Risk State

![]()

RISK STATE

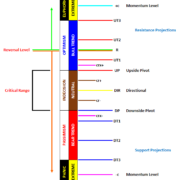

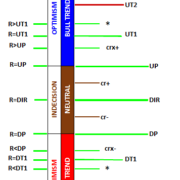

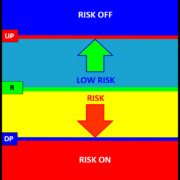

Hedging is about managing risk which can be defined in term of volatility. Volatility Indices identify the RISK STATE or condition of the underlying security or futures market. The price points at which the RISK STATE will change are identified in the RISK STRUCTURE of a markets associated VIX. The RISK STRUCTURE alignment can be used as the foundation framework to create a hedge strategy in the underlying security or futures market position to be hedged. This is done by observing the current price position in relation to the PriceMap R LEVEL within the PriceMap framework of a markets VIX.

R LEVEL

The R LEVEL is the dynamic point of equilibrium that defines the Sentiment Bias for the trade period. It is the price level where the bias shifts from positive to negative and vice versa. Where the R LEVEL is on the PriceMap framework determines the RISK STATE. In terms of a Volatility Index like the SP500 VIX the bias shift can be looked at as RISK ON /RISK OFF flip switch for the RISK STATE.

Example

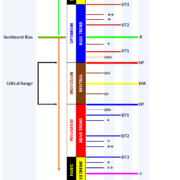

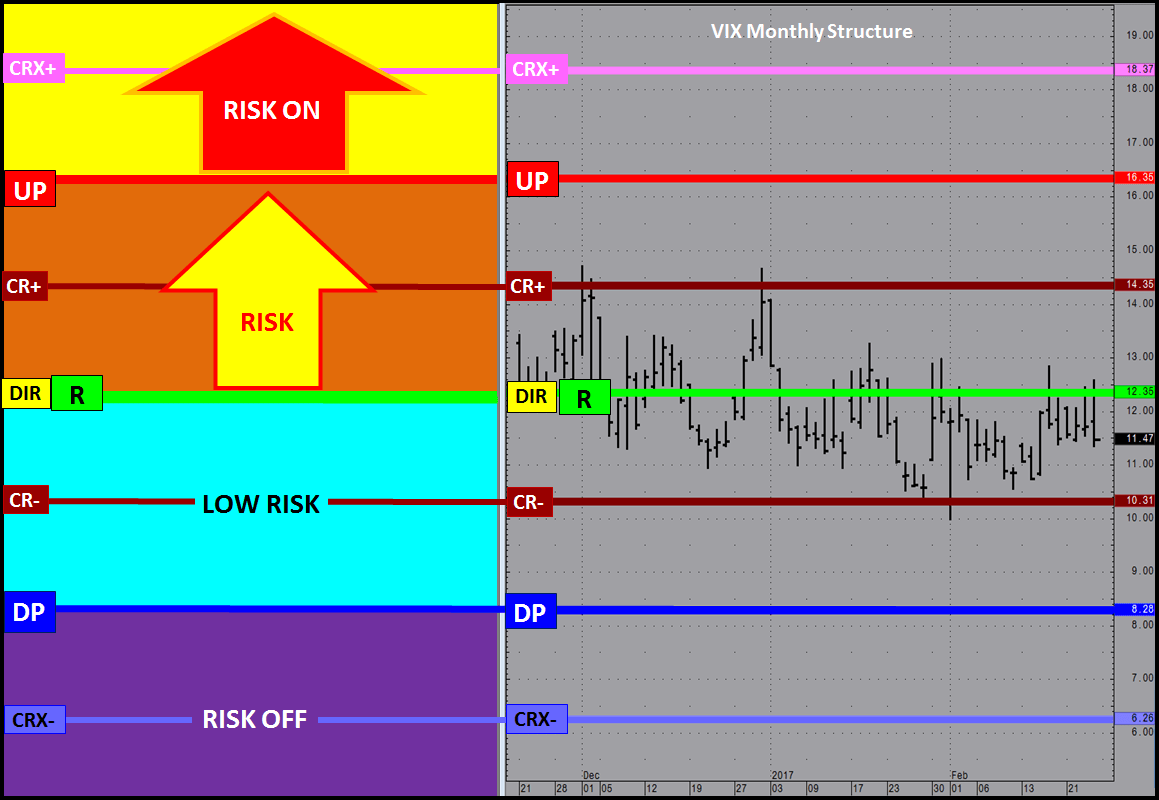

The following is a Hedge Strategy Overlay example applying JSAnalytics to the SP500 VIX. The example shows how to identify the current risk condition and the specific action qualifiers that will trigger shifts in that condition along with the recommended strategy themes and tactics to construct a hedge to protect against an increase in volatility.

RISK STATE

$VIX RISK STATE

The image above shows the Monthly structure for the cash VIX Index which is in a LOW RISK condition below the R LEVEL. A move above the R LEVEL will change the state to a RISK position. Knowing the FACTS of the RISK condition or State provides clarity, which can be used as the basis to construct a systematic approach to managing risk and constructing a Hedge Strategy.

The CBOE (Chicago Board of Options Exchange) and the CFE (Chicago Futures Exchange) has expanded coverage of volatility indices or VIX into grains, currencies, crude oil and interest rates along with sector ETFs and individual stocks. Knowing the fact associated with a markets RISK STATE improves awareness and offers an indicator of confluence to standardize trading tactics into a more structured approach.

For more information Click HERE.