PriceMap Qualifiers R LEVEL Positions

![]()

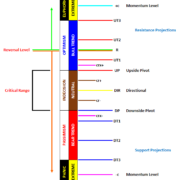

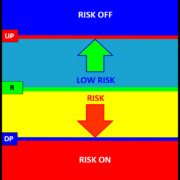

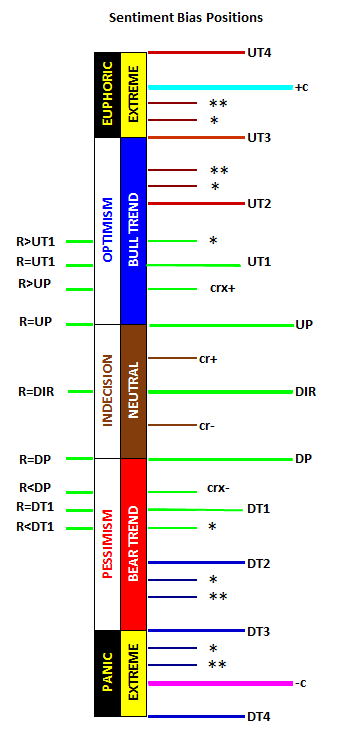

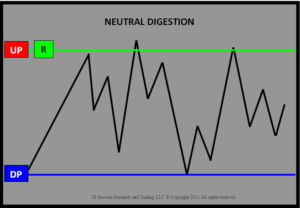

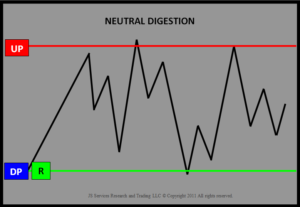

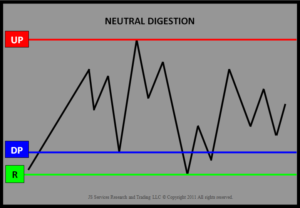

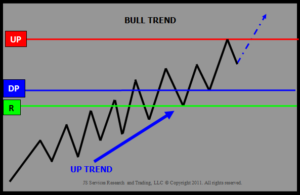

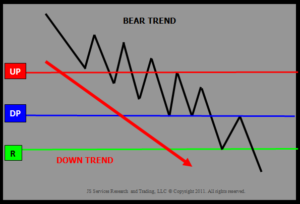

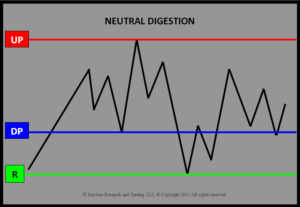

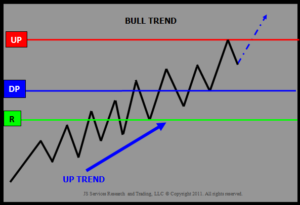

The PriceMap is the framework of the market STATE and the R LEVEL defines the behavioral sentiment bias for the trade period. Where the R level is on the PriceMap will skew the condition of the market state. The R LEVEL is a floater number which can be in one of 9 PriceMap positions each with its own identity that is outlined below.

R LEVEL Positions

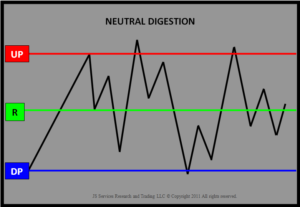

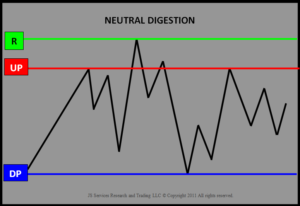

R =DIR – The R LEVEL equal to the DIR (Directional) is in a classic pivot point position, as sentiment is balance and “on the fence”. The market is indecisive or is preparing to make a move. Any Market State with the R=DIR should respect the pivotal nature of sentiment. Typically when the R LEVEL is in this position it will either just breakout and “go” producing a linear move or a difficult rotational trade will consume the market for the trade period.

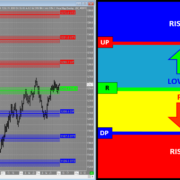

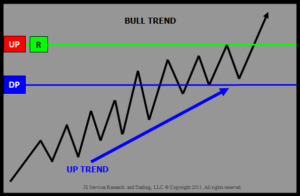

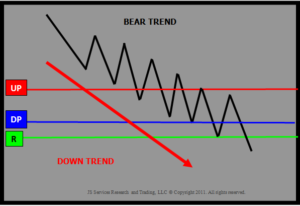

R =UP – The R LEVEL at the top of the CriticalRange defines a “hard” resistance point at the UP (UpsidePivot). Energy is centered at this price point and a violation should be expected to produce sharp interest. A downside failure below the DP (DownsidePivot) however should be expected to NOT have the same energy and any downside breakout to be more measured.

R >UP – The R LEVL above the UP but less than the UT1 creates a RESISTANCE BAND with the UP. Trading tactics should focus on the entire zone for signal acceptance. Typically this would be on the sell side as this is a resistance band but will transition into a support band if the market violates the R LEVEL and starts to transition higher.

R =UT1 – The R LEVEL = to the UT1 (Upside Target #1) creates an even wider resistance band with the UP. Signal acceptance anywhere in the price band is acceptable however it is best to commit to opportunities closer to the UP or UT1. As the R LEVEL moves farther above the DIR the energy in the market place is skewed higher. Any lower price movement should be expected to be more measured and any positive turn from lower levels should be expected to target the R LEVEL

Same Images for R>UP and R=UT1

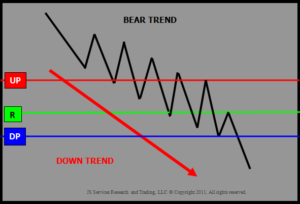

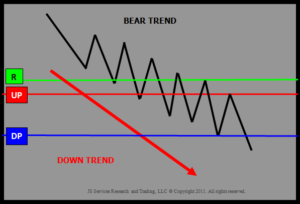

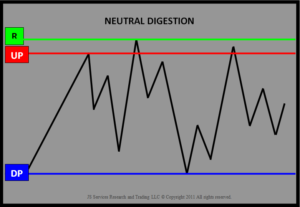

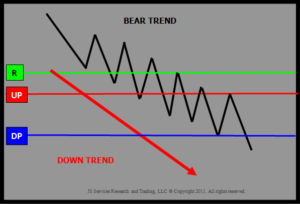

R >UT1 – The R LEVEL above the UT1 identifies the high point for any price squeeze against the underlying trend if it is going to resume in the session. A market in this position has a defined underlying negative tone and any sell signal, especially at higher levels, below this price points are actionable. Sells below the DP are a lower value opportunity and the threat of a corrective squeeze up to the R LEVEL is real. Typically the market will attempt some type of corrective move when the R LEVEL is in this position.

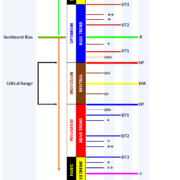

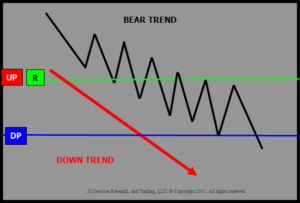

R =DP – The R LEVEL at the bottom of the CriticalRange defines a “hard” support level at the DP (DownsidePivot). Energy is centered at this price level and a failure should be expected to produce aggressive offers. An upside breakout above the UP (UpsidePivot) however should be expected to NOT have the same energy and any upside breakout to be more measured.

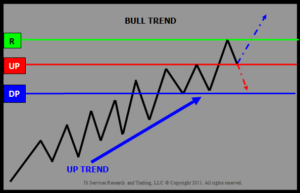

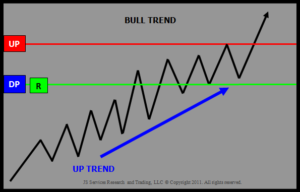

R < DP – The R LEVEL below the DP but greater than the DT1 creates a SUPPORT BAND with the DP. Trading tactics should focus on the entire zone for signal acceptance. Typically this would be on the buy side as this is a support band but will transition into a resistance band if the market violates the R LEVEL and starts to transition lower.

R =DT1 – The R LEVEL = to the DT1 (Downside Target #1) creates an even wider support band with the DP. Signal acceptance anywhere in the price band is acceptable however it is best to commit to opportunities closer to the DP or DT1. As the R LEVEL moves farther below the DIR the energy in the market place is skewed lower. Any higher price movement should be expected to be move measure and any negative turn from higher levels should be expected to target the R LEVEL.

Same Images for R<DP and R=DT1

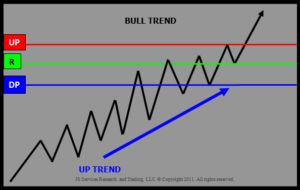

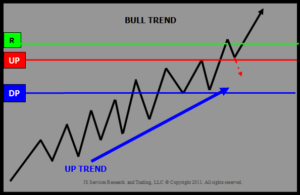

R < DT1 – The R LEVEL below the DT1 identifies the low point for any price squeeze against the underlying trend if it is going to resume in the session. A market in this position has a defined underlying positive tone and any buy signal, especially at lower levels, above this price points are actionable. Buys above the UP are a lower value opportunity and the threat of a corrective squeeze down to the R LEVEL is real. Typically the market will attempt some type of corrective move when the R LEVEL is in this position.

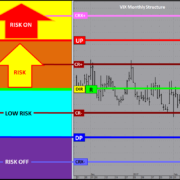

PRACTICAL APPLICATION

* The R Level position itself can be a condition on its own to align trading tactics. For example any time, in any market state that the R=DIR it is a sign that the market is in a “pivotal” position, as sentiment is balanced. Trading tactics that perform well in pivotal market states can search out all markets that have an R=DIR.

* The R Level significantly above R>UT1 and R=UT1 or significantly below R is a “tell” that a corrective trade may develop targeting the R LEVEL. Identifying a break in PriceMap STRUCTURE is typically the 1st signal that a corrective move is in play.

* Always note the differential between the last traded price an the R Level as this is the price point that defines the rik for any trade.