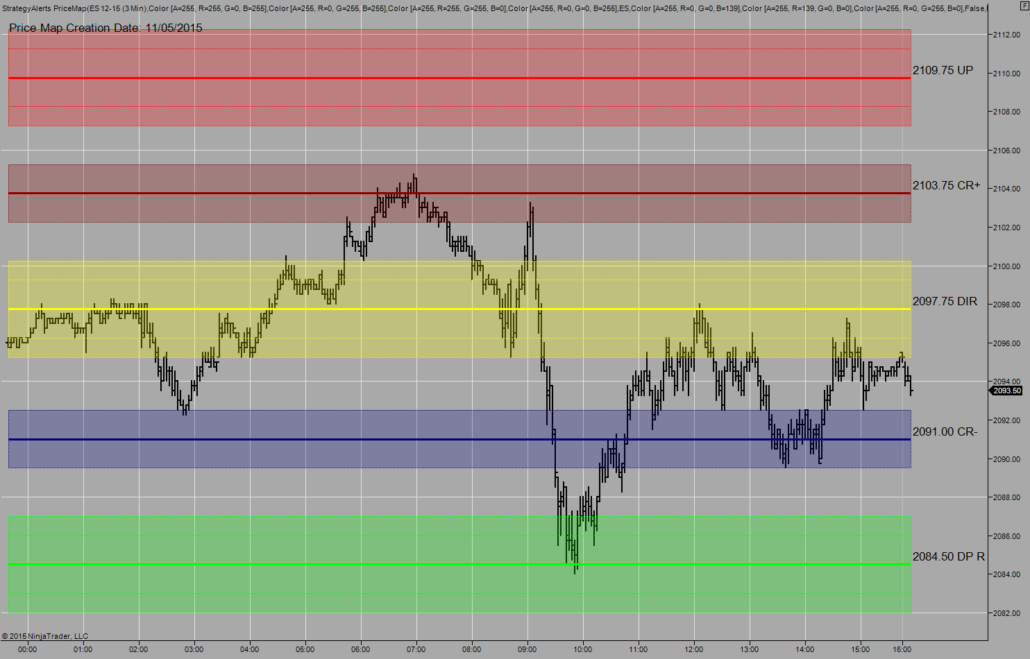

PriceMap BASIC VIEW

If no features are selected only the Major Price Map Levels (MPML) are displayed. This provides a nice broad overview of the key Market Structure PriceMap levels.

PriceMap FULL view

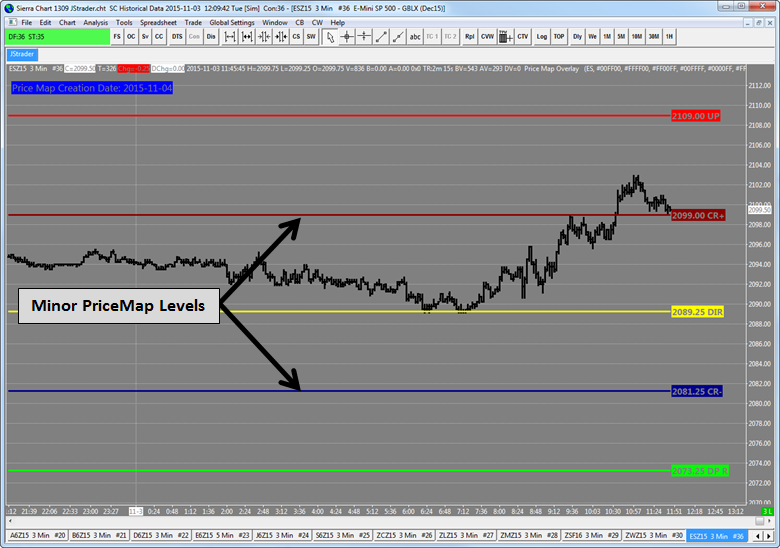

If the Show Minor Levels feature is selected the FULL PriceMap will be displayed.

MARKET METRICS

The Market Metrics identify the area of influence around a PriceMap level. Each metric has its own variance and meaning. These metrics are dynamically updated each day in accordance to the volatility expectation of the trade period.

VARIANCE (VAR)

The VAR metric represents the optimal area to entry or exit the market. It also identifies the potential “slippage” area around a Major PricMap level.

ALERT DISTANCE (AD)

The AD identifies the value area or sweet spot around a PriceMap level. This is the distance that defines the zone that most profitable trades will occur within. In addition it is a good metric to identify when market price is “through” a level.

MAXIMUM STOP DISTANCE (MSD)

The MSD is the maximum distance for any influence a PriceMap level with have and confirmation that the level has been violated.

PriceMap Market Metric FULL VIEW

In the FULL VIEW the Minor PriceMap levels will only have the AD displayed. There are no VAR or MSD metrics for the Minor PriceMap levels.

Additional Features

The default setting displays the current trading session PriceMap data. Up to 3 days’ worth of data can be requested by adding the following parameter to the Integration script : -dateRange=3. Below is an example that will grab 3 days’ worth of JSData. 3 is the maximum number of days that can be displayed. This may slow the daily retrieval down slightly.

Script Example:

-outputView=11 -outputStyle=5 -outputType=xml -outputFilename=”js_data” -outputDirectory=”C:\SierraChart\Data” -dateRange=3 -overwrite –indent

Application Integration NinjaTrader

/in JSIntegration /by JSServices

Integration

How to set-up the JS PRICEMAP Integration Video click HERE

- DOWNLOAD DATA

- DOWNLOAD and IMPORT the JS NT SCRIPT

- ADD the PRICEMAP to a CHART

- EDIT the SETTINGS

- DISPLAY FEATURES

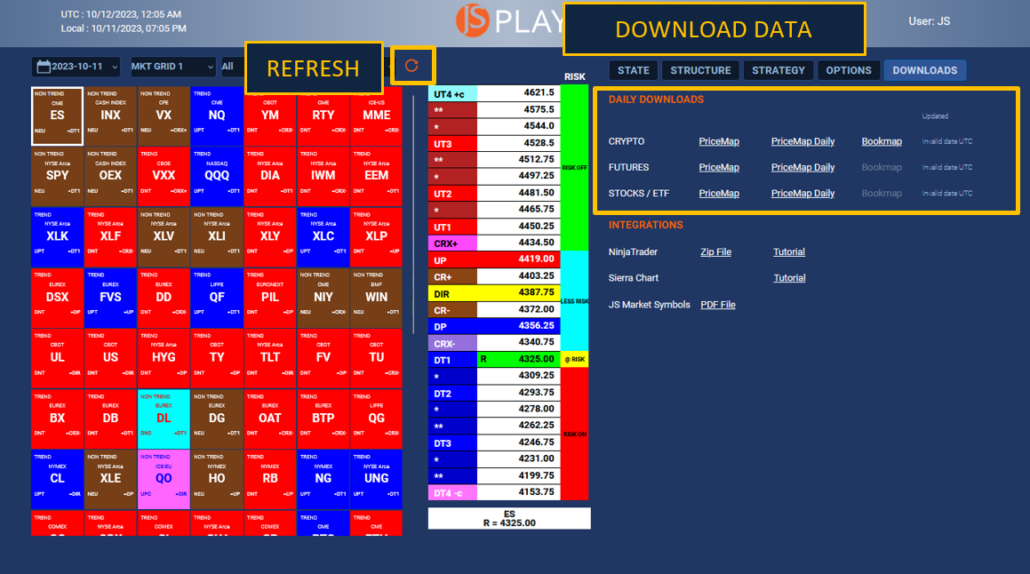

STEP 1 DOWNLOAD DATA

The PRICEMAP integration for NinjaTrader comprises two essential parts:

- The NinjaScript indicator, which displays PRICEMAP levels on your chart.

- The data files, which contain the price levels shown.

Updating this data is a crucial part of your DAILY WORKFLOW.

To DOWNLOAD DATA:

- OPEN the PLAYBOOK

- Refresh the PLAYBOOK to be sure you have the current data.

- Go to the DOWNLOAD TAB and select the PriceMap files you want to download.

- PriceMap file contains DAILY, WEEKLY, MONTHLY data available for Tier 2 subscriptions.

- PriceMap Daily file contains ONLY DAILY data is for Tier 1 subscriptions.

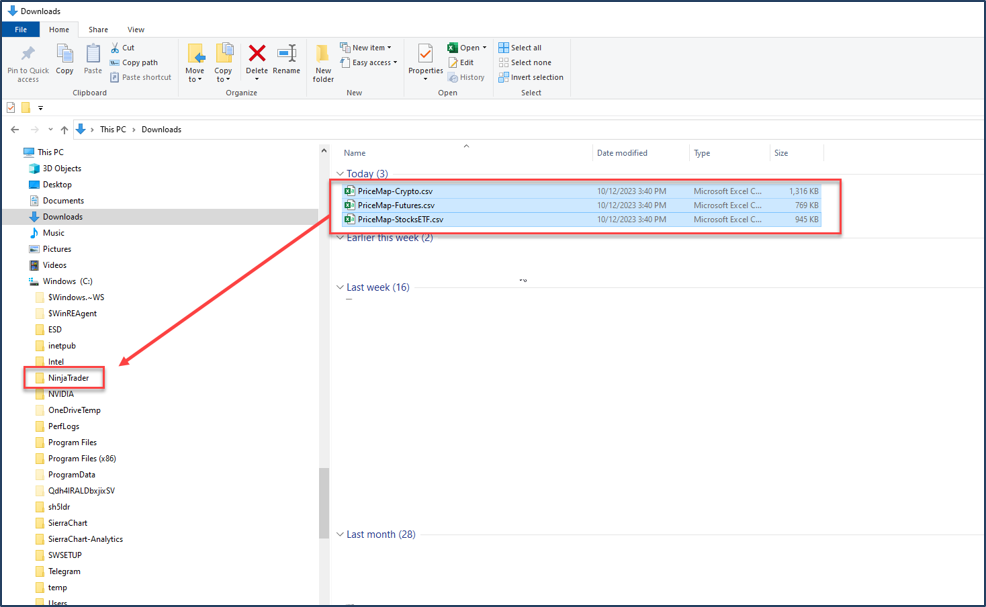

- Selected files will show up in Your DOWNLOAD directory.

- Choose an existing directory or create a new one on your local drive to store the files. The directory name is flexible; however, consistency is key. Ensure you save and overwrite files in this specific directory each trading day.

- Avoid copying and pasting them directly from the DOWNLOAD directory. Instead, select the files and drag them to the designated data directory (e.g., C: folder). This ensures the original files are moved out of the DOWNLOAD directory.

- Note: Direct copying leads to duplicate files in the DOWNLOAD directory, like PriceMap-Futures.csv. When you download again, the system will generate a new file, PriceMap-Futures(1).csv, which disrupts the integration due to the changed filename. Dragging ensures the file is moved, not duplicated.

- Remember the file path. For this example: C:\NinjaTrader\ PriceMap-Crypto.csv

STEP 2 –DOWNLOAD and IMPORT the JS NT SCRIPT

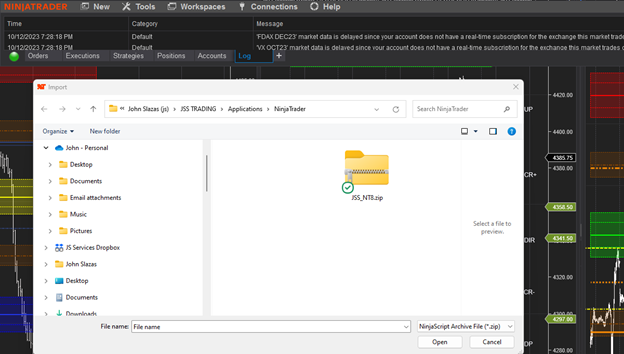

1. DOWNLOAD JS NinjaScript

Download and save the JS_NT8.zip file from the JS PLAYBOOK DOWNLOAD tab. You can save it in the same directory you created for your data files.

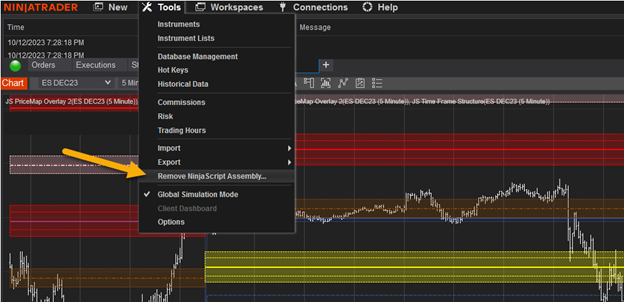

2. Remove Previous JS NinjaScript Version

- If you already have an older version of the JS NinjaScript installed, it’s essential to remove it before importing the new one. If you do not, then proceed to Step 4.

- Open the NinjaTrader Control Center.

- Navigate to TOOLS > Remove NinjaScript Assembly.

- From here, select and remove the older version of the JS NinjaScript.

- Once removed, you can proceed to import the new version.

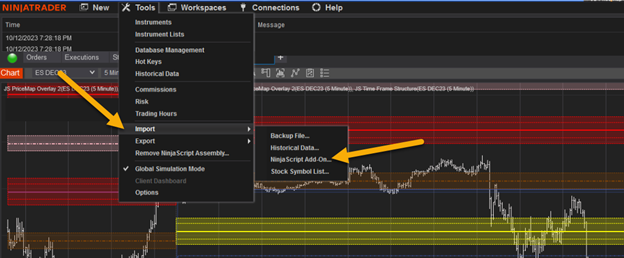

3. Import JS NinjaScript

-

- Open the NinjaTrader Control Center.

- Navigate to TOOLS > IMPORT.

- From here, select > NinjaScript Add On.

- This should open the directory that contains the JSS_NT8.zip. If not go to the directory you saved the file in, find the file and select it.

NinjaTrader will confirm the success of the IMPORT. If not close and re-open the NT application and repeat STEP 2.

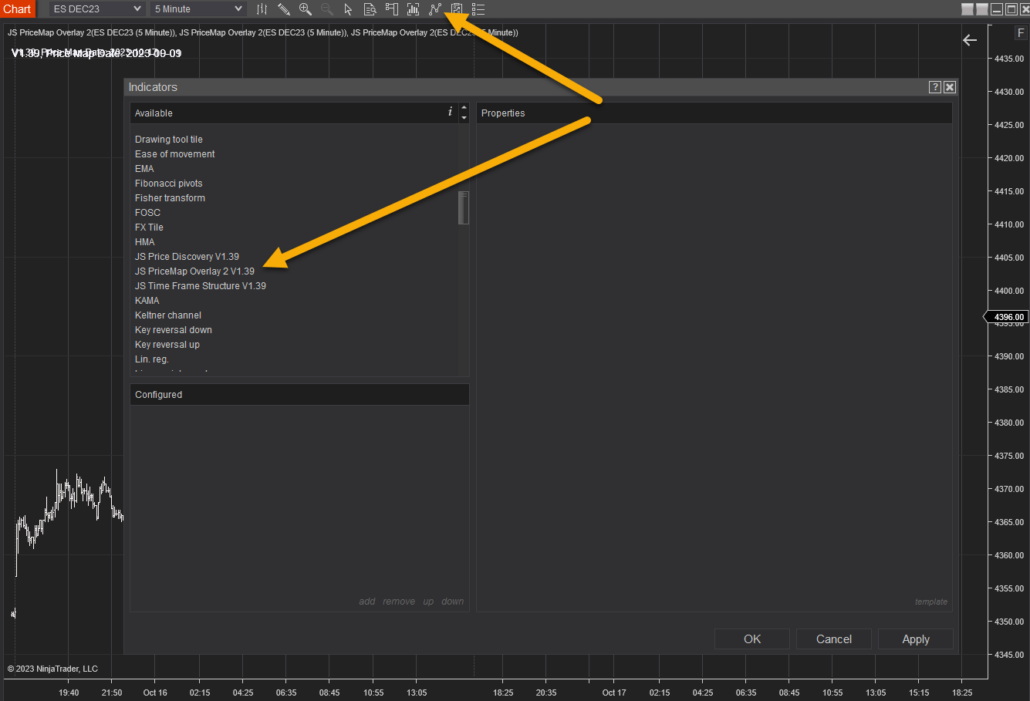

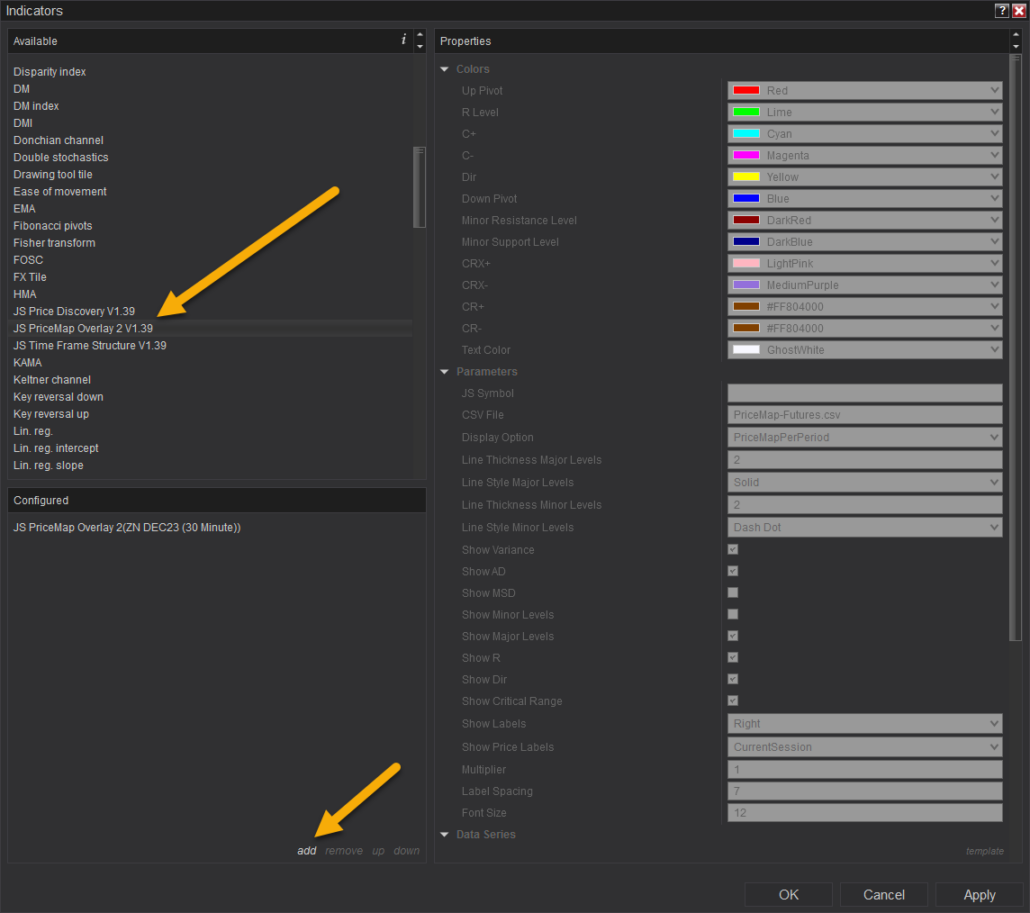

STEP 3 ADD the PRICEMAP to a CHART

- Open the INDICATORS window and scroll down to find the JS PriceMap Overlay Indicator.

2. Select the JS PriceMap Overlay Indicator and select ADD.

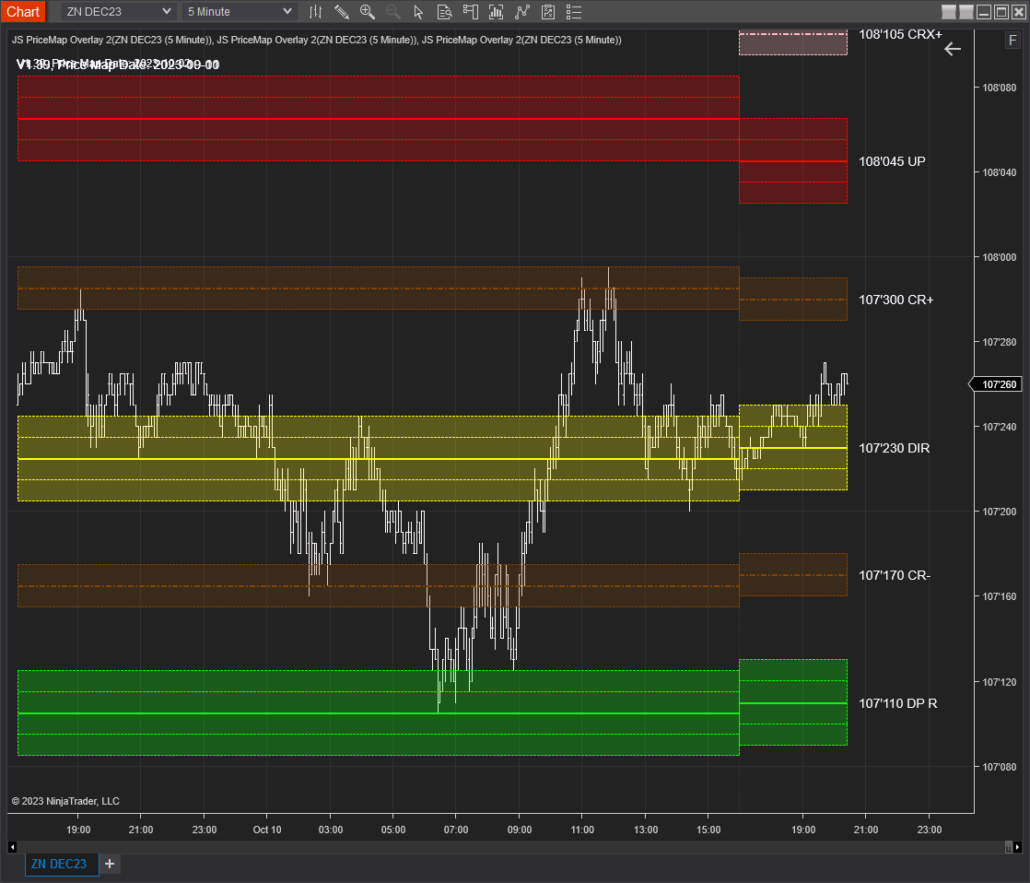

3. Enter the JS Symbol with the Time Frame for the desired PriceMap period. Example below:

TY.D = 10yr T-NOTE DAILYPriceMap

TY.W = 10yr T-NOTE WEEKLY PriceMap

TY.M = 10yr T-NOTE MONTHLY

- For JS SYMBOL LIST click HERE

4. Enter the CSV FILE path. Be sure to enter the entire directory name, file name and extension. Example below (Your path will be unique to your machine):

-

- C:\Users\JSTRADE\NinjaTrader\PriceMap-Futures.csv

5. Click APPLY then OK. The PriceMap Levels should appear.

Trouble Shooting

If the PriceMap levels do not show up

- Be sure you are connected to the internet and NT data source connection.

- Be sure to check the spelling of the CSV PATH. The entire directory name, file name and extension are needed.

- C:\Users\JSTRADE\NinjaTrader\PriceMap-Futures.csv

- Be sure the CSV file is in the directory you entered in the CSV PATH and it has the correct date.

6. Set up All PriceMap Indicator Timeframes

- Highlight the DAILY JS PriceMap Overlay that you just created and Click the TEMPLATE button in the lower right-hand corner.

- Name and Save this template. You can then load this template in the future with your CSV path and customized settings only having to edit the JS Symbol and Time Frame extension.

- Highlight the JS PriceMap Overlay Indicator and add two additional instances to display the WEEKLY and MONTHLY PriceMap levels.

- Load the Saved Template and edit the appropriate JS Symbol extension (.W and .M).

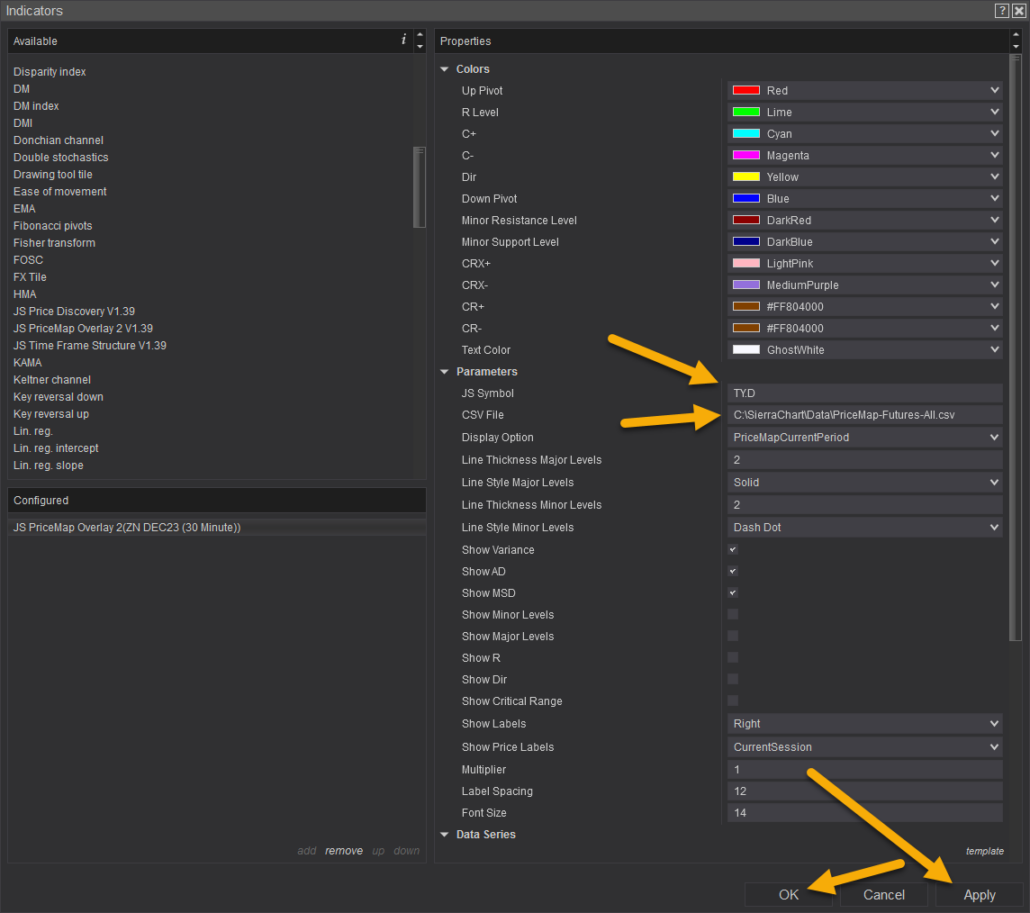

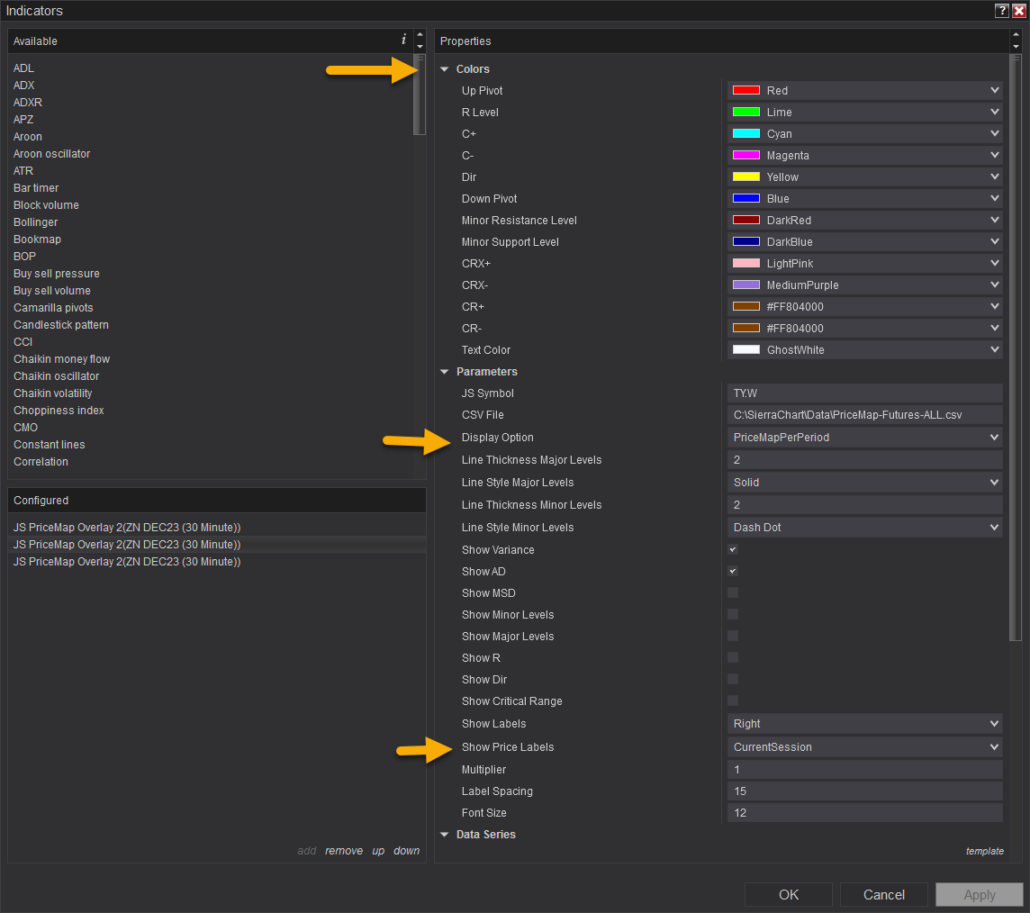

STEP 4 EDIT the SETTINGS

The PriceMap Overlay Indicator has many customization settings. This section will go over the key ones that can ONLY be modified in the setting Properties not directly from the chart Display:

- Qualifier COLOR

- Display Options

- Price Label Display

- QUALIFIER COLOR – Each of the PriceMap qualifiers coloring can be edited however we do not recommend doing so other than to change the shade slightly to contrast better with the background chart color. All qualifier colors aere standardized in the education tutorials are a key awareness component for more intuitive execution. For example, my chart background is dark and I slightly lighten the DP “Blue” to make it easier to read the qualifier label against the dark chart background.

- DISPLAY OPTIONS

- PriceMapNewPeriod – This is an advanced setting designed for specific times during the week or month and offers insight rather than structural information. Purpose: It previews potential PriceMap levels and the R LEVEL for the upcoming period, assuming the previous period close was the current periods. Key Points:

- Not Valid for Trading: These levels aren’t valid for trading decisions.

- Insight at Period Ends: For instance, when using the (.M) symbol for the monthly PriceMap, this setting provides insights on possible R LEVEL shifts in the new month while applying this display option during the end of the current month’s settlement period.

- Not Guaranteed: These previews aren’t definitive. True structure emerges only after the period closes.

- Useful for Overlaps: Gaining insights into possible shifts can be valuable for decisions that stretch into the new time frame as the New Period R LEVEL and DIR will influence momentum bias.

- Not for Daily (.D) Traders: Do not use this setting for the DAILY PriceMap. If your PriceMap levels seem off, check if “PriceMapNewPeriod” is selected in DISPLAY OPTION. Switch to “PriceMapCurrentPeriod” if it is.

Remember, use this feature wisely and understand its limitations.

- PriceMapCurrentPeriod

- This is the recommended display setting.Purpose: It shows the levels for the current time period.Key Points:

- Valid for Trading: These are the only PriceMap levels considered valid for trading decisions.

- Stay Current: Ensure accurate and real-time trading insights by always using the “PriceMapCurrentPeriod” setting.

For optimal trading accuracy, it’s essential to use this recommended setting.

- This is the recommended display setting.Purpose: It shows the levels for the current time period.Key Points:

- PriceMapNewPeriod – This is an advanced setting designed for specific times during the week or month and offers insight rather than structural information. Purpose: It previews potential PriceMap levels and the R LEVEL for the upcoming period, assuming the previous period close was the current periods. Key Points:

- PriceMapPerPeriod

- Overview: This setting offers a combined view of the current PriceMap and its historical counterparts. Benefits:

- Deep Dive into Past Behavior: By observing past PriceMap patterns, gain a clearer understanding of market trends and behaviors.

- Inform Current Actions: Historical insights can shed light on the market’s present tendencies.

- Decision-making Guide: Keep in mind, only the current period’s levels are actionable for trading. Use historical levels purely for context and not for direct trading actions.

For effective trading, rely predominantly on the current period’s PriceMap levels.

- Overview: This setting offers a combined view of the current PriceMap and its historical counterparts. Benefits:

- SHOW PRICE LABELS

-

- ALL: Useful for those wanting a detailed view, especially when combined with the PricePerPeriod historical display for back testing purposes.

- CurrentSession: Generally the preferred setting, this displays only the labels for the ongoing trading session. It helps to avoid label overlap over price action, ensuring clarity.

- Disabled: opt for a clean view with no labels displayed at all.

-

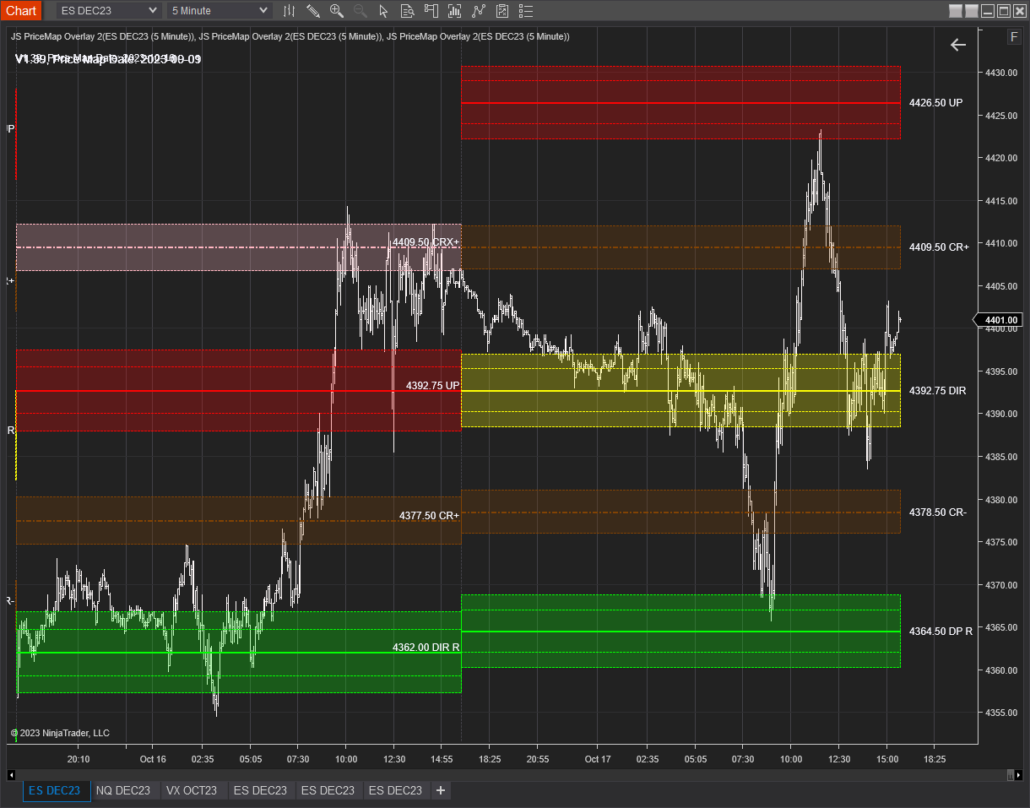

STEP 5 DISPLAY FEATURES

The display features are accessed by RIGHT CLICK on the chart. Here are the basic Display Features:

R LEVEL ONLY

CRITICALRANGE ONLY

ALL MAJOR and MINOR LEVELS

VAR Metric Boundary

AD Metric Boundary

MULTI TIME FRAME VIEW

Additional Features

JS TIME FRAME STRUCTURE

The JS TIME FRAME STRUCTURE Indicator can be accessed in the same manner as the JS PriceMap Overlay. The TIME FRAME STRUCTURE plots the Previous Period HIGH, LOW, CLOSE and MIDPOINT and the Current Period HIGH, LOW and MIDPOINT.

SET-UP INSTRUCTIONS

- Add the Time Frame Structure Indicator

- Add the JS Symbol Only. Do not add an extension.

- Add the csv file path and file name.

4. Click APPLY and OK

DISPLAY SETTINGS

The default setting is for the indicator to display all time frames for both the Current and Previous Period.

RIGHT CLICK on the chart to select the desired Time Frame and period to display. You may have to scroll down to view all the display options.

Below is a view of the PREVIOUS DAY and the PREVIOUS WEEK parameters.

NOTE on Time Frame Structure:

Prioritizing the PREVIOUS PERIOD TIME FRAME STRUCTURE is essential, as it holds more significance than the CURRENT PERIOD. The data for the CURRENT PERIOD, sourced from the data file, can be outdated, especially if the market is recording new highs or lows for that time frame.

However, as we approach the end of a time frame period, the CURRENT PERIOD structure gains relevance. A notable exception is the CURRENT PERIOD MIDPOINT, equivalent to the period’s VWAP, which remains consistently valid.

Recommendation: Focus primarily on the PREVIOUS PERIOD. It serves as the main time frame structure and provides a more reliable foundation for trading decisions.

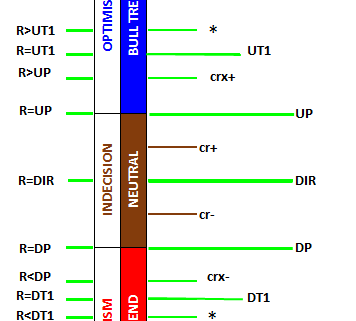

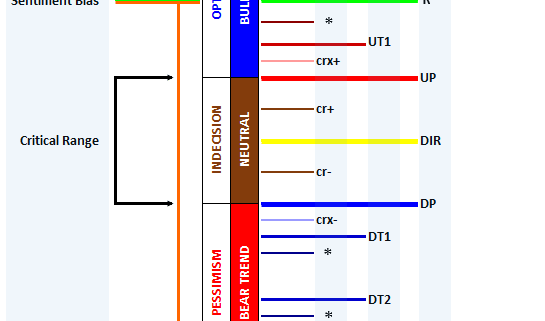

PriceMap Qualifiers CriticalRange

/in Analytics, PriceMap /by JSServicesCriticalRange

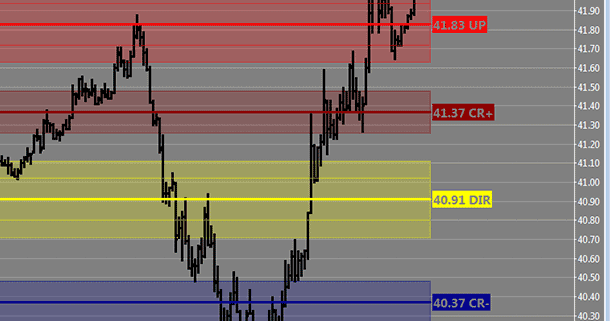

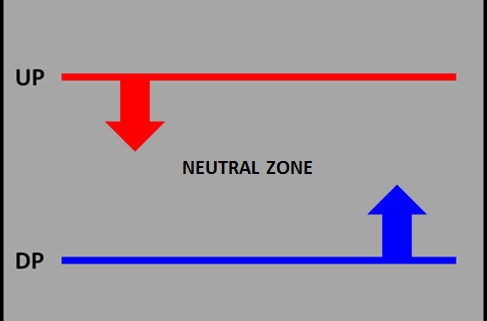

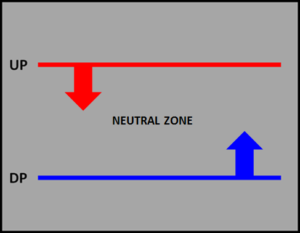

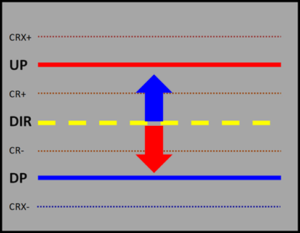

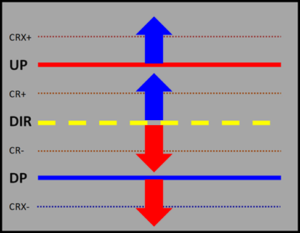

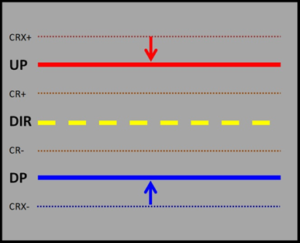

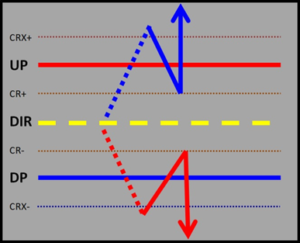

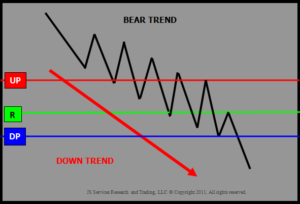

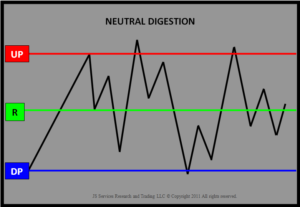

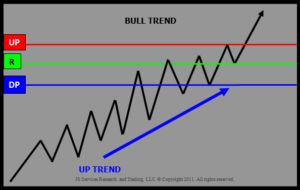

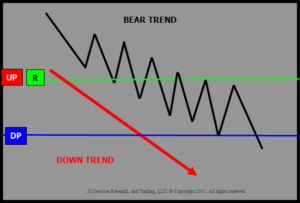

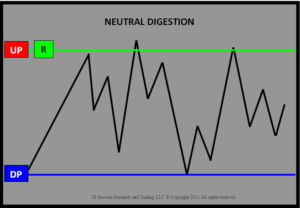

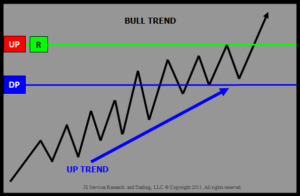

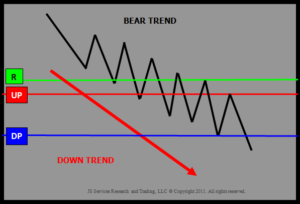

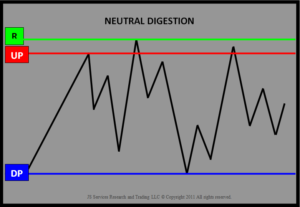

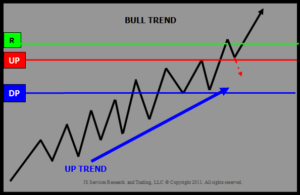

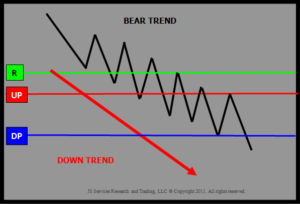

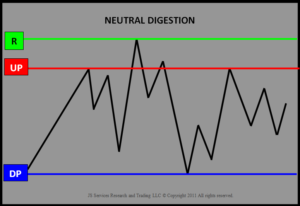

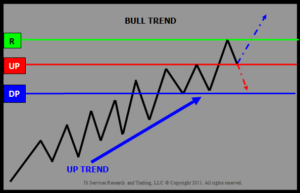

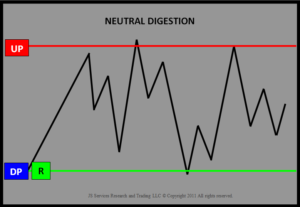

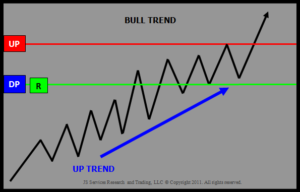

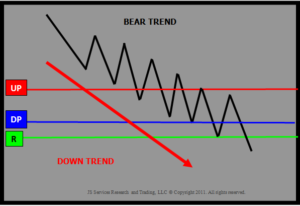

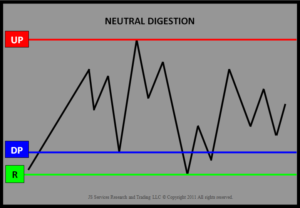

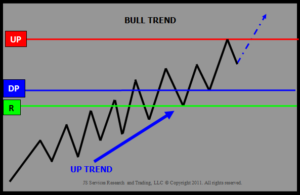

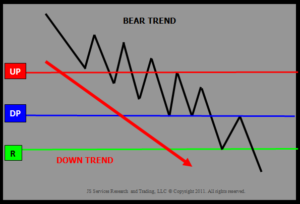

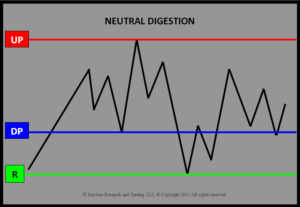

The PriceMap defines the structure of the market state by identifying the key price band or CriticalRange for the trade period. The Upside Pivot [UP] and Downside Pivot [DP] directional levels encapsulate the CriticalRange which will behave like key resistance and support levels, defining the behavioral area of indecision or neutral zone for the trade period.

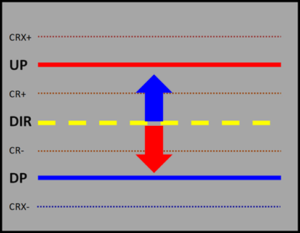

The CriticalRange is broken up into 6 quadrants, defined by a directional level mid point and minor levels on either side of the UP and DP. This structure and the inherent meaning of each level are key to interpreting market “tells” in real-time.

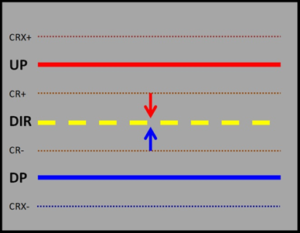

DIRECTIONAL

The DIR (Directional) is the mid-point of the Critical Range but is not necessarily symmetrical. The DIR acts as a classic pivot point for the trading session that the market will rotate around to find its immediate bias within the CriticalRange.

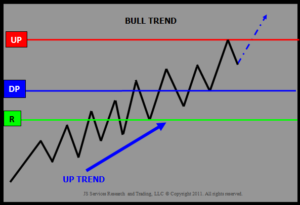

A held trade above the DIR gives the market a positive lean and below negative, targeting the UP and DP CriticalRange extremes. Trading within the CriticalRange represents a neutral posture for the market. A breakout of the CriticalRange signals a directional bias and possible trend move for the session.

CR + and CR –

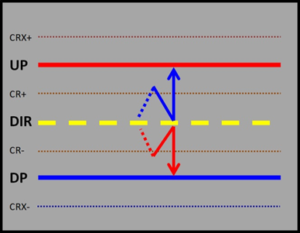

The CR+ and CR – define the interior quadrants of the CriticalRange. These minor levels will come into play as the market rotates around the DIR, either tightening the coil of a digestive trade or preparing for a transitional BREAKOUT.

- Classic rotational trading within the CR+ and CR- range is typical for NON TREND type consolidation prior to a move. A market that has tested both the CR+ and CR- and has maintained the integrity of each, is a “tell” that a sideways trade will persist producing a NON EVENT session.

- A breach of the CR+ or CR- after a rotational trade around the DIR will give the market a bias targeting the CriticalRange parameters (UP/DP). If the signal is valid and “ready to go”, price action will maintain structure at the DIR after a CR+ or CR- breach. If it does not, it is a sign of digestion or potential reversal.

CRX + and CRX –

The CRX +/- are the Critical Range Breakout extremes. These are the price points that must be taken out to confirm a structural break or “Breakout” and can result in good exhaustive extremes.

- Exhaustive Extreme – The CRX+ and CRX – identify the CriticalRange thresholds and represent an exhaustive extreme for any false CriticalRange BREAKOUT. If the integrity of the CRX + or CRX – remain intact any BREAKOUT signal must remain suspect. These levels can be used as stop levels for any FADE or REVERSAL strategy at the UP or DP as they are the “squeeze” high or low for any momentum exhaustion.

- Structure Break – The CRX+ and CRX – identify the confirmation points that must be violated to confirm a BREAKOUT. Once the CRX + or CRX – has been violated the market should maintain that bias above or below the respective CR + or CR-. The best BREAKOUT scenarios have the market hold structure above the UP or below the DP and just “go” with only one shot, if any, after a CRX +/- violation. Trading back inside the CriticalRange to the CR + or CR – will take some of the energy away from the BREAKOUT signal and is a “tell” for more of a “stop and go” trend condition.

PRACTICAL APPLICATION

* Use the price action within the CriticalRange to provide insight to the markets next move.

* Use the CR +/- and the CRX +/- to confirm or deny a trend move.

* Note tactic signals at these minor levels for position management of STRATEGY themes.

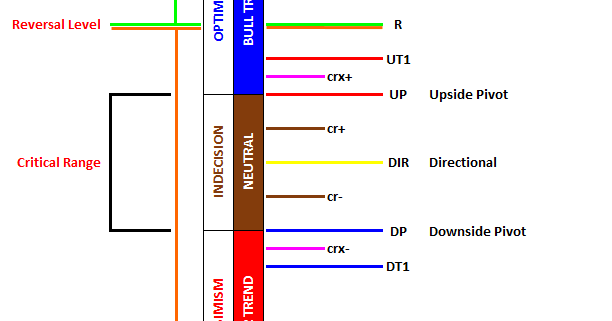

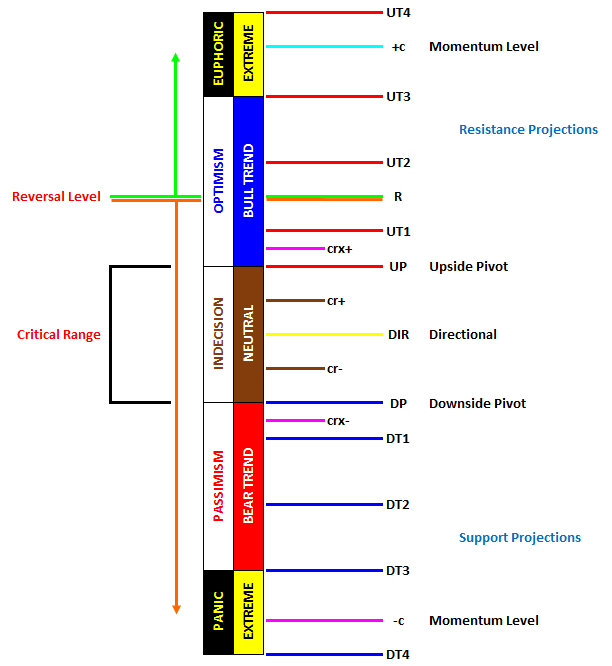

PriceMap Qualifiers R LEVEL Positions

/in Analytics, PriceMap /by JSServices![]()

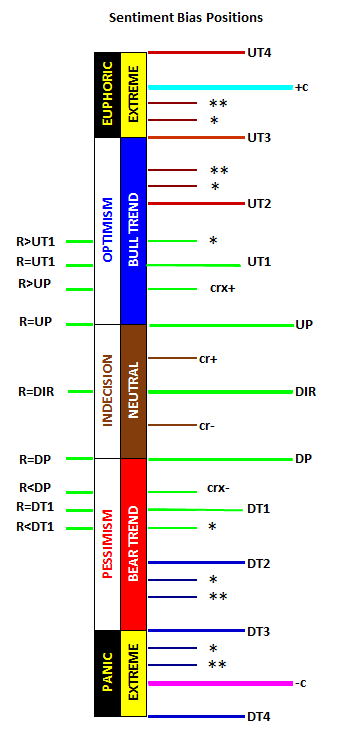

The PriceMap is the framework of the market STATE and the R LEVEL defines the behavioral sentiment bias for the trade period. Where the R level is on the PriceMap will skew the condition of the market state. The R LEVEL is a floater number which can be in one of 9 PriceMap positions each with its own identity that is outlined below.

R LEVEL Positions

R =DIR – The R LEVEL equal to the DIR (Directional) is in a classic pivot point position, as sentiment is balance and “on the fence”. The market is indecisive or is preparing to make a move. Any Market State with the R=DIR should respect the pivotal nature of sentiment. Typically when the R LEVEL is in this position it will either just breakout and “go” producing a linear move or a difficult rotational trade will consume the market for the trade period.

R =UP – The R LEVEL at the top of the CriticalRange defines a “hard” resistance point at the UP (UpsidePivot). Energy is centered at this price point and a violation should be expected to produce sharp interest. A downside failure below the DP (DownsidePivot) however should be expected to NOT have the same energy and any downside breakout to be more measured.

R >UP – The R LEVL above the UP but less than the UT1 creates a RESISTANCE BAND with the UP. Trading tactics should focus on the entire zone for signal acceptance. Typically this would be on the sell side as this is a resistance band but will transition into a support band if the market violates the R LEVEL and starts to transition higher.

R =UT1 – The R LEVEL = to the UT1 (Upside Target #1) creates an even wider resistance band with the UP. Signal acceptance anywhere in the price band is acceptable however it is best to commit to opportunities closer to the UP or UT1. As the R LEVEL moves farther above the DIR the energy in the market place is skewed higher. Any lower price movement should be expected to be more measured and any positive turn from lower levels should be expected to target the R LEVEL

Same Images for R>UP and R=UT1

R >UT1 – The R LEVEL above the UT1 identifies the high point for any price squeeze against the underlying trend if it is going to resume in the session. A market in this position has a defined underlying negative tone and any sell signal, especially at higher levels, below this price points are actionable. Sells below the DP are a lower value opportunity and the threat of a corrective squeeze up to the R LEVEL is real. Typically the market will attempt some type of corrective move when the R LEVEL is in this position.

R =DP – The R LEVEL at the bottom of the CriticalRange defines a “hard” support level at the DP (DownsidePivot). Energy is centered at this price level and a failure should be expected to produce aggressive offers. An upside breakout above the UP (UpsidePivot) however should be expected to NOT have the same energy and any upside breakout to be more measured.

R < DP – The R LEVEL below the DP but greater than the DT1 creates a SUPPORT BAND with the DP. Trading tactics should focus on the entire zone for signal acceptance. Typically this would be on the buy side as this is a support band but will transition into a resistance band if the market violates the R LEVEL and starts to transition lower.

R =DT1 – The R LEVEL = to the DT1 (Downside Target #1) creates an even wider support band with the DP. Signal acceptance anywhere in the price band is acceptable however it is best to commit to opportunities closer to the DP or DT1. As the R LEVEL moves farther below the DIR the energy in the market place is skewed lower. Any higher price movement should be expected to be move measure and any negative turn from higher levels should be expected to target the R LEVEL.

Same Images for R<DP and R=DT1

R < DT1 – The R LEVEL below the DT1 identifies the low point for any price squeeze against the underlying trend if it is going to resume in the session. A market in this position has a defined underlying positive tone and any buy signal, especially at lower levels, above this price points are actionable. Buys above the UP are a lower value opportunity and the threat of a corrective squeeze down to the R LEVEL is real. Typically the market will attempt some type of corrective move when the R LEVEL is in this position.

PRACTICAL APPLICATION

* The R Level position itself can be a condition on its own to align trading tactics. For example any time, in any market state that the R=DIR it is a sign that the market is in a “pivotal” position, as sentiment is balanced. Trading tactics that perform well in pivotal market states can search out all markets that have an R=DIR.

* The R Level significantly above R>UT1 and R=UT1 or significantly below R is a “tell” that a corrective trade may develop targeting the R LEVEL. Identifying a break in PriceMap STRUCTURE is typically the 1st signal that a corrective move is in play.

* Always note the differential between the last traded price an the R Level as this is the price point that defines the rik for any trade.

PriceMap QUICK START

/in Analytics, PriceMap /by JSServices![]()

PRACTICAL APPLICATION

The PriceMap provides traders with the ability to anticipate opportunity at key structure points and create risk defined strategies with improved trade vision of expected price movement. The method is scalable as a unified approach across all markets and asset classes.

SIGNAL ACCEPTANCE – Focus trading and signal acceptance at PriceMap level structure points. Avoid trading “in the middle”.

SIZE MANAGEMENT – Value trade opportunities and position sizing based on the PriceMap qualifier weighting. As a rule of thumb the R LEVEL should carry the greatest value or position size followed by the CRITICAL RANGE extremes (UP and DP). The DIR “Directional” (+++ +++) and *** 3 star PriceMap level target next followed by the ** 2 and * 1 star PriceMap levels. The +c and -c are major “target” levels but should be integrated as a directional pivot for insight to market momentum in the next session.

TRADE OPPORTUNITIES – Use the PriceMap as a “ladder” for trade management. Think in terms of price segment trade vision with opportunities defined as 1/2, full and X2 APMD (Average Price Map Distance) profit targets.

POSITION MANAGEMENT – Use the PriceMap as a “ladder” for position management. Markets make trend moves by holding positive or negative structure. Use price action within the PriceMap as a position management tool, adjusting stops as the market breaches a PriceMap level anticipating that it will go to the next level by holding above/below the breached level. If the breached level cannot sustained the violation it is a “tell” that the market may be set to REVERSE for a test of the opposing level on the PriceMap.

PriceMap Definitions

/in Analytics, PriceMap /by JSServices![]()

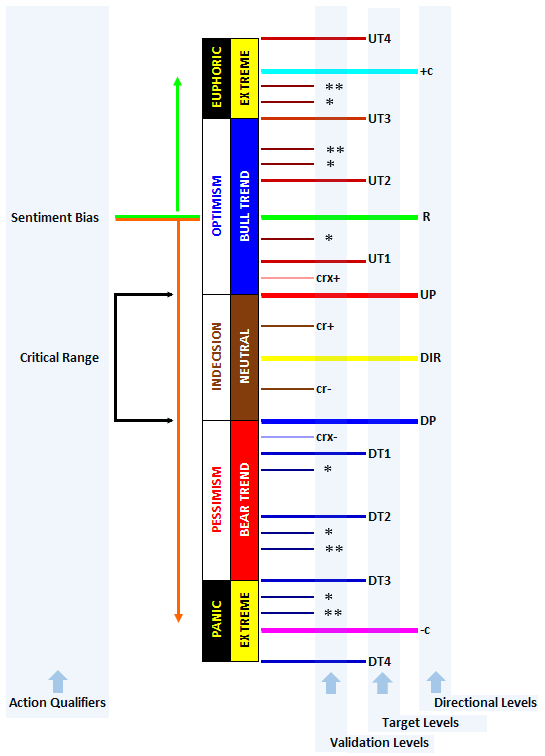

JSServices PriceMap Analytics use quantitative methods to objectively define the price STRUCTURE of the market STATE. The knowledge of the market STATE STRUCTURE and the awareness of current price action within it, provides clarity to the value of an opportunity and the risk and reward associated with it.

OVERVIEW

Price levels in the PriceMap series followed by stars *** are minor structure and major target “support and resistance” levels. The star *** value weights are determined by their structural significance to the market state alignment. Alignment defined as the price point that will have an influence on the market maintaining structure or not. The more stars ***, the more value a level has and the greater significance to the structural integrity of the price framework of the market STATE. Prices followed by symbols (+++ +++ (DIR), UP, DP, R, +c and – c) are directional pivots or trend indicators. These levels are the actionable points of the PriceMap, as they define where potential transitional shifts in STATE will occur and are the preferred entry levels.

In a general sense trading within the CRITICAL RANGE (UP–DP) represents a neutral posture for the market and trading outside a trend posture with the DIRECTIONAL (+++ +++ the classic pivot point within this range. The ***# levels are Upside/ Downside Target (UT/DT) projections the for a CRITICAL RANGE breakout.

The R Level qualifier represents the sentiment bias for the trade period. Trading above the R signals a positive buy break bias, while trading below signifies a negative sell rally bias. A price violation or failure at the R Level would reverse this bias.

+c and – c symbols represent Continuation Momentum numbers that define the technical event extremes.

JS PRICEMAP QUALIFIER KEY

R = REVERSAL LEVEL is the SENTIMENT BIAS level for the trade period, positive bias above, negative below.

UP = UPSIDE PIVOT is a key resistance point for the trade period and the top of the CRITICAL RANGE

DP = DOWNSIDE PIVOT is a key support point for the trade period and the bottom of the CRITICAL RANGE

MAJOR LEVELS

DIR (+++ +++) DIRECTIONAL is a classic pivot point that sets the bias for trading within the CRITICAL RANGE [CR]

UT1 (***1) UPSIDE TARGET #1 is the minimum target for a CR BREAKOUT

UT2 (***2) UPSIDE TARGET #2 is the expected target for a CR BREAKOUT

UT3 (***3) UPSIDE TARGET #3 is the best case objective for a CR BREAKOUT

UT4 (***4) UPSIDE TARGET #4 is an event extreme target

+c +CONTINUATION MOMENTUM defines the technical extreme

DT1 (***1) DOWNSIDE TARGET #1 is the minimum target for a CR BREAKOUT

DT2 (***2) DOWNSIDE TARGET #2 is the expected target for a CR BREAKOUT

DT3 (***3) DOWNSIDE TARGET #3 is the best case objective for a CR BREAKOUT

DT4 (***4) DOWNSIDE TARGET #4 is an event extreme target

-c -CONTINUATION MOMENTUM defines the technical extreme

MINOR LEVELS

* MINOR 1 STAR LEVEL represent a minor support or resistance level

** MINOR 2 STAR LEVEL represent a good minor support or resistance level

CRX+ CRITICAL RANGE EXTREME + defines the CRITICAL RANGE positive extreme

CR+ CRITICAL RANGE + defines the interior +quadrant of the CRITICAL RANGE

CR- CRITICAL RANGE – defines the interior -quadrant of the CRITICAL RANGE

CRX- CRITICAL RANGE EXTREME – defines the CRITICAL RANGE negative extreme

MARKET METRICS

VAR = VARIANCE – defines the optimal area influence of a Major or Minor Level

AD = ALERT DISTANCE – defines the area of signal acceptance and structure thresholds for a Major Level

MSD = MAXIMUM STOP DISTANCE – Defines the maximum area of influence of a Major Level

Latest News

Support Contact

Email: info@jsservices.com

Risk Disclosure

Financial trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.