MCV Relative Strength

![]()

RELATIVE STRENGTH

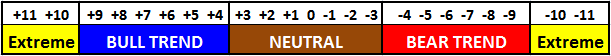

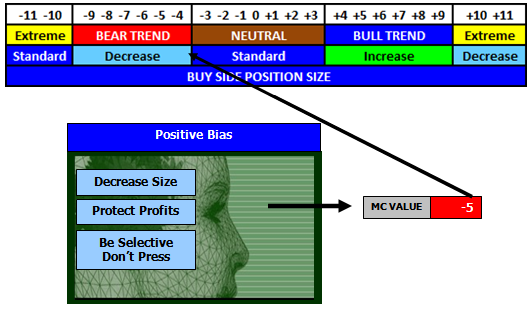

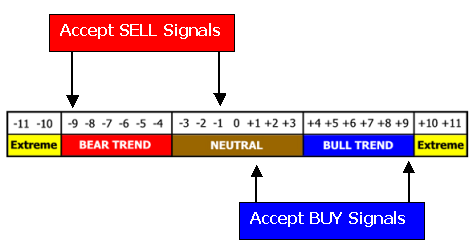

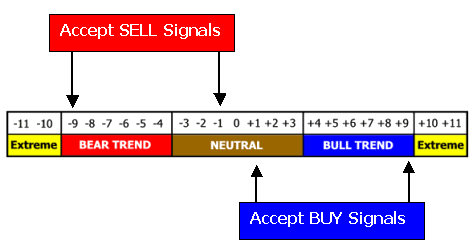

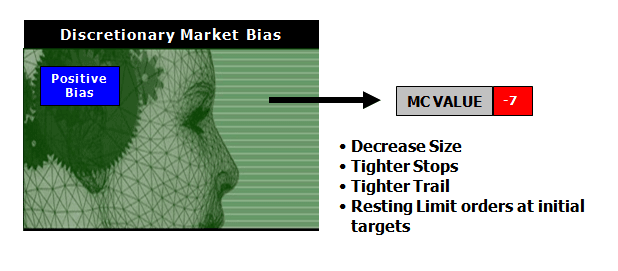

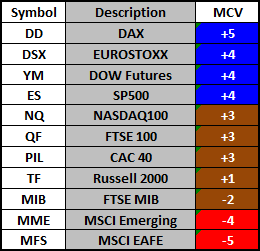

The MC VALUE is a single number in a bounded scale. This feature provides a quick “relative strength” comparison to other like markets for spread or paired opportunities.

![]()

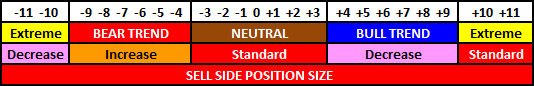

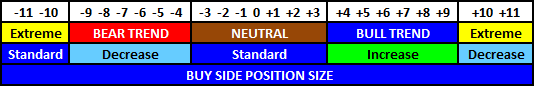

Every market has an MCV and that value is bounded in the MCV Table scale. The MCV technical rank allows a trader to quickly identify the markets that are technically bid or offered in a sector and select strategies that will work best for each market individually, by default creating a technically paired opportunity.

- Note: the MCV is not a “signal” and does not indicate a spread should be initiated that establishes a long position in a positive MCV market and short in a negative MCV market. It can however be used to accept sell signals in the markets of a sector that have weaker MCV and buy signals in markets with a stronger MCV.