MCV Size Management

![]()

SIZE MANAGEMENT

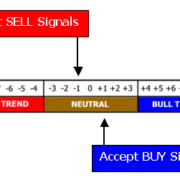

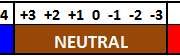

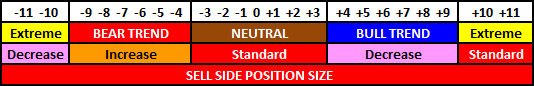

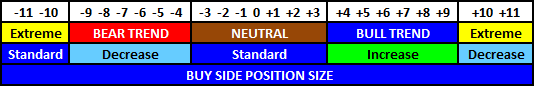

The MCV can be used for size management to gauge the amount of leverage used for a signal.

For example assuming all System or Fundamental strategy signals are accepted, size can be increased or decreased depending on the system signals confluence with the MCV.

The one thing we know for sure about the markets is that we don’t know what they are going to do. By accepting all signals but using the MCV as a size management tool, your strategies can naturally leverage up when they are aligned with the MCV.

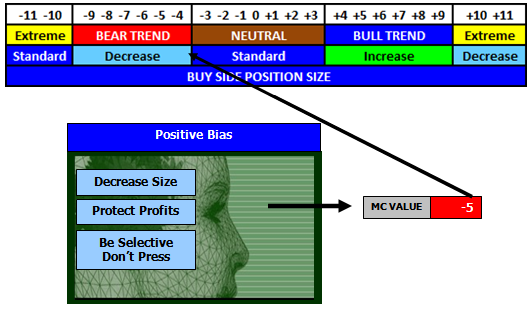

For discretionary traders when your market bias is in line with the MCV you can step out a little more and when it is not in alignment, step back and trade more conservatively with smaller size.

The edge discretionary trading has over machine signals is the “gut” feel to anticipate an opportunity. The MCV can be used as a “reality check” to keep your leverage and risk in line with the probabilities and not what you “think” “should” happen.