Webinar – Optimizing TradeTactics with Order Book Dynamics

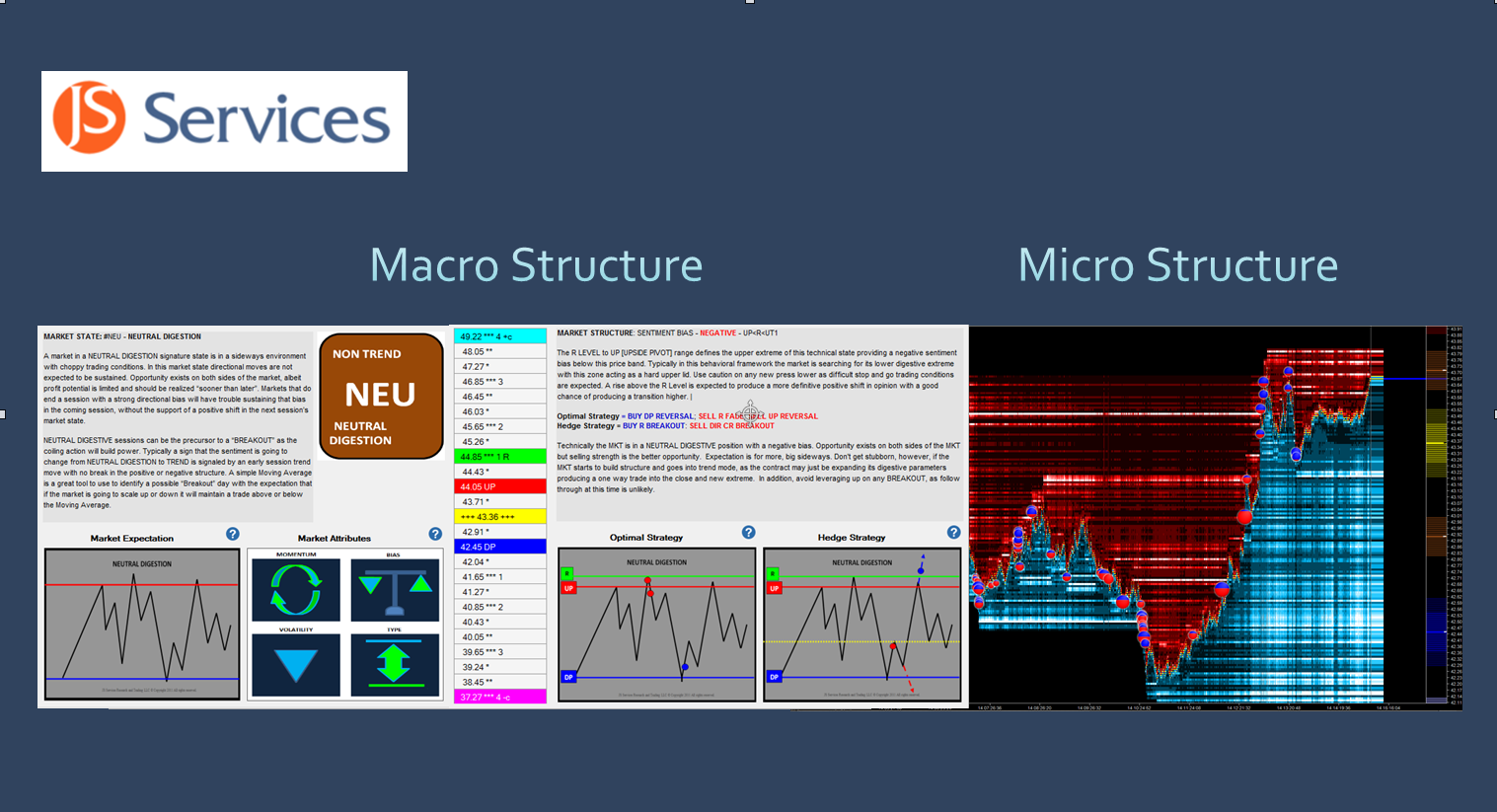

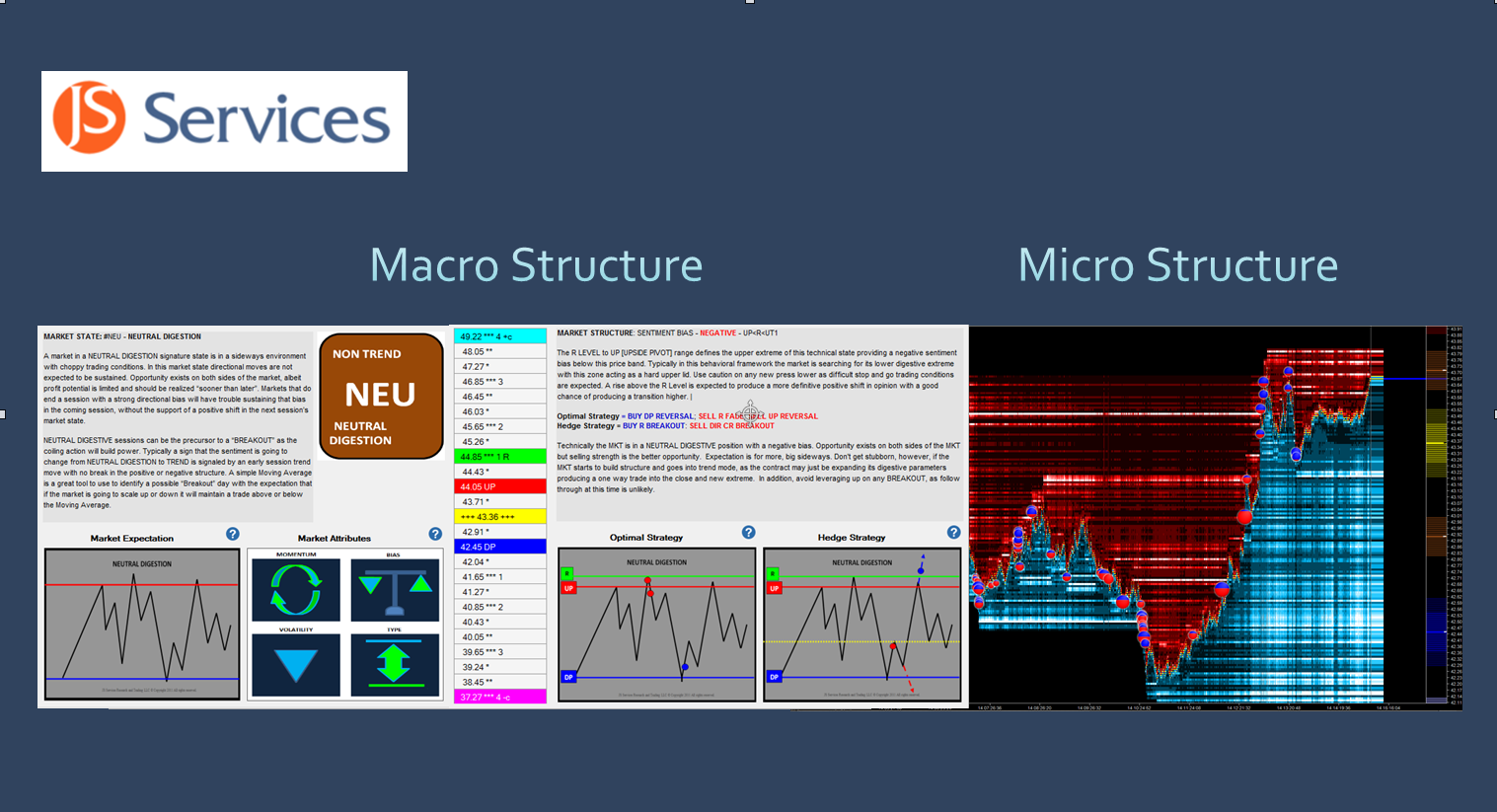

This webinar demonstrates how to optimizing Trade Tactics using JSServices analytics which define a markets macro structure and Jigsaw Trading micro structure order book display.

This webinar demonstrates how to optimizing Trade Tactics using JSServices analytics which define a markets macro structure and Jigsaw Trading micro structure order book display.

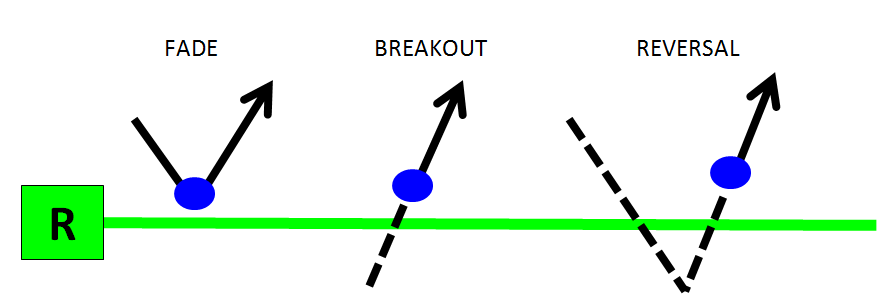

The PlayBook Strategy Themes represent the best risk defined opportunities for the trade session and are defined using 3 basic ENTRY tactics;

The naming schema for a PlayBook Trade Tactic BUY R FADE strategy reads as follows; looks to BUY the market at the R LEVEL using a FADE entry technique. This is a “theme” so the essence of the strategy is to FADE momentum into the R LEVEL area. Trading tactics and methods should be aligned with the basic properties of a FADE.

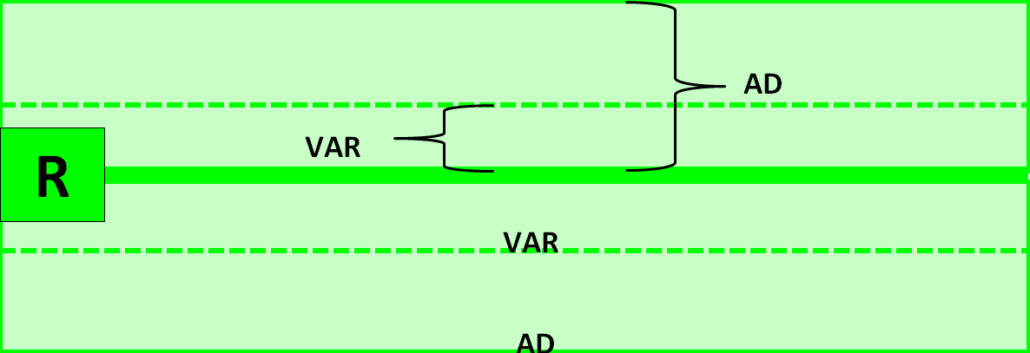

The Risk Parameters identify the area of influence or acceptance zone surrounding a trade entry level in which an opportunity remains valid when executing a specific trade tactic. The reason is that many profitable opportunities cannot be filled at the optimal entry level, in which case the surrounding acceptance zone is used to gauge if the fill price still presents an acceptable trade opportunity. The surrounding acceptance zone boundaries are defined by the AD (Alert Distance) and VAR (Variance) PriceMap Market Metrics offer a guideline for a systematic approach to the Trade Entry process by defining where to enter the market with the best chance to succeed with acceptable risk.

The Risk Parameters should be used to systematize the 3 main components of Trade Entry, the Conditional Alert, Entry Price and Exit Stop price.

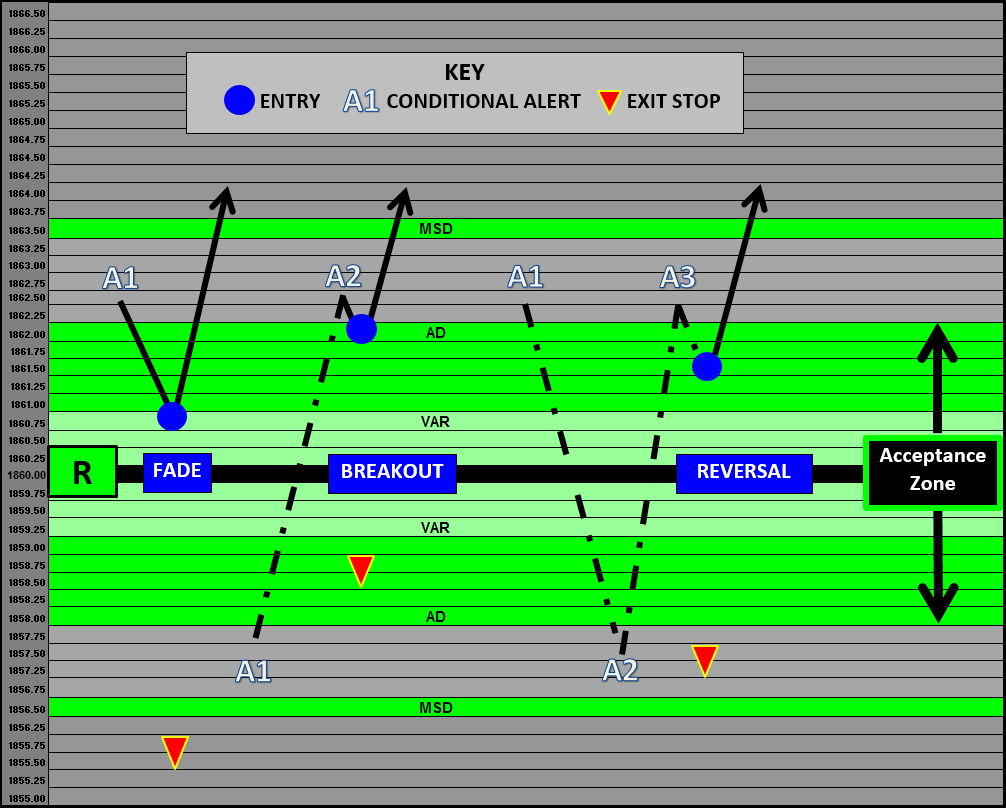

Example: The image above shows a basic textbook example of a FADE, BREAKOUT and REVERSAL Entry Tactic incorporating the Risk parameter Acceptance Zone.

The Risk Parameters are used to confirm a Trade Entry Tactic is “true” or valid.

After the Conditional Alert confirms the Entry Tactic the Risk Parameters can be used to systematize Entry orders within the acceptance zone.

The example presented are basic guidelines which can be optimized by taking into consideration the characteristics of the market state, the position on the PriceMap framework, the Strategy Theme the trade is aligned with and the dynamic micro structure of the order book.

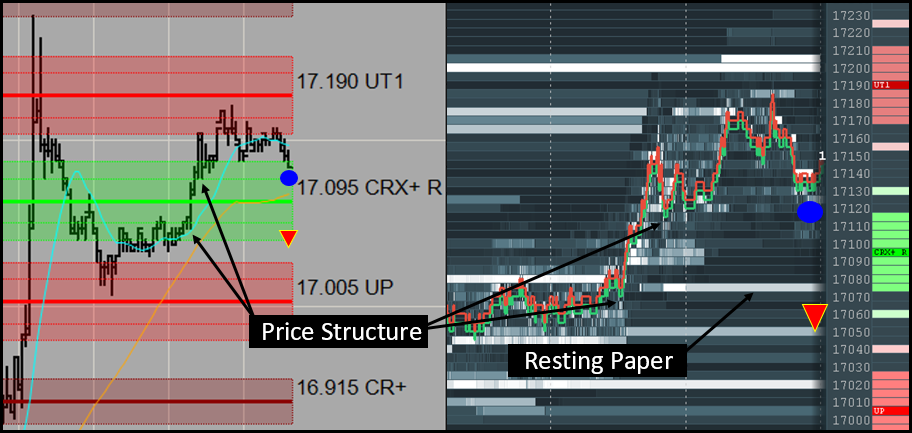

The Risk Parameters Market Metrics VAR, AD, and MSD can be used as parameters to set Exit Stops. Reward expectations should be considered when selecting which metric to use for an Exit Stop. The stop should never be placed “at the metric” as this represents the boundary limit which is anticipated to be tested but not broken. As a rule of thumb a minimum 1-3 tic variance through the metric should be used to avoid getting “dinked” at the risk parameter extreme. Price Structure and the order book dynamics can be used to optimize stop placement as well as entry

The image above shows how Entry and Exit Stop orders can be optimized when price structure and resting paper in the order book are in alignment with Risk Parameters.

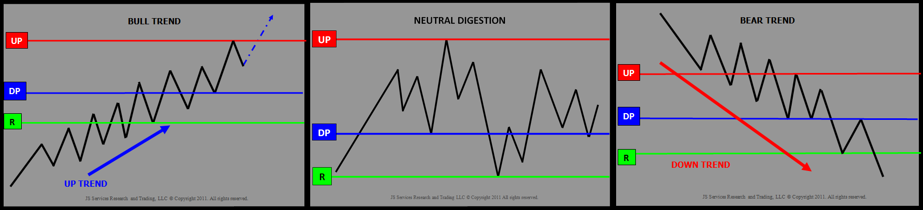

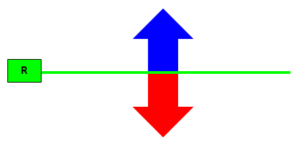

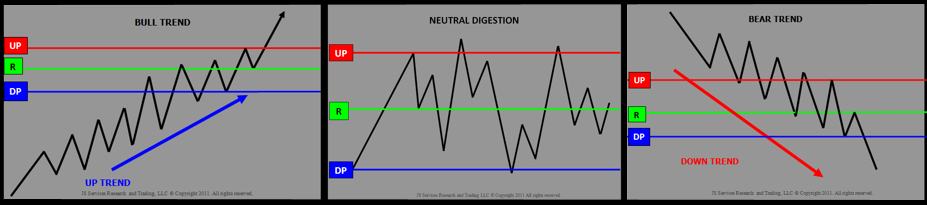

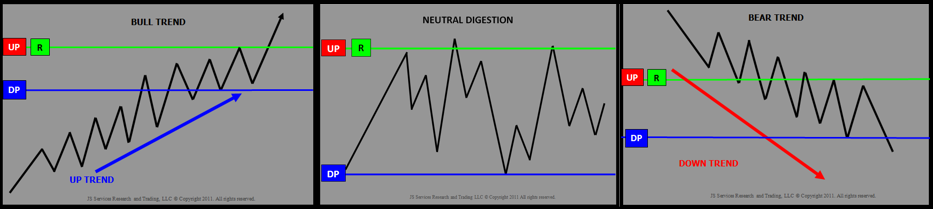

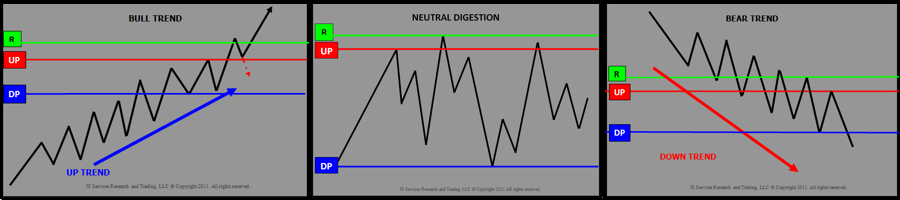

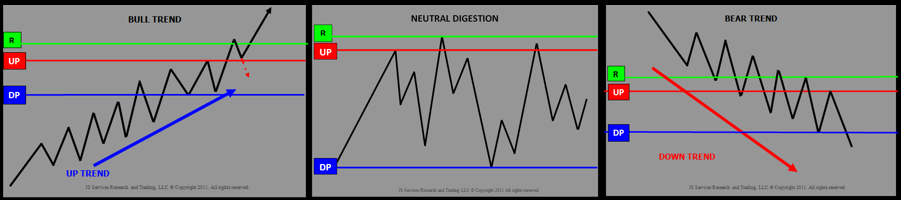

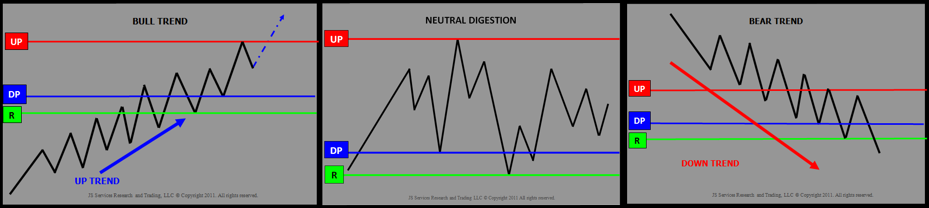

The R LEVEL [Reversal Level] is the “Over-Under” number for the trade period. Trading above the R signals a positive buy break bias and trading below the R signals a negative sell rally bias. This is the inflection point where sentiment shifts from positive to negative and vice versa.

The R LEVEL is the most significant price level on the PriceMap as it defines the session bias and is the best actionable starting point when using the analytics. Traders should be aware of price activity in relation to the R level and note if the current action is with or against the bias. In a general sense, signals in the direction of the R bias should be expected to be smoother, with follow through potential, and signals against the R bias to be more laborious and unlikely to be sustained.

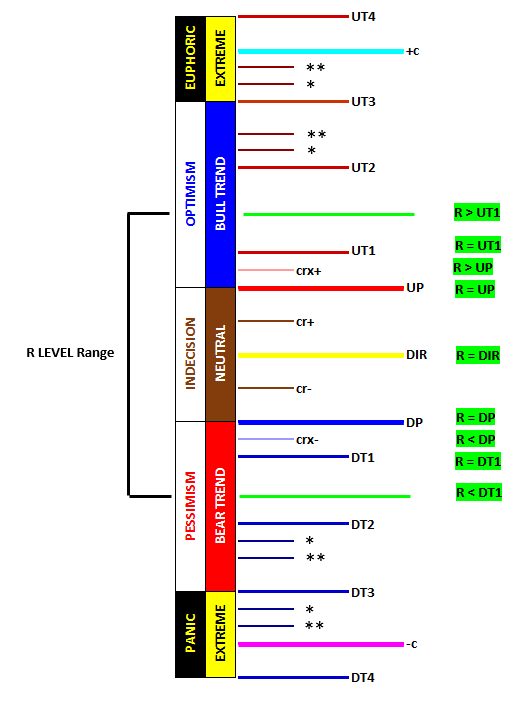

The R LEVEL represents the sentiment bias for the trading period which further defines the market State expectation by its position on the PriceMap. Where the R level is on the PriceMap Framework will skew the condition of the market state and define a Market Structure Bias (MSB). There are 9 potential R LEVEL positions on the PriceMap Framework each with its own unique influence on the current condition. Trading tactics should be aligned with the MSB skew to improve their effectiveness.

PriceMap Framework R LEVEL Positions

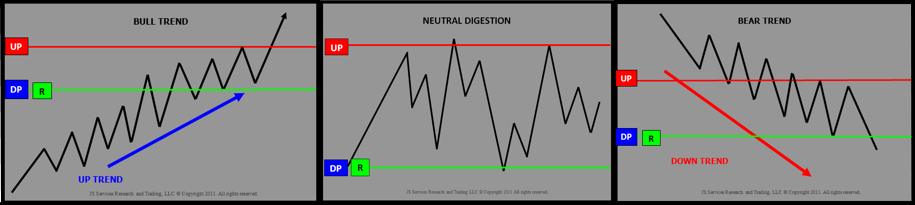

The R LEVEL equal to the DIR (Directional) is in a classic pivot point position, as sentiment is balanced or “on the fence”. The market is indecisive or is preparing to make a move. Any market State condition with the R=DIR structure bias should respect the pivotal nature of sentiment. Typically, when the R LEVEL is in this position it will either just breakout and “go” producing a linear move or a difficult rotational trade will consume the market for the trade period within the CR+ and CR- validation levels.

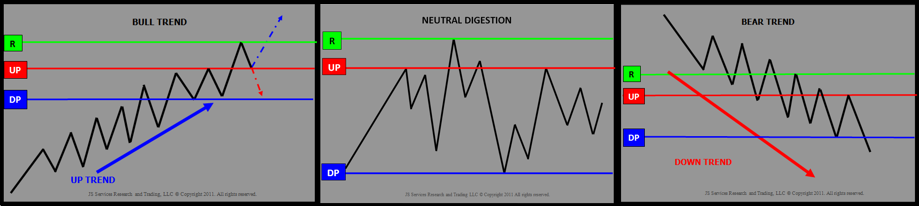

The R LEVEL at the top of the Critical Range defines a “hard” resistance point at the UP (Upside Pivot). Energy is centered at this price point and a violation should be expected to produce sharp interest. A downside failure below the DP (Downside Pivot) however should NOT be expected to have the same energy and have a more measured expectation. This structure bias identifies a corrective expectation for positive trend type states and the optimal entry area for negative trend states.

The R LEVL above the UP but less than the UT1 creates a RESISTANCE BAND with the UP. Trading tactics should focus on the entire zone for signal acceptance. Typically this would be on the sell side as this is a resistance band but will transition into a support band if the market violates the R LEVEL and starts to transition higher. This structure bias identifies a corrective expectation for a positive trend type states and the optimal entry area for negative trend states.

The R LEVEL = to the UT1 (Upside Target #1) creates an even wider resistance band with the UP. Signal acceptance anywhere in the price band is acceptable however it is best to commit to opportunities closer to the UP or UT1. As the R LEVEL moves farther outside the CriticalRange the energy in the market place is skewed higher. Any lower price movement should be expected to be move measured and any positive turn from lower levels should be expected to target the R LEVEL. This structure bias identifies a corrective or digestive expectation for positive trend type states with the R LEVEL defining current lid for the underlying positive momentum. For negative trend states the R LEVEL identifies where the real selling energy is and the optimal entry area to get back on the down trend.

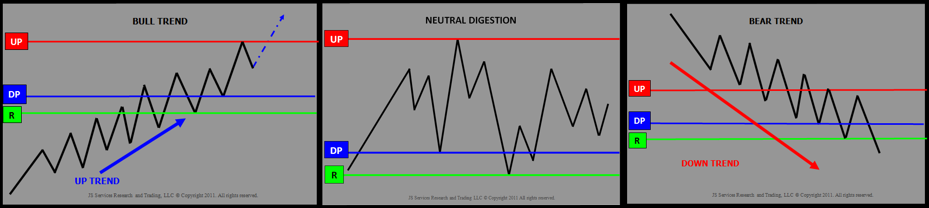

The R LEVEL above the UT1 identifies the high point for any price squeeze against the underlying trend if it is going to resume in the session. A market in this position has an underlying negative tone and any sell signals within the UP to R LEVEL range, are an actionable opportunity. Sales below the DP is a lower value opportunity and the threat of a corrective squeeze up to the R LEVEL is real. Typically the market will attempt some type of corrective move when the R LEVEL is in this position. A good “tell” is either an exhaustive REVERSAL signal at the DP or a transitional positive BREAKOUT at the DIR targeting the R LEVEL.

The R LEVEL at the bottom of the Critical Range defines a “hard” support level at the DP (Downside Pivot). Energy is centered at this price point and a failure should be expected to produce aggressive offers. An upside breakout above the UP (Upside Pivot) however should be expected to NOT have the same energy and any upside breakout to be more measured. This structure bias identifies a corrective expectation for negative trend type states and the optimal entry area for positive trend states.

The R LEVEL below the DP but greater than the DT1 creates a SUPPORT BAND with the DP. Trading tactics should focus on the entire zone for signal acceptance. Typically this would be on the buy side as this is a support band but will transition into a resistance band if the market violates the R LEVEL and starts to transition lower. This structure bias identifies a corrective expectation for a negative trend type states and the optimal entry area for positive trend states.

The R LEVEL = to the DT1 (Downside Target #1) creates an even wider support band with the DP. Signal acceptance anywhere in the price band is acceptable however it is best to commit to opportunities closer to the DP or DT1. As the R LEVEL moves farther below the DIR the energy in the market place is skewed lower. Any higher price movement should be expected to be move measure and any negative turn from higher levels should be expected to target the R LEVEL. This structure bias identifies a corrective or digestive expectation for negative trend type states with the R LEVEL defining current floor for the underlying negative momentum. For positive trend states the R LEVEL identifies where the real buying energy is and the optimal entry area to get back on the up-trend.

The R LEVEL below the DT1 identifies the low point for any price squeeze against the underlying trend if it is going to resume in the session. A market in this position has a defined underlying positive tone and any buy signals within the DP to R LEVEL range are an actionable opportunity. Buys above the UP are a lower value opportunity and the threat of a corrective squeeze down to the R LEVEL is real. Typically the market will attempt some type of corrective move when the R LEVEL is in this position. A good “tell” is either an exhaustive REVERSAL signal at the UP or a transitional negative BREAKOUT at the DIR targeting the R LEVEL.