PriceMap Definitions

![]()

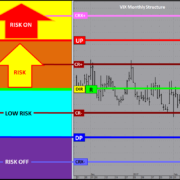

JSServices PriceMap Analytics use quantitative methods to objectively define the price STRUCTURE of the market STATE. The knowledge of the market STATE STRUCTURE and the awareness of current price action within it, provides clarity to the value of an opportunity and the risk and reward associated with it.

OVERVIEW

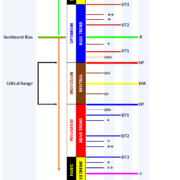

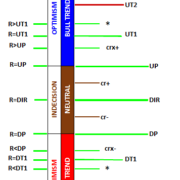

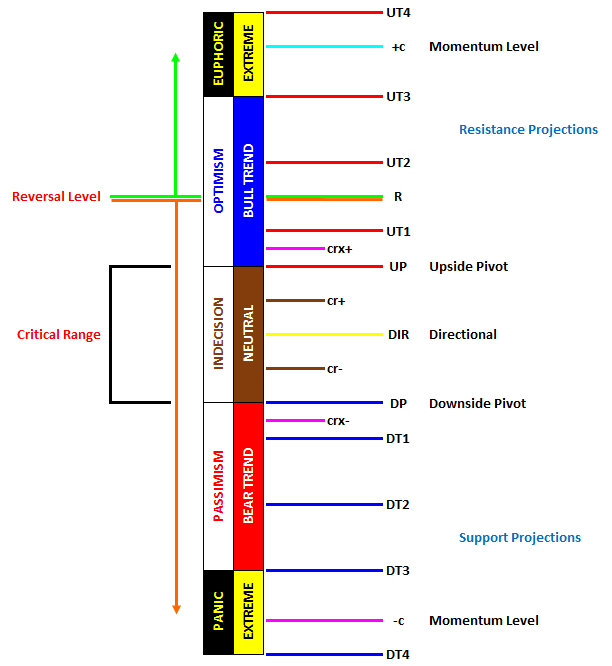

Price levels in the PriceMap series followed by stars *** are minor structure and major target “support and resistance” levels. The star *** value weights are determined by their structural significance to the market state alignment. Alignment defined as the price point that will have an influence on the market maintaining structure or not. The more stars ***, the more value a level has and the greater significance to the structural integrity of the price framework of the market STATE. Prices followed by symbols (+++ +++ (DIR), UP, DP, R, +c and – c) are directional pivots or trend indicators. These levels are the actionable points of the PriceMap, as they define where potential transitional shifts in STATE will occur and are the preferred entry levels.

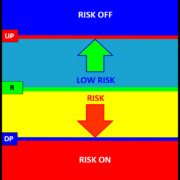

In a general sense trading within the CRITICAL RANGE (UP–DP) represents a neutral posture for the market and trading outside a trend posture with the DIRECTIONAL (+++ +++ the classic pivot point within this range. The ***# levels are Upside/ Downside Target (UT/DT) projections the for a CRITICAL RANGE breakout.

The R Level qualifier represents the sentiment bias for the trade period. Trading above the R signals a positive buy break bias, while trading below signifies a negative sell rally bias. A price violation or failure at the R Level would reverse this bias.

+c and – c symbols represent Continuation Momentum numbers that define the technical event extremes.

JS PRICEMAP QUALIFIER KEY

R = REVERSAL LEVEL is the SENTIMENT BIAS level for the trade period, positive bias above, negative below.

UP = UPSIDE PIVOT is a key resistance point for the trade period and the top of the CRITICAL RANGE

DP = DOWNSIDE PIVOT is a key support point for the trade period and the bottom of the CRITICAL RANGE

MAJOR LEVELS

DIR (+++ +++) DIRECTIONAL is a classic pivot point that sets the bias for trading within the CRITICAL RANGE [CR]

UT1 (***1) UPSIDE TARGET #1 is the minimum target for a CR BREAKOUT

UT2 (***2) UPSIDE TARGET #2 is the expected target for a CR BREAKOUT

UT3 (***3) UPSIDE TARGET #3 is the best case objective for a CR BREAKOUT

UT4 (***4) UPSIDE TARGET #4 is an event extreme target

+c +CONTINUATION MOMENTUM defines the technical extreme

DT1 (***1) DOWNSIDE TARGET #1 is the minimum target for a CR BREAKOUT

DT2 (***2) DOWNSIDE TARGET #2 is the expected target for a CR BREAKOUT

DT3 (***3) DOWNSIDE TARGET #3 is the best case objective for a CR BREAKOUT

DT4 (***4) DOWNSIDE TARGET #4 is an event extreme target

-c -CONTINUATION MOMENTUM defines the technical extreme

MINOR LEVELS

* MINOR 1 STAR LEVEL represent a minor support or resistance level

** MINOR 2 STAR LEVEL represent a good minor support or resistance level

CRX+ CRITICAL RANGE EXTREME + defines the CRITICAL RANGE positive extreme

CR+ CRITICAL RANGE + defines the interior +quadrant of the CRITICAL RANGE

CR- CRITICAL RANGE – defines the interior -quadrant of the CRITICAL RANGE

CRX- CRITICAL RANGE EXTREME – defines the CRITICAL RANGE negative extreme

MARKET METRICS

VAR = VARIANCE – defines the optimal area influence of a Major or Minor Level

AD = ALERT DISTANCE – defines the area of signal acceptance and structure thresholds for a Major Level

MSD = MAXIMUM STOP DISTANCE – Defines the maximum area of influence of a Major Level