MCV Strategy Selection

![]()

STRATEGY SELECTION

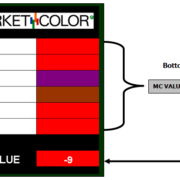

The MCV is an objective Technical Indicator, which can be used as a criteria filter for confluence with a fundamental position, a technical system signal or discretionary market bias.

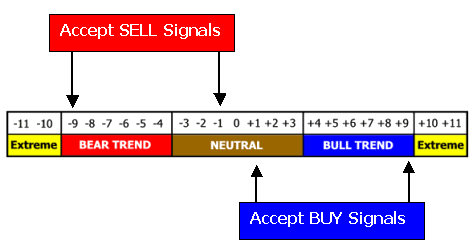

For example, in its most basic form a SELL SIGNAL would only be accepted when the MCV is negative and a BUY SIGNAL only when the MCV is positive.

This does not mean that negative system or fundamental signal will not “work” when the markets technical state or MCV is in a positive position, it just means that the chances are lower that it will and the follow through potential of the signal is decreased.

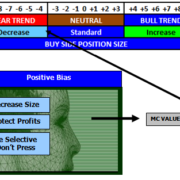

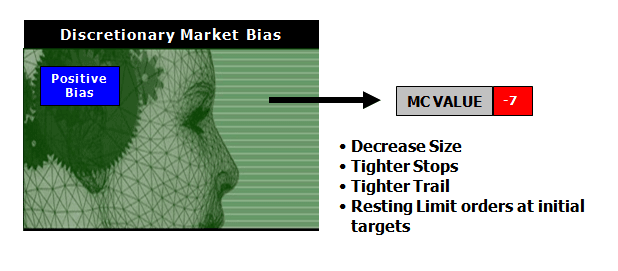

For a discretionary trader, if you have a positive outlook on the market but the MCV is negative you should be more conservative and selective in your trades and avoid “pressing” the long side with the understanding that today the MCV bias is against you and if you have profits from any longs you should take them.

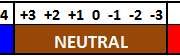

Note: Markets are dynamic and are shifting from one technical state to the next. By keeping signal acceptance in line with the MCV the chance of success is improved. This does not mean that signals counter to this bias cannot be profitable and no doubt most major “reversal” signals are “counter” to the current technical state, however they do occur less frequently.