PriceMap QUICK START

![]()

PRACTICAL APPLICATION

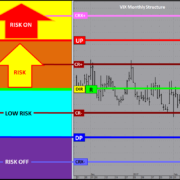

The PriceMap provides traders with the ability to anticipate opportunity at key structure points and create risk defined strategies with improved trade vision of expected price movement. The method is scalable as a unified approach across all markets and asset classes.

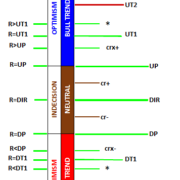

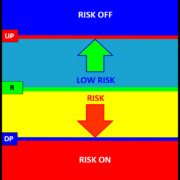

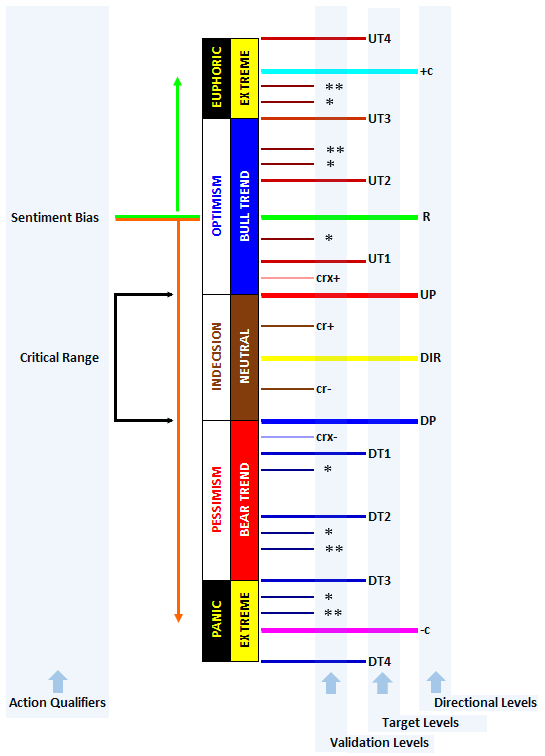

SIGNAL ACCEPTANCE – Focus trading and signal acceptance at PriceMap level structure points. Avoid trading “in the middle”.

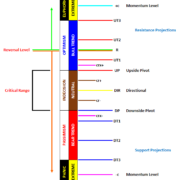

SIZE MANAGEMENT – Value trade opportunities and position sizing based on the PriceMap qualifier weighting. As a rule of thumb the R LEVEL should carry the greatest value or position size followed by the CRITICAL RANGE extremes (UP and DP). The DIR “Directional” (+++ +++) and *** 3 star PriceMap level target next followed by the ** 2 and * 1 star PriceMap levels. The +c and -c are major “target” levels but should be integrated as a directional pivot for insight to market momentum in the next session.

TRADE OPPORTUNITIES – Use the PriceMap as a “ladder” for trade management. Think in terms of price segment trade vision with opportunities defined as 1/2, full and X2 APMD (Average Price Map Distance) profit targets.

POSITION MANAGEMENT – Use the PriceMap as a “ladder” for position management. Markets make trend moves by holding positive or negative structure. Use price action within the PriceMap as a position management tool, adjusting stops as the market breaches a PriceMap level anticipating that it will go to the next level by holding above/below the breached level. If the breached level cannot sustained the violation it is a “tell” that the market may be set to REVERSE for a test of the opposing level on the PriceMap.