TradeStrategy Overview

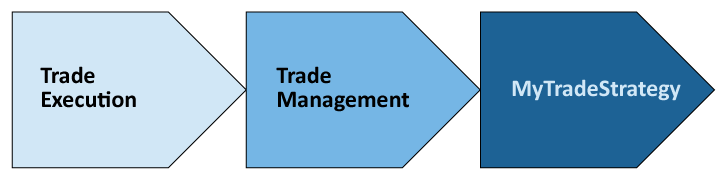

The normalization process takes a standardized trade plan and conforms it into your daily work flow to create a TradeStrategy. This is done using our applications which provide the specific levels for Trade Execution and parameters for Trade Management. Every market state has its own characteristics and structure that define it. Certain strategy themes that are inherent to a condition will have better alignment than others to a trader’s unique standardized TradePlan. By normalizing favorable market state conditions that compliment a TradePlan with the specific PriceMap levels that define the structure alignment, the optimal TradeStrategy can be achieved. The result is a unique MyTradeStrategy which offers a more consistent structured approach to trading that is applicable across all markets.

TradeStrategy Normalization Analysis

TradeStrategy Normalization

The Normalization process starts with conforming trade execution of a TradePlan into a strategy by using JSApplications to create guidelines for entry and exit. A TradeStrategy is completed when trade management modules of position, risk and size management are normalized with this process.

Trade Execution

JSServices applications and analytics provide an objective resource to normalize a standardized TradePlan into a consistent TradeStrategy using specific PriceMap levels for trade execution.

- Entry Points

- Directional Levels are the ideal Entry Points to normalize a TradeStrategy as they are the best risk defined levels on the PriceMap Framework. Directional Levels are the pillars of the market structure alignment which forecast change in the market state and are the optimal areas initiate a trade.

- Exit Points

- Target Levels – PriceMap Target Levels are the ideal Exit Points to normalize a momentum or BREAKOUT TradeStrategy as they define the price segment moves the market is trading in offering a consistent approach to define risks with.

- Directional Levels – are the ideal Exit Points to normalize a FADE or exhaustive REVERSAL TradeStrategy as they define the price framework of the market structure alignment, offering a consistent approach to identify risk associated with defined reward.

- Leverage Points

- Validation Levels – Validation Levels normalize the process of adding leverage to an opportunity by identifying specific price points that when violated confirm the directional momentum of a trade, offering a uniform approach that can be applied across all markets.

Trade Management

JSServices applications and analytics provides a structured approach to normalize the position management of a TradeStrategy using the PriceMap Framework, MarketMetrics and PlayBook strategy themes.

- Position Management Tactics

- PriceMap Framework– The PriceMap Framework provides a structured overlay that defines the price segment distance the market is trading in. This can be used to normalize the position management of a TradeStrategy to make it more consistent.

- Risk Management

- MarketMetrics– The PriceMap Analytics provide MarketMetrics which define risk parameters that outline each level on the PriceMap Framework. The metrics provide a standard to identify risk levels that are used to normalize the risk management of a TradeStrategy which is unified across all markets.

- Size Management

- PlayBook – The PlayBook provides a clear guide to the strategy themes that are inherent in the state condition. The themes define the best opportunities in the trade period and are classified into Optimal and Hedge Strategies. This offers a consistent value ranking to normalize the size management of a TradeStrategy.

MyTradeStrategy Deliverables

Traders that create a MyTradeStrategy have a consistent structured approach to executing a Trade Plan that can be applied to any market.

Trade Execution Analysis

Designed for traders who want create a consistent unified approach to executing their method. One on one consulting services are offered to create a TradeStrategy by normalizing trade execution and trade management using JSApplications. The program goes through the entire PriceMap framework identifying the ideal entry points, Exit Stop and target levels along with validation levels for adding leverage to an existing position. Traders come away with a clear TradeStrategy that can be consistently applied in any market, in any asset class under any technical condition.

Trade Execution Normalization Includes:

- Entry Points Normalization – PriceMap Directional Levels

- Exit Points Normalization – PriceMap Target Levels

- Leverage Points Normalization – PriceMap Validation Levels

Includes 40 min One-on-one consultation

Cost: Contact info@jsservices.com for pricing.

Trade Management

Designed for traders who want create a consistent unified approach to trade management. One on one consulting services are offered to create a Trade Management process by normalizing the position, risk and size management of Trade Strategy using JSApplications and analytics. The program goes through the entire PriceMap framework and PlayBook strategy themes to outline processes that can be used for a more consistent approach to trade management. Traders come away with a structured Trade Management method for their TradeStrategy that can be consistently applied in any market, in any asset class under any technical condition.

Trade Management Normalization Includes:

- Position Management Strategies – PriceMap Validation Levels

- Risk Management Strategies – PriceMap Framework

- Size Management Strategies – PlayBook Strategy Themes

Includes 40 min One-on-one consultation

Cost: Contact info@jsservices.com for pricing.

![]()