Market State Transition

![]()

MARKET STATE TRANSITION

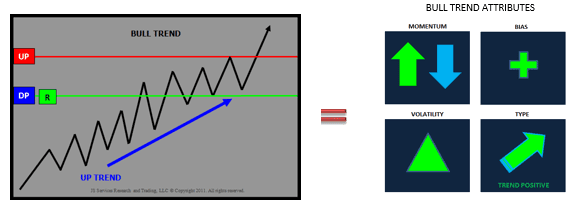

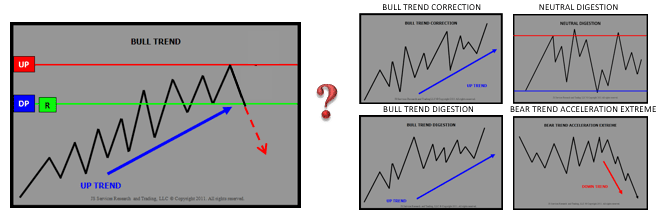

A market STATE condition as a definition does not change and is the same from day to day or from market to market regardless of asset class. A BULL TREND STATE will always be classified as a trending market that has positive higher move high higher move low structure. That is the definition of what a BULL TREND “is”. If the market is not maintaining positive structure then the definition is no longer true and signals that the market is transitioning into a different STATE. In a general sense markets that are performing to their STATE expectation are easier to anticipate verses markets that are not performing to expectation and are transitioning into a new market STATE.

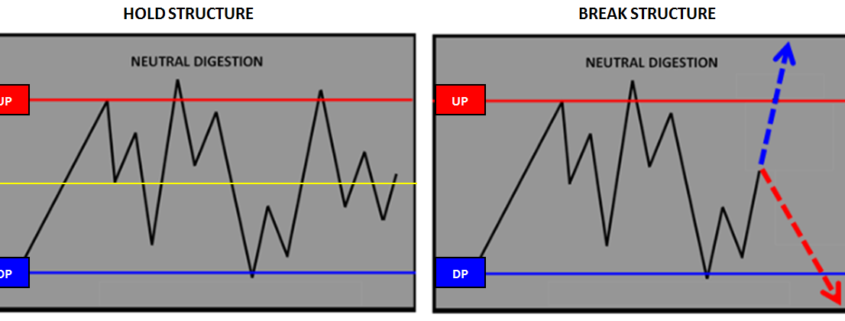

We do not know when a market will transition to a new market STATE but we do know where it will make a decision to do so or not. It is at the market STRUCTURE points that define the price alignment the STATE that the market will make a decision for the current STATE to persist by holding structure or break structure and transition to a new MARKET STATE.

Hold Structure

Break Structure

If price action holds STRUCTURE, it is a sign that the attributes of the market STATE will dominate price action. A break in STRUCTURE is a signal that the market is in transition to a new STATE. Markets that hold STRUCTURE are easier to predict as the context of the trading condition is known. Markets in transition that break STRUCTURE are more difficult to predict as the characteristics of the condition are fluid and not defined.