PlayBook Entry Strategy Tactics

Trade Entry Tactics

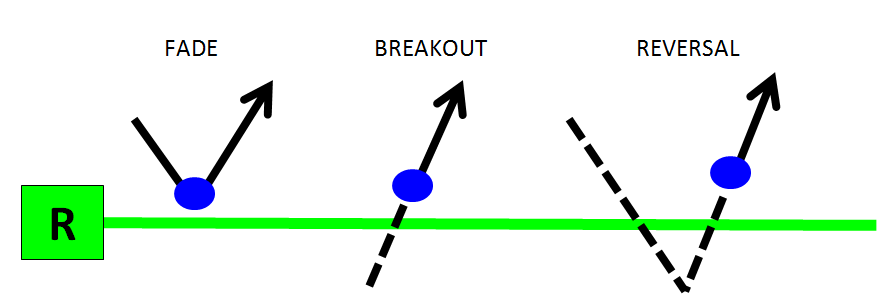

The PlayBook Strategy Themes represent the best risk defined opportunities for the trade session and are defined using 3 basic ENTRY tactics;

- FADE momentum

- BREAKOUT, trade with momentum

- REVERSAL, false breakout exhaustive signal

The naming schema for a PlayBook Trade Tactic BUY R FADE strategy reads as follows; looks to BUY the market at the R LEVEL using a FADE entry technique. This is a “theme” so the essence of the strategy is to FADE momentum into the R LEVEL area. Trading tactics and methods should be aligned with the basic properties of a FADE.

Risk Parameters

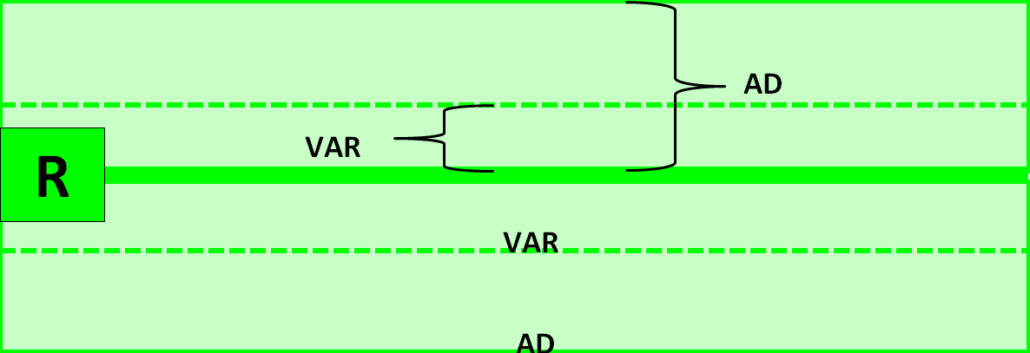

The Risk Parameters identify the area of influence or acceptance zone surrounding a trade entry level in which an opportunity remains valid when executing a specific trade tactic. The reason is that many profitable opportunities cannot be filled at the optimal entry level, in which case the surrounding acceptance zone is used to gauge if the fill price still presents an acceptable trade opportunity. The surrounding acceptance zone boundaries are defined by the AD (Alert Distance) and VAR (Variance) PriceMap Market Metrics offer a guideline for a systematic approach to the Trade Entry process by defining where to enter the market with the best chance to succeed with acceptable risk.

- VAR (Variance) metric defines the variance surrounding a PriceMap level that should be considered “at the level”. This metric can be used for risk management but its primary function is to identify the optimal ENTRY area. The VAR is also the signal acceptance zone for a minor or validation level.

- AD (Alert Distance) metric defines the signal acceptance area surrounding a Directional or Major PriceMap level. This metric also qualifies the structure thresholds for conditional alerts and stop placement for JSServices PlayBook strategy themes.

The Risk Parameters should be used to systematize the 3 main components of Trade Entry, the Conditional Alert, Entry Price and Exit Stop price.

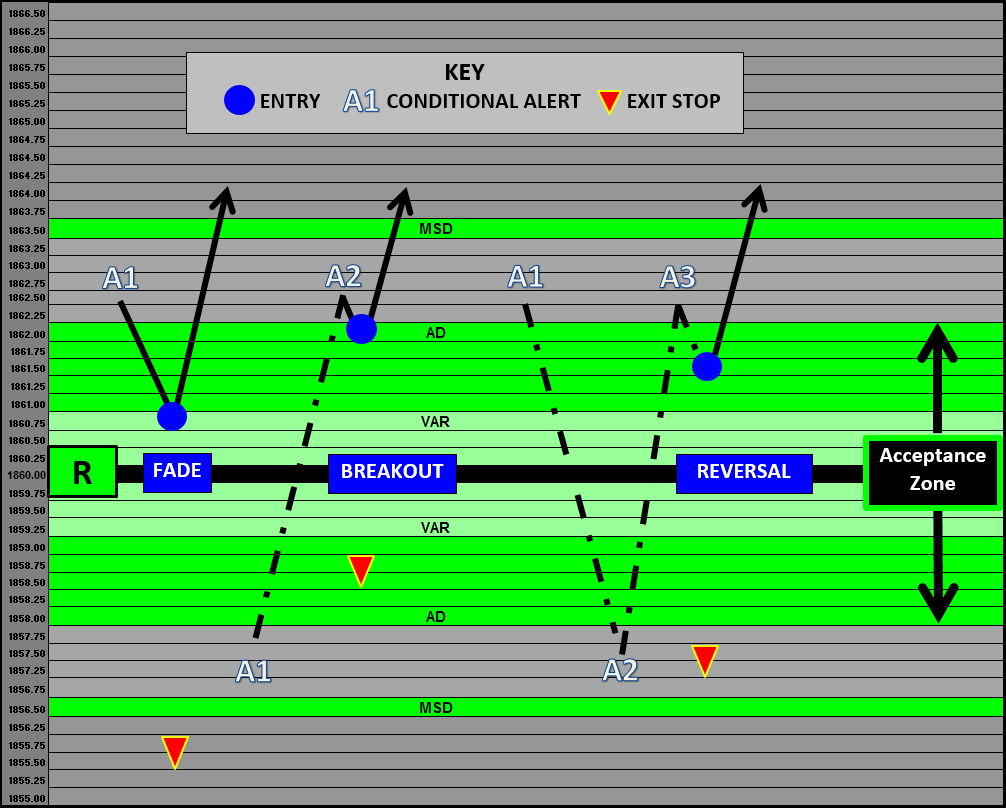

Example: The image above shows a basic textbook example of a FADE, BREAKOUT and REVERSAL Entry Tactic incorporating the Risk parameter Acceptance Zone.

Conditional Alert

The Risk Parameters are used to confirm a Trade Entry Tactic is “true” or valid.

- FADE technique is the most basic as it has only 1 conditional alert (A1). This is to confirm that the LTP (Last Traded Price) is “in front” of the PriceMap level so momentum can then be “faded” in the acceptance zone. The example above shows the AD (Alert Distance) being used as the A1 Conditional Alert.

- BREAKOUT technique has 2 conditional alerts. A1 to confirm that price was qualified “in front” of the PriceMap level on the opposing side of the acceptance zone and then A2 to confirm a BREAKOUT through the PriceMap level creating a new bias. Once the BREAKOUT statement is “true” entry orders can be executed anywhere within the acceptance zone.

- REVERSAL technique has 3 conditional alerts that must be met in sequence. Price must confirm that A1 is true first, then A2 and finally A3 to make the REVERSAL statement true. Once this occurs then entry orders may be placed anywhere within the acceptance zone.

Entry Price

After the Conditional Alert confirms the Entry Tactic the Risk Parameters can be used to systematize Entry orders within the acceptance zone.

- FADE, in the example the BUY FADE entry is placed at the VAR (Variance) with the expectation that the momentum is going to press into the acceptance zone and afford an entry close to the PriceMap level.

- BREAKOUT places an order at the AD as the expectation is that the new buy signal is going to just “ go” with a minimal pull-back.

- REVERSAL order is placed in the middle between the AD and VAR as a balance between a “choppy” transition or a steady shift in momentum.

The example presented are basic guidelines which can be optimized by taking into consideration the characteristics of the market state, the position on the PriceMap framework, the Strategy Theme the trade is aligned with and the dynamic micro structure of the order book.

Exit Stop Price

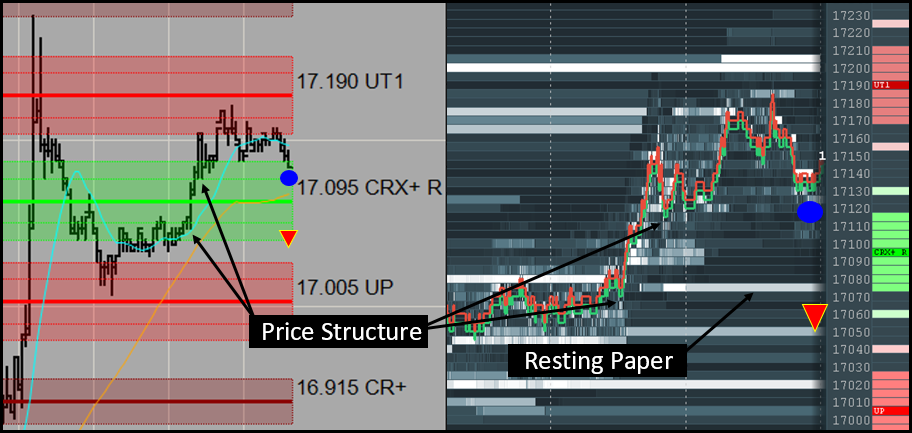

The Risk Parameters Market Metrics VAR, AD, and MSD can be used as parameters to set Exit Stops. Reward expectations should be considered when selecting which metric to use for an Exit Stop. The stop should never be placed “at the metric” as this represents the boundary limit which is anticipated to be tested but not broken. As a rule of thumb a minimum 1-3 tic variance through the metric should be used to avoid getting “dinked” at the risk parameter extreme. Price Structure and the order book dynamics can be used to optimize stop placement as well as entry

The image above shows how Entry and Exit Stop orders can be optimized when price structure and resting paper in the order book are in alignment with Risk Parameters.

General Thoughts on Trade Entry Tactics

- Awareness of the Risk Parameters provides additional insight and clarity to the current condition.

- Signal acceptance should be limited to within the AD (Alert Distance) acceptance zone.

- Entry within the VAR acceptance zone should be considered optimal.

- Trading outside the acceptance zone assumes much higher risk and slippage and should be avoided.

- The opposing VAR and AD can be used for STOP placement. The placement of such orders can be optimized with price structure confluence. In fact when price structure and market structure metrics are aligned it signals a good risk based opportunity.

- Historical resting paper in the order book that is in alignment with Risk Parameter Market Metrics can be used to optimize Stop Exit placement by adjusting stops through the liquidity.

- If an ENTRY LIMIT order is placed too close to the PriceMap Level, the strategy will “miss” opportunities (winners), that “just didn’t make it” to the point of entry but will participated in all of the losers because market went through the PriceMap level.

- If you want to have a position it is best to enter the MKT at the AD and then average in with a lower entry at the VAR. Ideally the micro structure of the order book should be used to optimize ENTRY orders with supporting liquidity events.