MCS Explanation

![]()

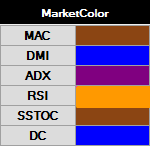

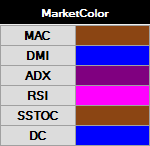

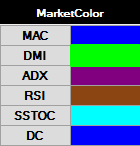

MARKETCOLOR STATE (MCS)

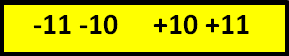

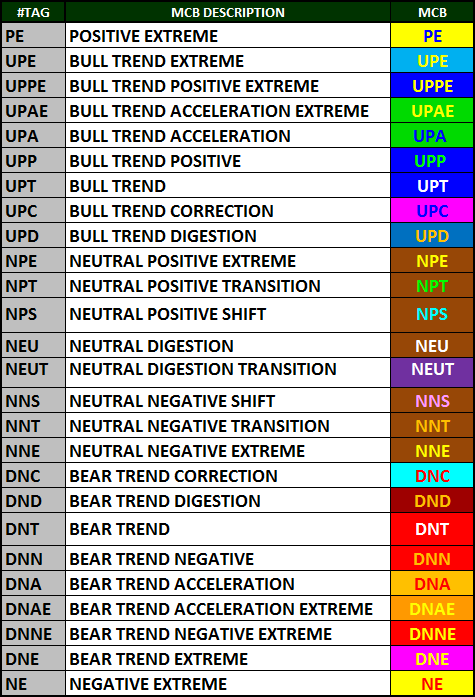

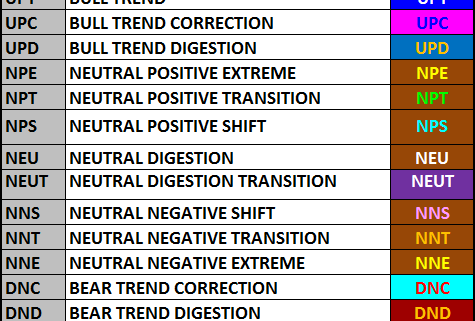

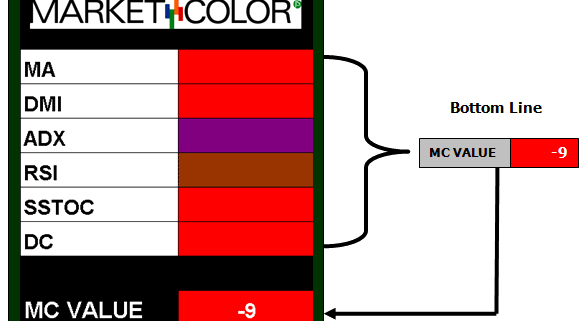

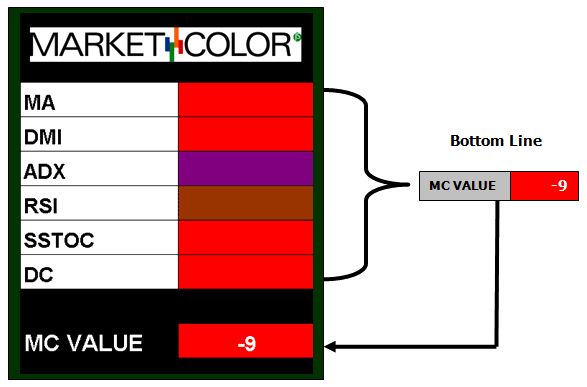

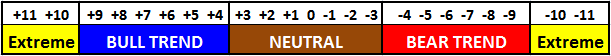

The MC VALUE (MCV) is a bounded scale study which has a finite set of MC VALUE CHANGE (MCC) permutations, each result representing a defined technical “signature” state whose characteristics, expectations and attributes can be qualified. There are 26 unique signature trade states that define the MarketColor State [MCS].

OVERVIEW

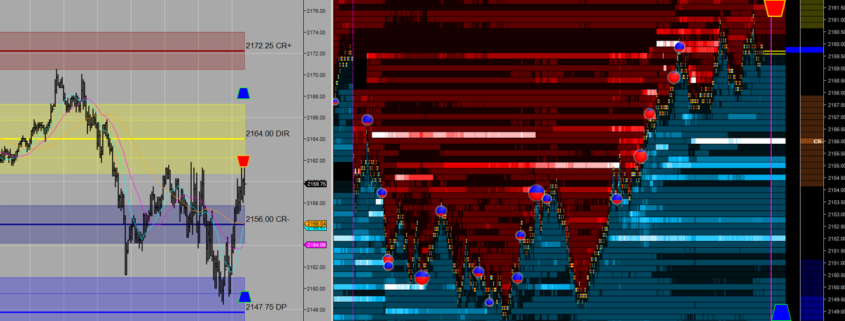

The MCS provides an objective definition of a markets technical state. By understanding MARKET STATE traders are able to align trading tactics to the expectation of the state conditions. It is important to understand that markets are constantly in transition from one state to the next. The MCS identifies what the current state is and the “tells” to look for that signal the market state is going to persist or not.

- When the market performs to the expectation of the state, trading seems easier as opportunities align with the characteristics of the state and can be anticipated. When the market is not performing to the characteristics of the state, it is in transition and trading opportunity is more difficult to predict. The key is to recognize as early as possible the markets intentions of what it wants to do. The reason its easy to look back at the end of the day and explain “why” the market did what it did in the session, is that the market leaves “tells” to its intentions in its price action. By understanding the market state and knowing what the market “should” do you are able to recognize these tells in real time and not in hindsight, dramatically improving your intuitive decision making. The MCS is the foundation of this knowledge base and is divided into 3 section: Characteristics, Expectations and Attributes

MCS – CHARACTERISTICS

MCS Characteristics highlight the specific FACTS of the market state. It is the textbook definition of what the market “should” do if it performs to expectation of the state including the “tells” to look for to confirm or deny this expectation and contingencies to apply when the markets transition. Traders should align their tactics with these facts.

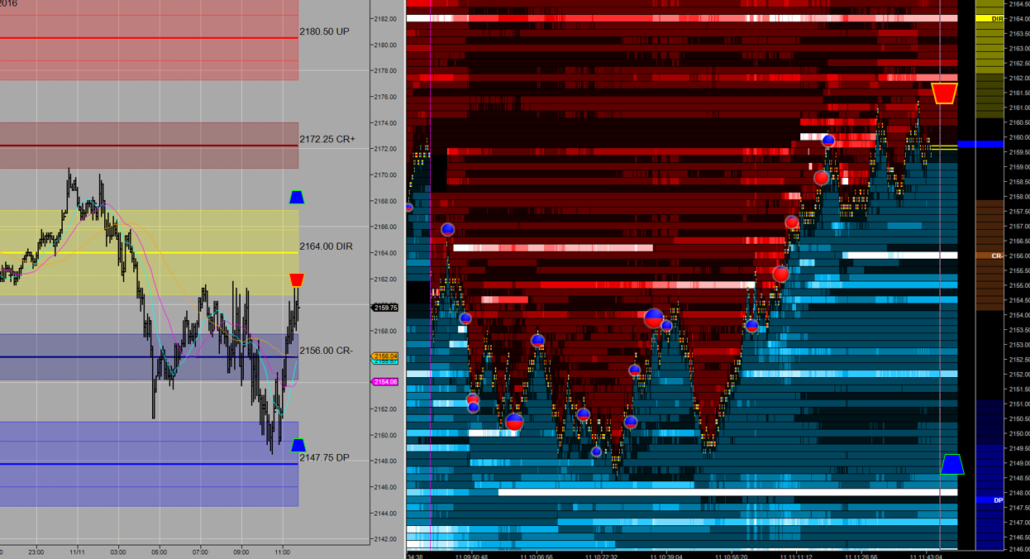

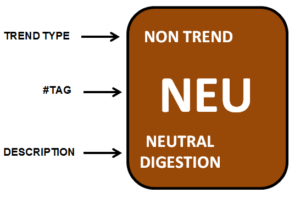

The MCS icon provides key information about the state at a glance, its TREND TYPE, #TAG and tag DESCRIPTION

- TREND TYPE – This item represents the general market state type or primary state. These are the generally defined states: NON TREND | TREND |EXTREME

- MCB #TAG and DESCRIPTION – define the signature market state which is a subset of the general TREND TYPE.

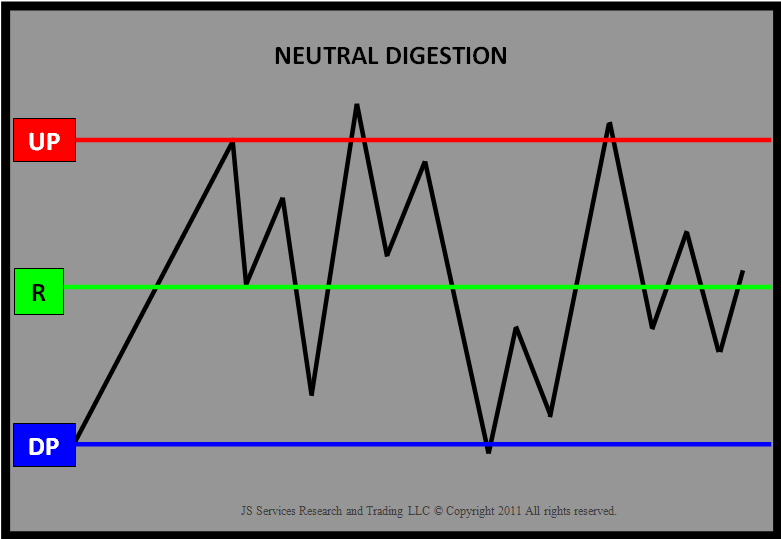

NEU is a general NON TREND market state type with no signature. The state is defined by and MCV in the 3 to +3 range and an MCC that is less than an absolute 3 shift.

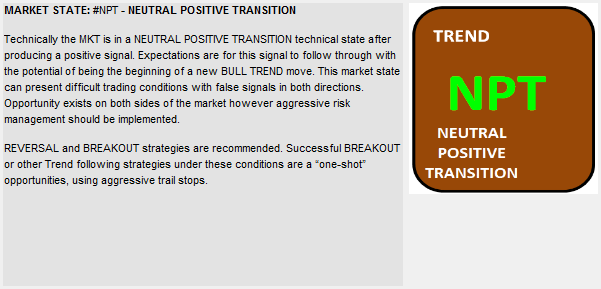

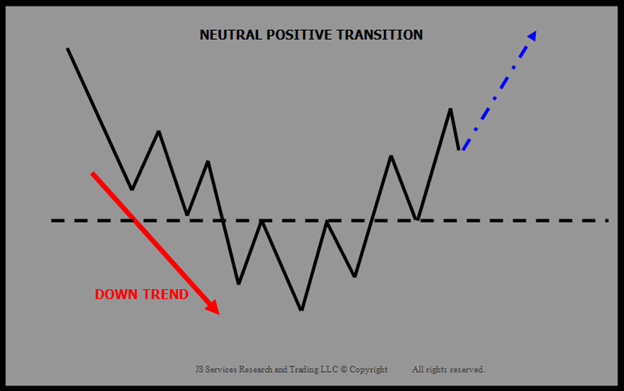

NPT is a general TREND type market state that has an MCV in the -3 to +3 NEUTRAL range but does have an MCC that is = or greater +3 identifying a positive transition signature in the MCV NEUTRAL ZONE.

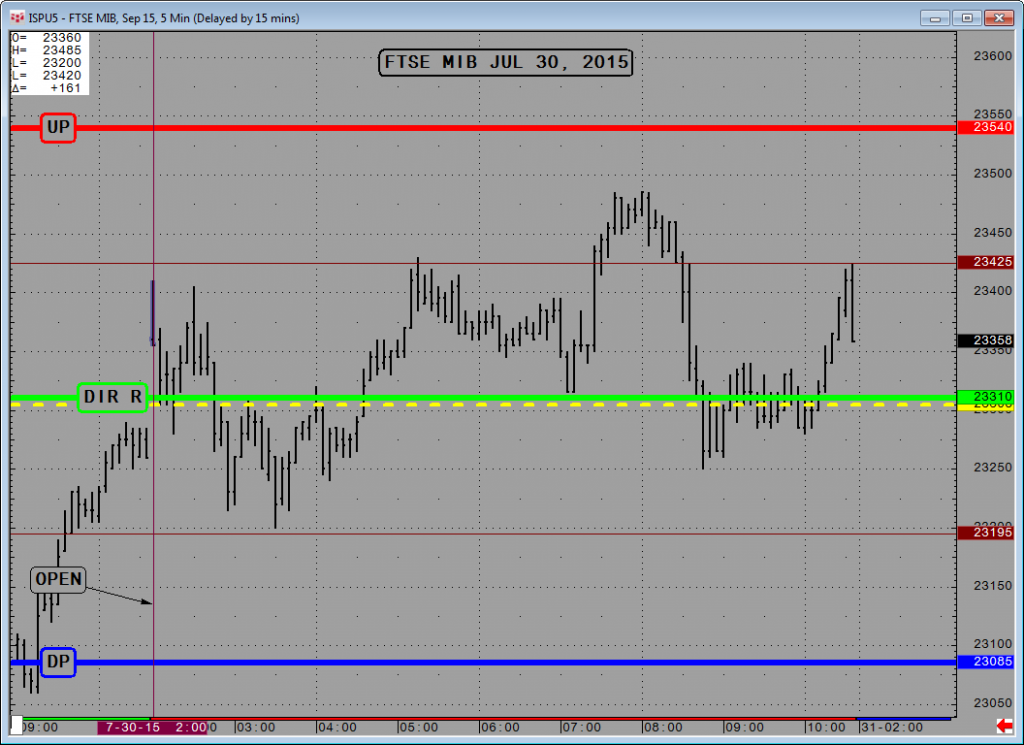

Example

The TREND TYPE and SIGNATURE state characteristics allow traders to align tactics across general type or dial into the specific nuances of a signature state.

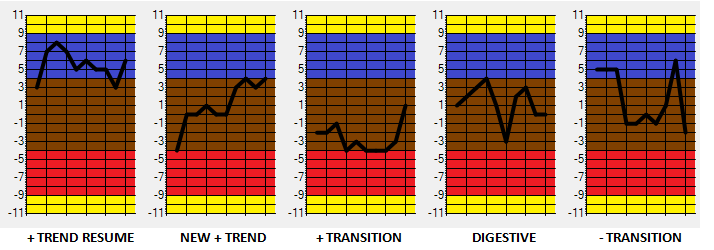

MCS – EXPECTATIONS

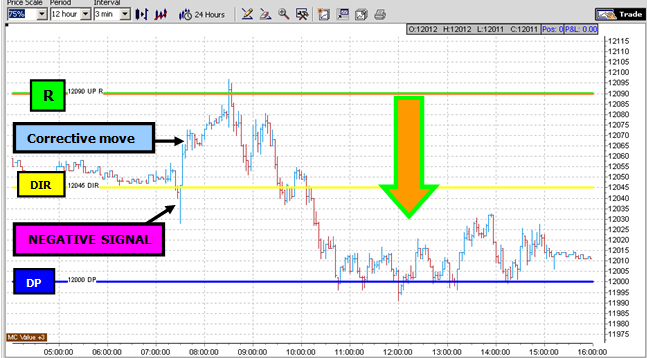

The MCS EXPECTATION provides a textbook graphic of the expected price action of the defined Market State. It is important to understand the complete picture so expectations can be aligned. An expectation of a NPT-Neutral Positive Transition MCS is that it will trend higher as this is the characteristic of the state. IF the market is not trending THEN it is a “tell” the market is transitioning back into a NON TREND condition. Knowing these facts improves awareness to align tactics and anticipate opportunity.

MCS – ATTRIBUTES

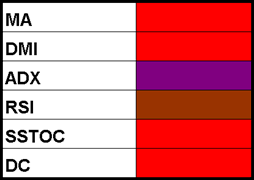

The MARKET STATE ATTRIBUTE icons define specific nuances of the current Market State in regards to MOMENTUM, DIRECTIONAL BIAS, VOLATILITY expectation and TREND TYPE. Traders can use these as an easy classification tool to align tactics with the attributes of the state.

MOMENTUM

This is a MOMENTUM icon denotes the markets ability to trend and is the preferred attribute for all trading tactics that like to trade with momentum.

This icon identifies a market with NO MOMENTUM and is the preferred attribute for non trend tactics which like to fade momentum.

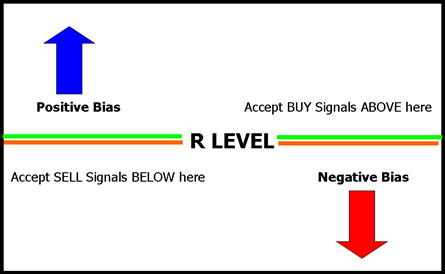

DIRECTIONAL BIAS

This icon identifies a market with a POSITIVE BIAS and is the preferred attribute for BUY SIGNALS

This icon identifies a market with a NEGATIVE BIAS and is the preferred attribute for SELL SIGNALS

This icon identifies a market with a NO BIAS and is the preferred attribute for both BUY and SELL SIGNALS and transitional or rotational trading strategies

VOLATILITY

This icon identifies a market with a VOLATILITY INCREASE expectation and is the preferred attribute for TREND FOLLOWING momentum strategies.

This icon identifies a market with a VOLATILITY DECREASE expectation and is the preferred attribute for NON TREND FADE momentum strategies.

This icon identifies a market with a MIXED VOLATILITY expectations and is the preferred attribute for ROTATIONAL and TRANSITIONAL BREAKOUT momentum strategies.

TREND TYPE

This icon identifies a market in a POSITIVE TREND and is the preferred attribute for BUY BREAKOUT TREND FOLLOWING strategies

This icon identifies a market in a NEGATIVE TREND and is the preferred attribute for SELL BREAKOUT TREND FOLLOWING strategies

This icon identifies a market in a NON TREND position and is the preferred attribute for DEVIATION and FADE strategies

This icon identifies a market in a EXTREME POSITIVE position and is the preferred attribute for SELL REVERSAL strategies

This icon identifies a market in a EXTREME NEGATIVE position and is the preferred attribute for BUY REVERSAL strategies

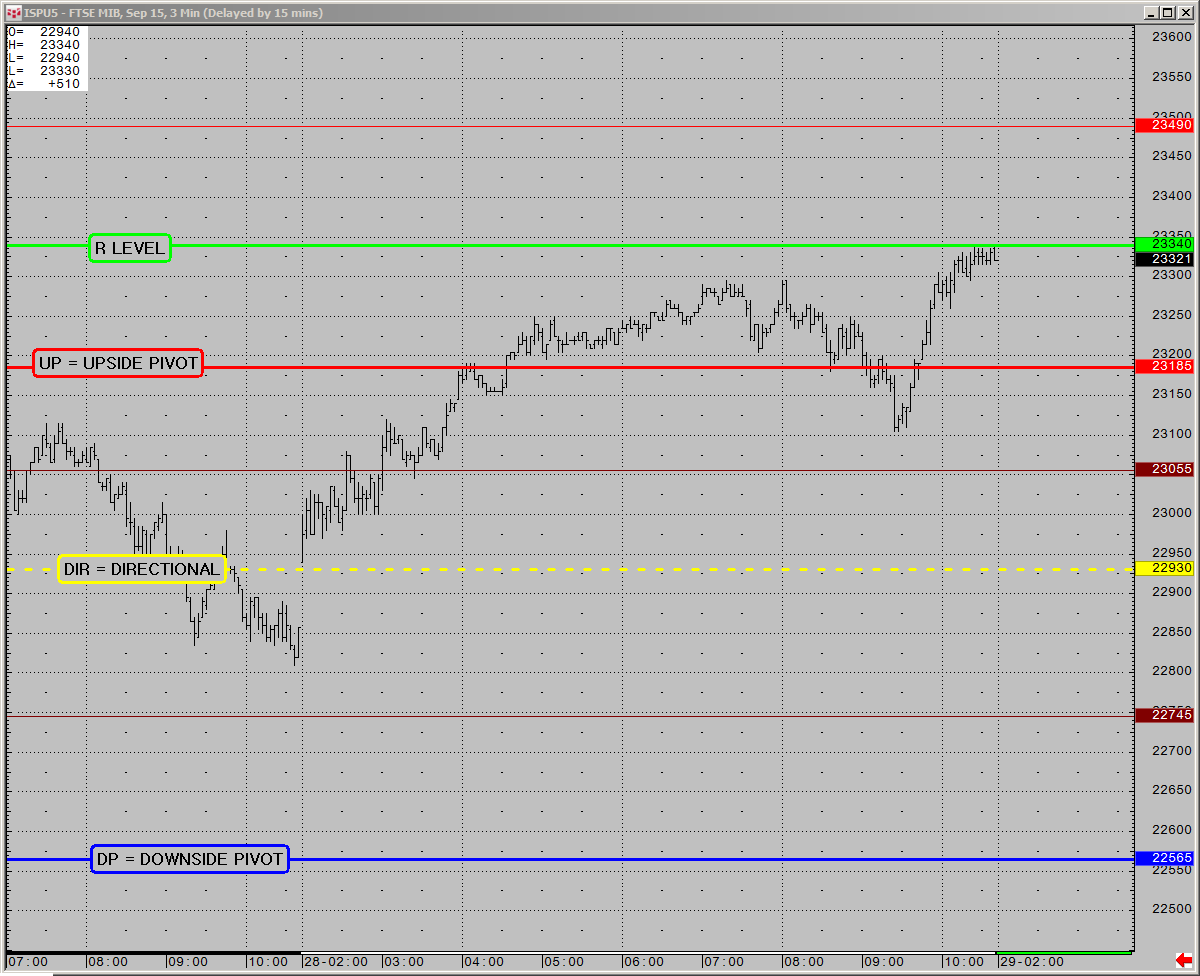

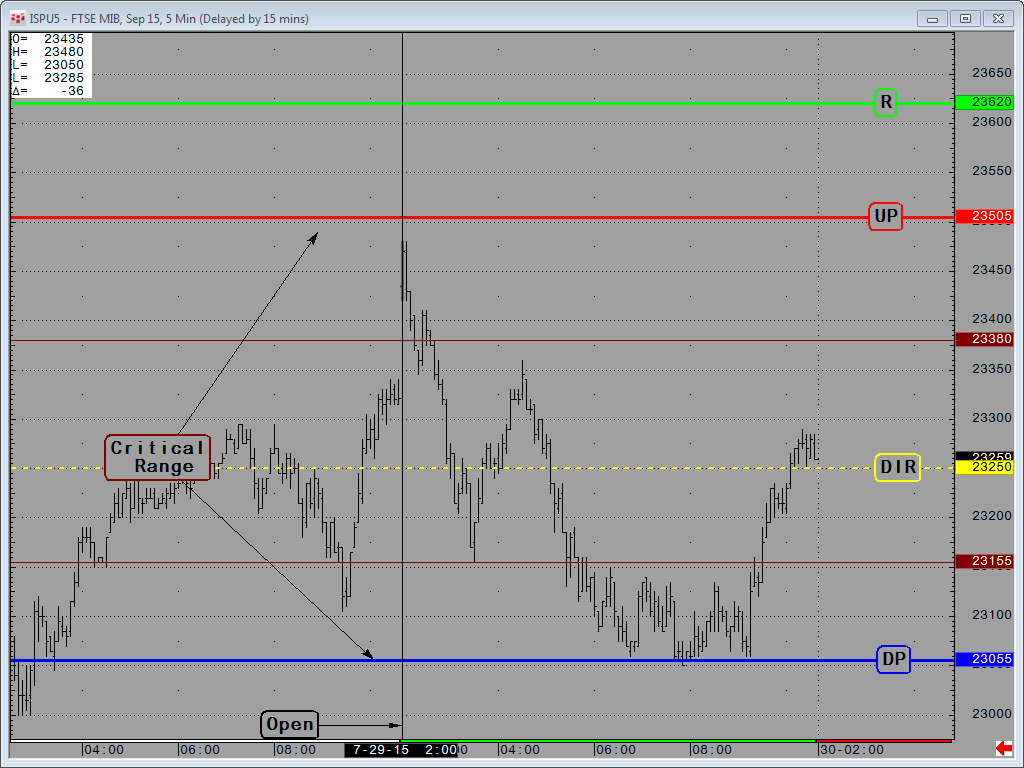

NEUTRAL ZONE

NEUTRAL ZONE